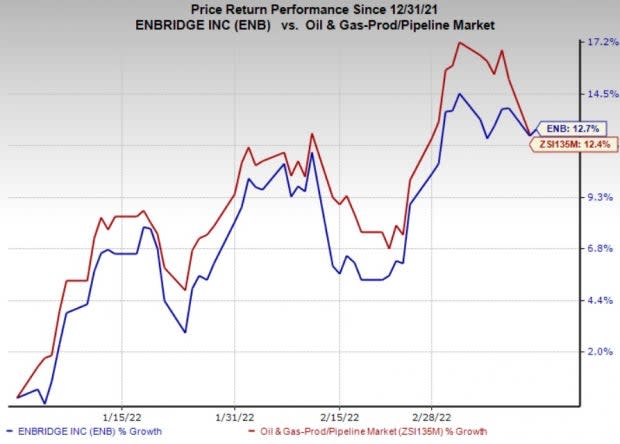

Enbridge (ENB) Jumps 12.7% Year to Date: More Room to Run?

Enbridge Inc.’s ENB shares have jumped 12.7% year to date compared with the industry’s 12.4% rally. The Zacks Rank #3 (Hold) stock is likely to witness year-over-year earnings growth of 10.9% and 4.4%, respectively.

Image Source: Zacks Investment Research

Factors Favoring the Stock

Enbridge has an extensive network of pipeline assets responsible for transporting roughly 25% of North American crude oil production. The midstream properties are also responsible for carrying as much as 20% of the natural gas that Americans consume. In Ontario and Quebec, Enbridge is dedicatedly serving 3.8 million retail customers through Gas Distribution and Storage operations.

With a significant portion of its assets being contracted by shippers for the long term, its business model is less exposed to volatility in oil and gas prices. Underpinned by long-term contracts, Enbridge’s business model has lower volume risk exposure.

ENB is expecting considerable growth in EBITDA this year, backed by C$10 billion of capital projects that were placed in service last year. Enbridge is projecting growth of 5-7% in distributable cash flow per share through 2024, banking on the advancement of its C$10-billion secured growth program.

Enbridge also has a strong focus on returning capital to shareholders. The midstream player increased its 2022 dividend by 3%. This marks ENB’s dividend hike for 27 straight years.

Considering these developments, there’s a lot more room for the stock to grow in the coming days.

Stocks to Consider

Some better-ranked players in the energy space include Exxon Mobil Corporation XOM, EOG Resources EOG and Chevron Corporation CVX, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ExxonMobil is banking on key upstream projects centered around Permian — the most prolific basin in the United States — and offshore Guyana resources.

ExxonMobil reported strong fourth-quarter results, thanks to improved realized oil and natural gas prices as well as higher refining and chemical margins. In the past 30 days, ExxonMobil has witnessed upward earnings estimate revisions for 2022.

For this year, EOG Resources has laid out a plan to generate $6.4 billion in free cash flow at a West Texas Intermediate crude price of $80 per barrel. EOG Resources has also committed $1.7 billion in regular dividend payments.

With the employment of premium drilling, EOG Resources is reducing cash operating costs per barrel of oil equivalent, thereby aiding the bottom line.

In the Permian basin, Chevron has a strong footprint. The majority of Chevron’s assets in the most prolific basin of the United States have minimal royal payments, thereby securing handsome cash flows for the company in the long run.

In the past seven days, Chevron has witnessed upward earnings estimate revisions for 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance