Enbridge (ENB) Faces Delay in Line 5 Tunnel Permit Process

Enbridge Inc’s ENB federal permitting process for the proposed Great Lakes Tunnel has been extended by the U.S. Army Corps of Engineers.

The U.S. Army Corps of Engineers will take an additional 18 months to analyze Enbridge’s permit application for its Line 5 tunnel project.

The delay is a setback for the project, which Enbridge initially planned to complete as early as 2024. The extension will delay the commencement of construction work until 2026.

Line 5, which is part of Enbridge’s larger Mainline and Lakehead systems, extends from Wisconsin through Michigan and into Ontario. The pipeline is a major source of 540,000 barrels per day of propane and crude oil supply for Michigan and nearby areas.

The proposed Great Lakes Tunnel will house the Line 5 oil pipeline under the Straits of Mackinac in the Great Lakes. The tunnel was expected to take four years to develop. However, the latest decision indicated that the tunnel would not be operative until 2030 if the permit is approved in 2026.

In 2020, Enbridge submitted an application to develop the tunnel to address concerns that Line 5 could result in a catastrophic oil leak on the Bad River. The 70-year-old pipeline is in the middle of a continuing legal dispute between Enbridge and the State of Michigan, which claims that the pipeline should be shut down.

Enbridge’s Line 5 pipeline has faced sustained criticism for years over the risk of an oil leak since a section of the pipeline runs underwater through the Straits of Mackinac. The Army Corps is responsible for determining whether to issue Enbridge a Clean Water Act permit for the project.

The Line 5 tunnel project has become a hot spot for environmental opposition. In 2019, the Bad River Band sued Enbridge in federal court and forced the company to shut down Line 5 as it poses an unreasonable threat to health and safety due to the risk of a potential rupture.

Last year, Canada expressed concerns that a potential shutdown of Line 5 would cause an extensive economic and energy disruption, thereby impacting energy prices. These are unsatisfactory outcomes when global inflation is making it difficult for families to cope.

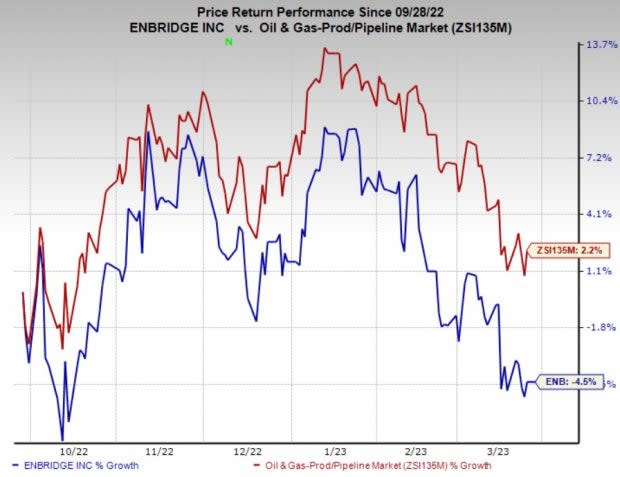

Price Performance

Shares of Enbridge have underperformed the industry in the past six months. The stock has declined 4.5% against the industry’s 2.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Enbridge currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Liberty Energy Inc. LBRT announced fourth-quarter 2022 earnings per share of 82 cents, which handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impacts of strong execution and increased service pricing.

As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 a piece since July and reinstated a quarterly cash dividend of 5 cents in the fourth quarter.

Murphy USA Inc.’s MUSA fourth-quarter 2022 earnings per share of $5.21 missed the Zacks Consensus Estimate of $6.16. The underperformance can be attributed to lower-than-expected petroleum product sales.

Murphy USA expects the 2023 fuel volume to be 240-245 thousand gallons on an APSM basis. Murphy USA’s 2023 guidance includes up to 45 new stores, up to 30 raze-and-rebuilds, and $795-$815 million in merchandise margin contribution.

Oceaneering International, Inc.’s OII fourth-quarter 2022 adjusted profit of 6 cents per share missed the Zacks Consensus Estimate of a profit of 17 cents. The underperformance was due to weaker results in certain segments.

For 2023, Oceaneering projects consolidated EBITDA of $260-$310 million and a free cash flow generation of $75-$125 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance