Is EMvision Medical Devices' (ASX:EMV) Share Price Gain Of 227% Well Earned?

When you buy shares in a company, there is always a risk that the price drops to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the EMvision Medical Devices Limited (ASX:EMV) share price has soared 227% in the last year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 16% over the last quarter. We'll need to follow EMvision Medical Devices for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

See our latest analysis for EMvision Medical Devices

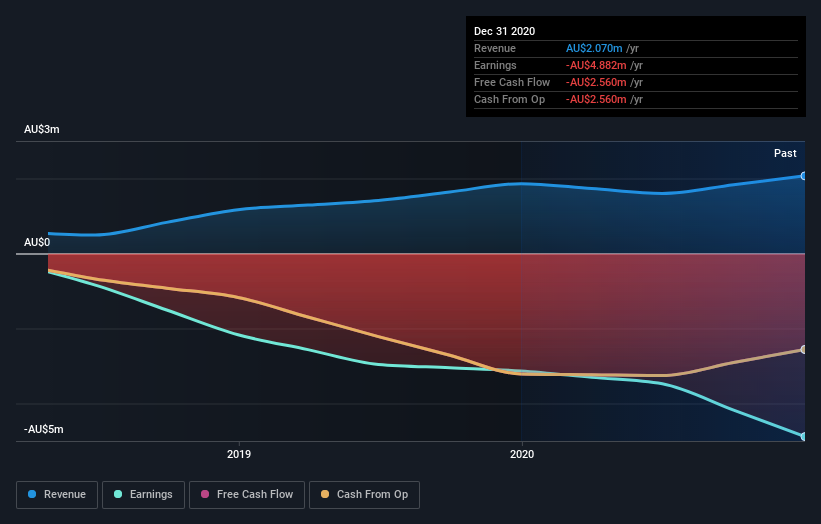

Given that EMvision Medical Devices didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, EMvision Medical Devices' revenue grew by 11%. That's not great considering the company is losing money. In contrast, the share price took off during the year, gaining 227%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on EMvision Medical Devices' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

EMvision Medical Devices boasts a total shareholder return of 227% for the last year. That's better than the more recent three month gain of 16%, implying that share price has plateaued recently. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that EMvision Medical Devices is showing 3 warning signs in our investment analysis , you should know about...

EMvision Medical Devices is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance