Empire (TSE:EMP.A) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Empire Company Limited (TSE:EMP.A) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Empire

How Much Debt Does Empire Carry?

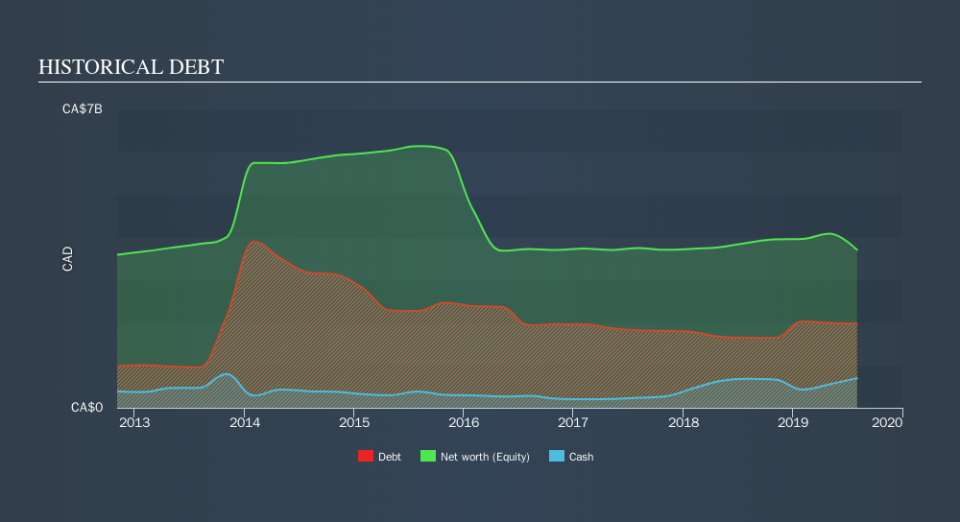

As you can see below, at the end of August 2019, Empire had CA$1.98b of debt, up from CA$1.65b a year ago. Click the image for more detail. On the flip side, it has CA$694.7m in cash leading to net debt of about CA$1.28b.

How Healthy Is Empire's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Empire had liabilities of CA$3.13b due within 12 months and liabilities of CA$7.12b due beyond that. Offsetting this, it had CA$694.7m in cash and CA$570.9m in receivables that were due within 12 months. So it has liabilities totalling CA$8.99b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of CA$9.50b, so it does suggest shareholders should keep an eye on Empire's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Empire's low debt to EBITDA ratio of 1.2 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.7 last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Pleasingly, Empire is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 139% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Empire can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Empire actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Happily, Empire's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its level of total liabilities. All these things considered, it appears that Empire can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Empire insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance