Empire State Realty Trust (NYSE:ESRT) pulls back 11% this week, but still delivers shareholders decent 67% return over 1 year

It's been a soft week for Empire State Realty Trust, Inc. (NYSE:ESRT) shares, which are down 11%. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 66%.

While the stock has fallen 11% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Empire State Realty Trust

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

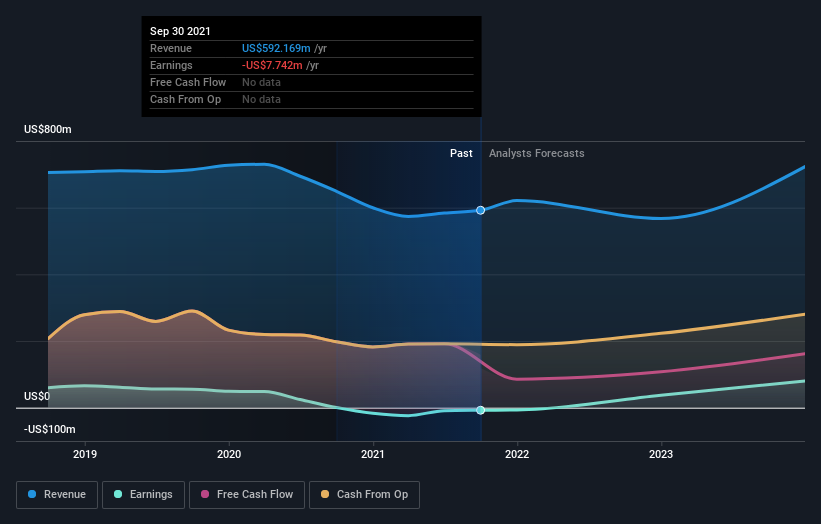

Over the last twelve months Empire State Realty Trust went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

We are skeptical of the suggestion that the 1.5% dividend yield would entice buyers to the stock. Unfortunately Empire State Realty Trust's fell 8.8% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Empire State Realty Trust shareholders have received a total shareholder return of 67% over one year. And that does include the dividend. That certainly beats the loss of about 8% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Empire State Realty Trust has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance