Empire Petroleum Corp (EP) Faces Headwinds: A Dive into the 2023 Earnings Report

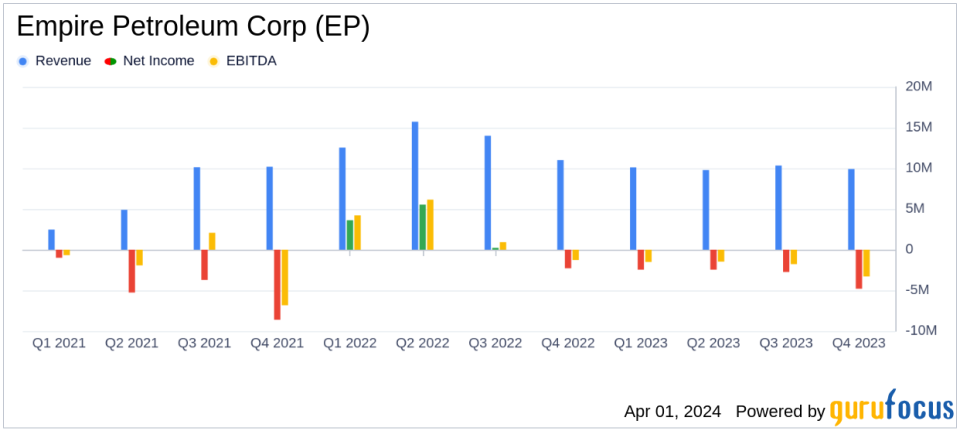

Net Sales: Q4 net sales down 6% year-over-year; full year net sales decreased by 3%.

Realized Prices: Realized prices per Boe decreased by 22% for the full year 2023 compared to 2022.

Product Revenue: Full year product revenue fell by 25%, reflecting lower prices and volumes.

Net Income: Net loss significantly widened to $(12.47) million for the full year from a profit of $7.08 million in 2022.

Adjusted EBITDA: Turned negative at $(2.38) million for the full year 2023, down from a positive $19.06 million in 2022.

Proved Reserves: Year-end 2023 SEC proved reserves decreased to 9.1 MMBoe from 13.2 MMBoe at the end of 2022.

Empire Petroleum Corp (EP) released its 8-K filing on April 1, 2024, revealing a challenging year with decreased production, lower realized prices, and a significant net loss. The company, which focuses on the exploration and development of oil and natural gas in the United States, particularly in New Mexico, North Dakota, Montana, Texas, and Louisiana, has faced headwinds that have impacted its financial performance.

Operational and Financial Performance

In the fourth quarter of 2023, Empire Petroleum reported net sales of 2,011 barrels of oil equivalent per day (Boe/d), a decrease from the previous quarter and year-over-year. The realized price per Boe also saw a decline, contributing to a 10% drop in product revenue compared to Q4 of the previous year. The company's net loss widened significantly to $(4.797) million in Q4 2023, from $(2.290) million in Q4 2022, and adjusted net loss and EBITDA also reflected negative movements.

For the full year, net sales averaged 2,099 Boe/d, with a notable 22% decrease in realized price per Boe from the previous year. This led to a 25% reduction in product revenue for the year. The net loss for the full year was substantial at $(12.470) million, a stark contrast to the net income of $7.084 million reported in 2022. Adjusted net loss and adjusted EBITDA for the full year also turned negative, indicating a challenging period for the company.

Financial Position and Capital Spending

Empire Petroleum invested approximately $19 million in capital expenditures in Q4 and $27 million for the full year, with a focus on developing its North Dakota operations. As of December 31, 2023, the company had about $8 million in cash and an additional $5.5 million available on its credit facility.

Year-End 2023 Proved Reserves

The year-end 2023 SEC proved reserves were reported at 9.1 MMBoe, down from 13.2 MMBoe at the end of 2022. The composition of these reserves was predominantly crude oil, with the entirety of the proved reserves classified as proved developed.

Mike Morrisett, President and CEO, remarked, "We are committed to executing on our targeted plan for developing our unique asset base. We see significant potential given our top-notch group of technical professionals led by the oversight of Phil Mulacek. Bottom line, we are looking at 2024 to be a real turning point for Empire."

Phil Mulacek, Chairman of the Board, added, "As we continue to refine our EOR drilling and completion techniques, we are pleased to see significant per well cost reduction with the most recent wells drilled, which drives better immediate and long-term economics."

Outlook and Strategic Focus

Despite the setbacks, management remains optimistic about the future, focusing on operational improvements and cost reductions, particularly in their North Dakota operations. There is also an anticipation of developing opportunities in New Mexico, with plans for a pilot drilling program later in the year.

Empire Petroleum's full year and Q4 results reflect the volatility and challenges inherent in the oil and gas industry, with significant impacts from fluctuating commodity prices and operational hurdles. However, the management's commitment to strategic development and cost management suggests a focus on long-term growth and operational efficiency.

For more detailed information, investors and interested parties are encouraged to review the full 8-K filing.

For value investors seeking insights and updates on Empire Petroleum Corp (EP) and other companies in the oil and gas sector, stay tuned to GuruFocus.com for professional, clear, and balanced financial news and analysis.

Explore the complete 8-K earnings release (here) from Empire Petroleum Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance