Embraer (ERJ) Q1 Earnings Beat Estimates, Revenues Up Y/Y

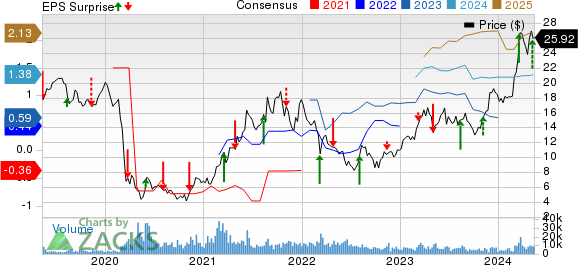

Shares of Embraer S.A. ERJ dropped 2.4% to reach $25.92 on May 10, following the company’s latest result release.

Embraer reported a first-quarter 2024 adjusted loss of 7 cents per American Depository Share (ADS), which was narrower than the Zacks Consensus Estimate of loss of 12 cents per share. The bottom line was also narrower than the loss of 48 cents per share incurred in the prior-year quarter.

The company reported quarterly GAAP earnings of 16 cents per ADS against a loss of 39 cents per share reported in first-quarter 2023.

Embraer-Empresa Brasileira de Aeronautica Price, Consensus and EPS Surprise

Embraer-Empresa Brasileira de Aeronautica price-consensus-eps-surprise-chart | Embraer-Empresa Brasileira de Aeronautica Quote

Total Revenues

Embraer’s first-quarter revenues totaled $896.6 million, up 25.1% year over year, primarily driven by higher revenues from its Executive Aviation and Services & Support segments. The reported figure surpassed the Zacks Consensus Estimate of $885 million by 1.4%.

Order & Delivery

Embraer delivered 25 jets in the quarter. It delivered seven commercial and 18 executive (11 light and seven midsize) jets compared with seven commercial and eight executive (six light and two midsize) jets in the prior quarter.

The backlog at the end of the first quarter of 2024 was $21.1 billion compared with $18.7 billion at the end of the fourth quarter of 2023.

Operational Highlights

Embraer’s operating loss amounted to $3.9 million compared with an operating loss of $52.1 million reported in the first quarter of 2023.

The company posted adjusted EBITDA of $47.1 million, which increased a solid 357.3% from the year-earlier quarter’s figure.

Financial Update

As of Mar 31, 2024, ERJ’s cash and cash equivalents amounted to $0.92 billion compared with $1.63 billion as of Dec 31, 2023.

The company had long-term debt of $2.53 billion as of Mar 31, 2024, down from $2.76 billion as of Dec 31, 2023.

Its adjusted free cash outflow (without Eve) totaled $346.1 million compared with a free cash outflow of $399 million reported in the prior-year period.

Guidance

Embraer reiterated its guidance for 2024. It still expects to deliver 72-80 commercial jets and 125-135 Executive Aviation jets in the year.

The company continues to anticipate revenues to be in the range of $6.0-$6.4 billion. The Zacks Consensus Estimate for ERJ’s revenues is pegged at $6.27 billion, which lies above the midpoint of the company’s guided range.

Embraer still expects an adjusted EBIT margin between 6.5% and 7.5%, and an adjusted free cash flow of $220 million or more.

Zacks Rank

Embraer currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

General Dynamics Corporation GD reported first-quarter earnings per share (EPS) of $2.88, which missed the Zacks Consensus Estimate of $2.89 by 0.4%. However, the figure increased 9.1% from earnings of $2.64 per share recorded in the year-ago quarter.

GD’s revenues of $10,731 million beat the consensus estimate of $10,201 million by 5.2%. The top line also improved 8.6% from the prior-year reported figure.

RTX Corporation’s RTX first-quarter 2024 adjusted EPS of $1.34 beat the Zacks Consensus Estimate of $1.23 by 8.9%. The bottom line also improved 9.8% from the year-ago quarter’s level of $1.22.

RTX’s net sales were $19,305 million, which surpassed the consensus estimate of $18,412.6 million by 4.8%. The top line also improved 12% from $17,214 million recorded in the first quarter of 2023.

TransDigm Group Incorporated TDG reported second-quarter adjusted earnings of $7.99 per share, which beat the Zacks Consensus Estimate of $7.37 by 8.4%. The bottom line also improved 33.6% from the prior-year quarter’s reported figure of $5.98.

Net sales amounted to $1.92 billion, up 20.5% from $1.59 billion registered in the prior-year period. The reported figure also beat the consensus estimate of $1.89 billion by 1.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance