Eldorado Gold Lowers Production Guidance

- By Alberto Abaterusso

Eldorado Gold Corp. (EGO) lowered its gold production guidance for its Kisladag mine on June 27.

At Kisladag, which is Turkey's largest mine, gold is attained through the heap leaching method. The graphic below illustrates the process. Previously crunched or grinding mineral ore is piled in a heap and a solvent, chemical-based solution is spread over the pile's surface.

Warning! GuruFocus has detected 3 Warning Signs with EGO. Click here to check it out.

The intrinsic value of EGO

Source

The chemical solution separates the desired metal (gold) from the mineral as it percolates the heap. The drained solution containing the gold is sent to the next processing phase for metal recovery after it has been collected in a basin.

Lower gold recovery rates at the mine forced Eldorado to review its production expectations. Kisladag is now expected to produce approximately 38,400 ounces of gold in the second quarter and 90,000 ounces in the first half of the year.

For the full year, projections for production at the mine have been reduced from between 230,000 ounces and 245,000 ounces to between 180,000 ounces and 210,000 ounces. Cash costs are expected to range between $450 and $500 per ounce.

Since the miner plans to recover the loss in gold production at Kisladag this year by increasing production next year, the guidance for 2018 gold production was revised. The initial guidance of 285,000 ounces was increased to range between 320,000 ounces and 335,000 ounces. The company expects to sustain cash costs between $425 per ounce and $475 per ounce in 2018.

Since Kisladag contributes 60-65% of the company's total production, Eldorado will likely miss expectations for the second quarter.

Analysts expect Eldorado to book second-quarter revenue of $134.34 million, a 25.5% increase from a year ago. Revenue estimates range between a low of $130.38 million and a high of $140.69 million.

Source: Yahoo Finance

For full-year 2017, revenue is expected to come in at $546.11 million, a 26.2% increase on a year-over-year basis. Estimates range between a low of $482.77 million and a high of $597.43 million.

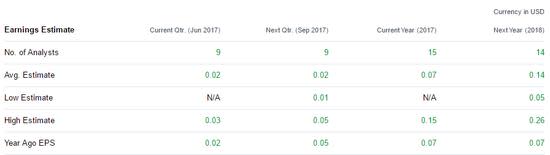

Concerning earnings, analysts expect Eldorado will post EPS of two cents for the quarter, a 60% decrease year over year, and seven cents for the year, flat from 2016 earnings.

Source: Yahoo Finance

Eldorado Gold is currently trading around $2.82, down seven cents or 2.42% from the previous trading day. The Canadian gold producer has a market capitalization of $1.94 billion and an enterprise value of $1.93 billion.

The miner has a price-earnings (P/E) ratio of -5.97, a price-sales (P/S) ratio of 4.31 and a price-book (P/B) ratio of 0.58.

Eldorado has declared 19.3 million ounces in gold reserves as of Dec. 30, 2016. This equates to an EVO (enterprise value divided by total reserves) of $100.19, which is currently one of the lowest in the gold stock industry.

Disclosure: I have no positions in Eldorado Gold Corp.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Signs with EGO. Click here to check it out.

The intrinsic value of EGO

Yahoo Finance

Yahoo Finance