Elders And Two Other Undervalued Small Caps With Insider Actions In Australia

The Australian market has shown resilience, maintaining a steady performance over the last week and achieving a 7.2% increase over the past year, with earnings projected to grow by 13% annually. In this context, identifying undervalued small-cap stocks like Elders, which also show insider buying actions, can be particularly compelling for investors looking for potential growth opportunities in stable market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.5x | 2.7x | 47.61% | ★★★★★★ |

Nick Scali | 13.6x | 2.5x | 45.98% | ★★★★★★ |

RAM Essential Services Property Fund | NA | 5.5x | 42.32% | ★★★★★☆ |

Healius | NA | 0.6x | 43.83% | ★★★★★☆ |

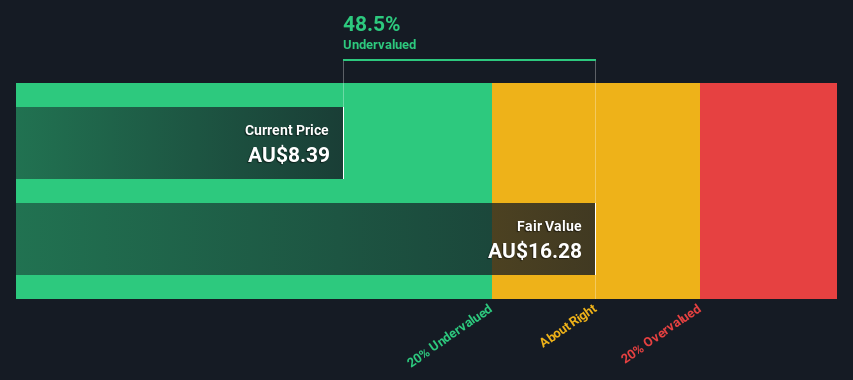

Elders | 20.9x | 0.4x | 48.47% | ★★★★☆☆ |

Dicker Data | 21.3x | 0.8x | 1.40% | ★★★★☆☆ |

Eagers Automotive | 9.4x | 0.3x | 34.98% | ★★★★☆☆ |

Codan | 28.2x | 4.1x | 28.16% | ★★★★☆☆ |

Tabcorp Holdings | NA | 0.7x | 20.73% | ★★★★☆☆ |

Coventry Group | 283.1x | 0.4x | -17.35% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Elders

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an agribusiness company that operates in branch network services, wholesale products, feed and processing services, and corporate services, with a market capitalization of approximately A$1.50 billion.

Operations: Branch Network generates the majority of revenue at A$2.54 billion, followed by Wholesale Products and Feed and Processing Services, contributing A$341.19 million and A$120.14 million respectively. The gross profit margin has seen fluctuations over the periods reviewed, with a notable figure of 20.23% in September 2016, demonstrating variability in profitability across different fiscal periods.

PE: 20.9x

Elders, a notable player in the Australian market, recently confirmed its earnings guidance for FY 2024 with an expected EBIT of A$120 million to A$140 million. Despite a challenging half year where net income and sales dropped significantly from the previous year, insider confidence remains strong as evidenced by recent appointments of experienced directors poised to steer future strategies. This strategic bolstering aligns with their projected annual earnings growth of 22.8%, highlighting potential overlooked by the market.

Dive into the specifics of Elders here with our thorough valuation report.

Evaluate Elders' historical performance by accessing our past performance report.

NRW Holdings

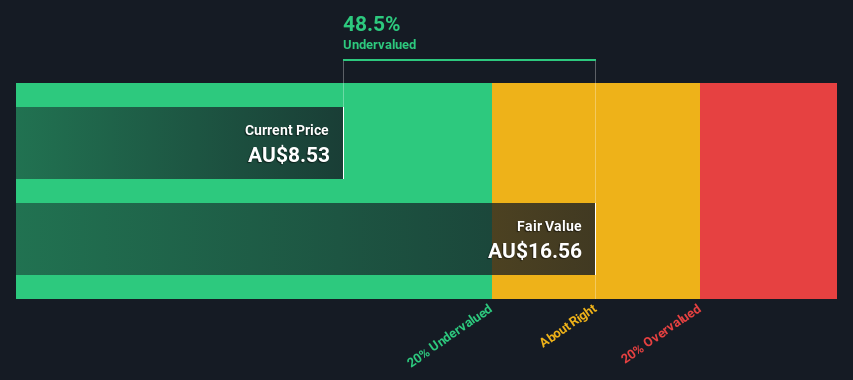

Simply Wall St Value Rating: ★★★★☆☆

Overview: NRW Holdings is an Australian company engaged in civil contracting and mining services, with a market capitalization of approximately A$1.76 billion.

Operations: The company's revenue is derived primarily from its Mining segment, which generated A$1.49 billion, followed by MET and Civil segments with revenues of A$739.07 million and A$593.62 million respectively. Its gross profit margin has shown an upward trend, reaching 47.41% in the most recent period reported.

PE: 15.8x

NRW Holdings, a standout among undervalued entities, has seen insider confidence with recent purchases signaling strong belief in the company's prospects. With earnings expected to grow annually by 13.46%, this firm relies entirely on external borrowing, avoiding customer deposit volatility. This financial strategy, while higher risk, underscores a proactive approach to capital management that could intrigue those looking for potential growth in lesser-known markets.

Unlock comprehensive insights into our analysis of NRW Holdings stock in this valuation report.

Assess NRW Holdings' past performance with our detailed historical performance reports.

Smartgroup

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Smartgroup is a company that provides outsourced administration, vehicle services, and software solutions with a market capitalization of approximately A$1.07 billion.

Operations: VS, OA, and SDGS generated revenues of A$18.12 million, A$232.39 million, and A$30.60 million respectively. The company's gross profit margin stood at 54.94% as of the latest reporting period in 2024.

PE: 18.0x

Recently, Smartgroup's leadership demonstrated strong insider confidence, with Independent Non-Executive Chairman John Prendiville acquiring 70,000 shares for A$584,000. This significant purchase underscores a belief in the company’s potential amidst its strategic moves towards acquisitions and enhancing digital technologies. With an earnings growth forecast of 8.23% per year and a commitment to returning value to shareholders through dividends and capital flexibility for strategic growth opportunities, Smartgroup is positioning itself as an intriguing entity within the Australian market space that might be overlooked despite its promising prospects.

Delve into the full analysis valuation report here for a deeper understanding of Smartgroup.

Explore historical data to track Smartgroup's performance over time in our Past section.

Make It Happen

Delve into our full catalog of 28 Undervalued ASX Small Caps With Insider Buying here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ELD ASX:NWH and ASX:SIQ.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance