Editas (EDIT) Beats on Q3 Earnings, Amends Celgene Deal

Editas Medicine, Inc. EDIT incurred a loss of 66 cents per share in the third quarter of 2019, narrower than the Zacks Consensus Estimate of 73 cents but wider than the year-ago quarter’s loss of 32 cents.

Collaboration and other research and development revenues comprising the company’s total revenues came in at $3.8 million, down 73.8% year over year. Meanwhile, sales were almost in line with the Zacks Consensus Estimate of $4million.

Editas has no approved product in its portfolio at the moment. The company generates collaboration revenues and other research and development revenues. Its collaboration revenues declined in the quarter due to lower revenues recognized under its collaboration with Allergan AGN. In the third quarter of 2018, Allergan exercised its option to develop and commercialize Editas’ lead pipeline candidate EDIT-101 globally, which resulted in higher revenues in the period.

In the reported quarter, research and development expenses were $22.7 million, up 30.5% from the year-ago period’s figure due to increased process and platform development costs. General and administrative expenses also rose 18.1% to $15.7 million due to higher professional services costs.

Amendment of Collaboration With Celgene

The company has a collaboration and licensing deal with Juno Therapeutics, now part of Celgene CELG, to develop autologous and allogeneic engineered alpha-beta T cell medicines for treating cancer and and autoimmune diseases. Along with the earnings release, Editas announced an amended agreement with Celgene to focus on engineered alpha-beta T cell medicines. The original collaboration covered the entire field of engineered T cells. With this amendment, Celgene will focus on alpha-beta T cells while Editas regained rights to develop non-alpha-beta T cells in all disease areas. For the amendment, Editas will receive a $70-million payment from Celgene and will also be entitled to future milestones and royalties.

Following the better-than-expected earnings results and the favorable amendment to the Celgene deal, Editas’ shares rose 10% on Tuesday. This year so far, the stock has declined 1.9% against the industry’s increase of 1.1%.

Pipeline Update

EDIT-101 uses CRISPR gene editing to treat Leber congenital amaurosis type 10 (LCA10), a rare genetic illness that causes blindness. Editas is developing EDIT-101 in partnership with Allergan. Both companies plan to initiate patient dosing in the phase I/II dose escalation study of Brilliance on EDIT-101 for LCA10 in early 2020. However, this is slightly delayed from the prior expectation of second-half 2019. The Brilliance study opened for patient enrolment in July.

Editas is also pursuing the development of CRISPR candidates for eye diseases other than LCA10 including Usher Syndrome type 2A (USH2A) and the recurrent ocular Herpes Simplex Virus type 1 (HSV-1) fibrosis. It expects to be ready for investigational new drug (IND) enabling activities for a USH2A program by this year-end.

The company is also designing novel medicines for non-malignant hematologic diseases, such as sickle cell disease and beta-thalassemia. It initiated IND enabling activities for EDIT-301, an experimental CRISPR medicine designed to treat sickle cell disease and beta-thalassemia by editing the beta-globin locus.

In the reported quarter, Editas signed a collaboration with AskBio, a leader in AAV gene therapy, to develop in vivo CRISPR medicines for the treatment of neurological diseases.

Genomic editing using CRISPR technology to repair a defective genetic material that causes diseases is probably one of the most promising and exciting healthcare innovations seen in decades. There are only a few companies making medicines using this revolutionary technology. Other than Editas, companies, namely CRISPR Therapeutics AG CRSP and Intellia Therapeutics are either planning to conduct or already started clinical studies to develop curative CRISPR/Cas9-based medicines.

Editas currently carries a Zacks Rank #4 (Sell).

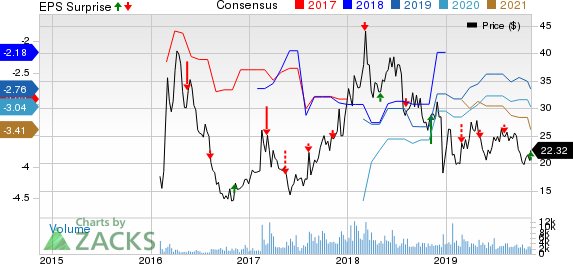

Editas Medicine, Inc. Price, Consensus and EPS Surprise

Editas Medicine, Inc. price-consensus-eps-surprise-chart | Editas Medicine, Inc. Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allergan plc (AGN) : Free Stock Analysis Report

Celgene Corporation (CELG) : Free Stock Analysis Report

Editas Medicine, Inc. (EDIT) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance