EDGEPOINT CANADIAN PORTFOLIO Adjusts Holdings with Uni-Select Inc Exit Leading the Change

Insight into the Latest Investment Moves by EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio)

EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio), known for its strategic investments in Canadian companies, has recently disclosed its N-PORT filing for the fourth quarter of 2023. The Portfolio is recognized for its focus on long-term capital appreciation, targeting firms with solid competitive positions, sustainable barriers to entry, promising growth prospects, and proficient management. The investment team's collective expertise and collaborative approach enable them to deeply understand the businesses they invest in, ensuring a well-researched and balanced portfolio.

Summary of New Buys

EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio) expanded its portfolio with 7 new stocks in the latest quarter. Noteworthy additions include:

TransAlta Corp (TSX:TA), purchasing 3,290,246 shares, which now comprise 1.23% of the portfolio, valued at C$36.26 million.

Dye & Durham Ltd (TSX:DND), with 2,476,511 shares, making up about 1.21% of the portfolio, valued at C$35.56 million.

CAE Inc (TSX:CAE), adding 1,088,210 shares, accounting for 1.06% of the portfolio, valued at C$31.12 million.

Key Position Increases

EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio) also bolstered its stakes in 14 stocks. Significant increases include:

Algonquin Power & Utilities Corp (TSX:AQN), with an additional 5,025,038 shares, bringing the total to 6,709,081 shares. This represents a 298.39% increase in share count and a 1.42% impact on the current portfolio, valued at C$56.08 million.

Artis Real Estate Investment Trust (TSX:AX.UN), with an additional 4,129,354 shares, now holding a total of 8,227,707 shares. This adjustment marks a 100.76% increase in share count, valued at C$54.55 million.

Summary of Sold Out Positions

During the fourth quarter of 2023, EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio) exited 6 positions entirely, including:

Uni-Select Inc (TSX:UNS), selling all 1,164,994 shares, which had a -2.05% impact on the portfolio.

SAP SE (NYSE:SAP), liquidating all 75,875 shares, causing a -0.51% impact on the portfolio.

Key Position Reductions

EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio) trimmed its holdings in 15 stocks. The most significant reductions were:

PrairieSky Royalty Ltd (TSX:PSK), reduced by 1,246,720 shares, leading to a -21.58% decrease in shares and a -1.08% impact on the portfolio. The stock traded at an average price of C$24.97 during the quarter and has returned 16.63% over the past 3 months and 15.48% year-to-date.

Tourmaline Oil Corp (TSX:TOU), reduced by 382,472 shares, resulting in a -27.26% reduction in shares and a -0.89% impact on the portfolio. The stock traded at an average price of C$67.3 during the quarter and has returned 8.25% over the past 3 months and 7.70% year-to-date.

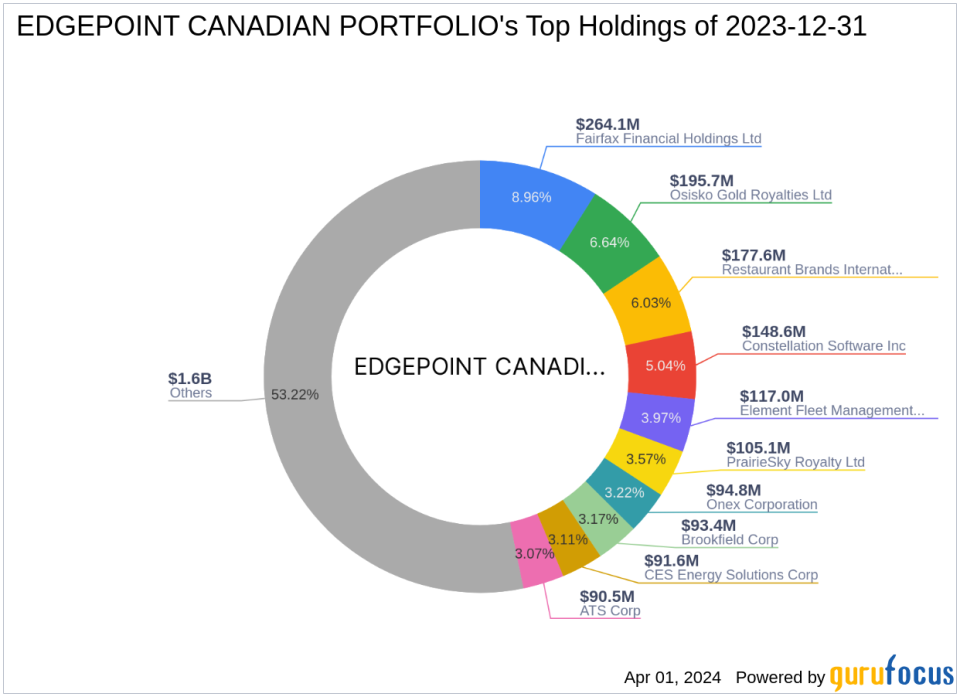

Portfolio Overview

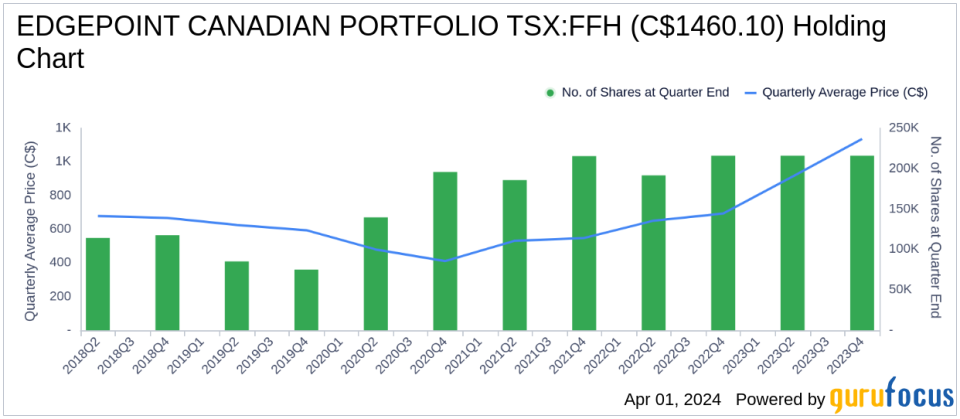

As of the fourth quarter of 2023, EDGEPOINT CANADIAN PORTFOLIO (Trades, Portfolio)'s portfolio consisted of 60 stocks. The top holdings included 8.96% in Fairfax Financial Holdings Ltd (TSX:FFH), 6.64% in Osisko Gold Royalties Ltd (TSX:OR), 6.03% in Restaurant Brands International Inc (TSX:QSR), 5.04% in Constellation Software Inc (TSX:CSU), and 3.97% in Element Fleet Management Corp (TSX:EFN). The investments are predominantly concentrated across 9 industries, including Financial Services, Industrials, Technology, Consumer Cyclical, Energy, Basic Materials, Real Estate, Utilities, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance