eBay (EBAY) Q1 Earnings & Revenues Beat Estimates, Rise Y/Y

eBay Inc. EBAY reported first-quarter 2023 non-GAAP earnings of $1.11 per share, which beat the Zacks Consensus Estimate by 4.7%. The bottom line increased 5% year over year.

Net revenues of $2.51 billion surpassed the Zacks Consensus Estimate of $2.48 billion. The figure increased 1% from the year-ago quarter on a reported basis and 3% on an FX-neutral basis.

Strengthening momentum across the advertising offerings of EBAY was a tailwind.

eBay’s Promoted Listings generated revenues of $285 million, up 27% on a reported basis and 31% on an FX-neutral basis from the prior-year quarter’s levels. This fueled momentum across EBAY’s first-party advertising products.

Total advertising offerings yielded $317 million in revenues, which grew 18.7% on a year-over-year basis.

However, softness in eBay’s Marketplace platform and weakening momentum among active buyers were concerns. EBAY witnessed a year-over-year decline of 7% in the active buyer base, which stood at 133 million at the end of the first quarter.

The active buyer count stood at 131 million, excluding contributions from GittiGidiyor and TCGplayer acquisitions.

eBay witnessed a declining gross merchandise volume (GMV) in the reported quarter, which remained an overhang.

eBay’s deepening focus on product categories like watches and sneakers, as well as refurbished items, has been a major positive. Its efforts toward strengthening its collectible offerings are noteworthy.

Shares of eBay have risen 2.6% in the after-hours trading due to the better-than-expected second-quarter revenue guidance.

On a year-to-date basis, EBAY has gained 7.3% compared with the industry’s growth of 10.7%.

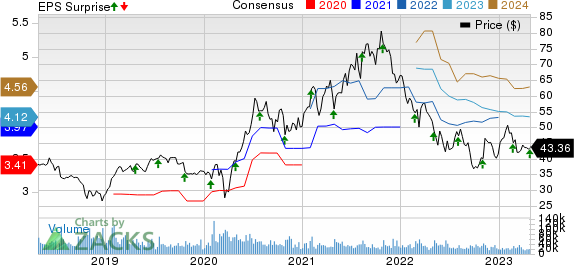

eBay Inc. Price, Consensus and EPS Surprise

eBay Inc. price-consensus-eps-surprise-chart | eBay Inc. Quote

GMV Details

EBAY’s total GMV of $18.41 billion in the reported quarter exhibited year-over-year declines of 5% and 2% on a reported and an FX-neutral basis, respectively.

Nevertheless, the reported GMV surpassed the Zacks Consensus Estimate of $18.13 billion.

The total GMV is categorized into two parts.

U.S. GMV totaled $9.01 billion, accounting for 48.9% of the total GMV, down 3% from the year-ago quarter.

International GMV was $9.4 billion, accounting for 51.1% of the total GMV. It fell 7% on a year-over-year basis.

Operating Details

In the first quarter, eBay’s gross margin was 72.1%, which contracted 10 basis points (bps) year over year.

Operating expenses of $1.25 billion rose 13.6% year over year. As a percentage of net revenues, the figure expanded 550 bps to 49.9% from the year-ago quarter.

The non-GAAP operating margin was 29.6% in the first quarter, contracting 280 bps year over year.

Balance Sheet & Cash Flow

As of Mar 31, 2023, cash equivalents and short-term investments were $4 billion, down from $4.8 billion as of Dec 31, 2022.

Long-term debt was $7.72 billion at the end of the first quarter, which was flat with that reported in the fourth quarter.

EBAY generated $841 million in cash from operating activities in the first quarter, up from $686 million in the fourth quarter.

Its free cash flow stood at $709 million in the reported quarter.

eBay repurchased $250 million worth of shares and paid out dividends of $134 million in the reported quarter.

Guidance

For second-quarter 2023, eBay expects revenues of $2.47-$2.54 billion. On an FX-neutral basis, year-over-year growth in revenues is anticipated to be 1-4%. On a spot-rate basis, the same is expected between 2% and 5%. The Zacks Consensus Estimate for revenues is pegged at $2.43 billion.

The non-GAAP operating margin is expected between 26.1% and 26.8%.

GMV for the second quarter is likely to be $17.8-$18.2 billion, indicating a decline of 4-2% on a spot-rate basis and 5-2% on an FX-neutral basis.

Non-GAAP earnings per share are anticipated between 96 cents and $1.01. The Zacks Consensus Estimate for the same is pegged at $1.01 per share.

Zacks Rank & Stocks to Consider

Currently, eBay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the retail-wholesale sector are The Kroger Co. KR, Ulta Beauty ULTA and Rush Enterprises RUSHA. Kroger sports a Zacks Rank #1 (Strong Buy), and Ulta Beauty and Rush Enterprises carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kroger has gained 7.8% on a year-to-date basis. The long-term earnings growth rate for KR is projected at 5.99%.

Ulta Beauty has gained 15.1% on a year-to-date basis. The long-term earnings growth rate for ULTA is projected at 12.26%.

Rush Enterprises has gained 0.2% on a year-to-date basis. The long-term earnings growth rate for RUSHA is projected at 15%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

eBay Inc. (EBAY) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance