Easy Come, Easy Go: How Granite Oil (TSE:GXO) Shareholders Torched 98% Of Their Cash

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Granite Oil Corp. (TSE:GXO) during the five years that saw its share price drop a whopping 98%. We also note that the stock has performed poorly over the last year, with the share price down 76%. On top of that, the share price has dropped a further 17% in a month.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Granite Oil

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

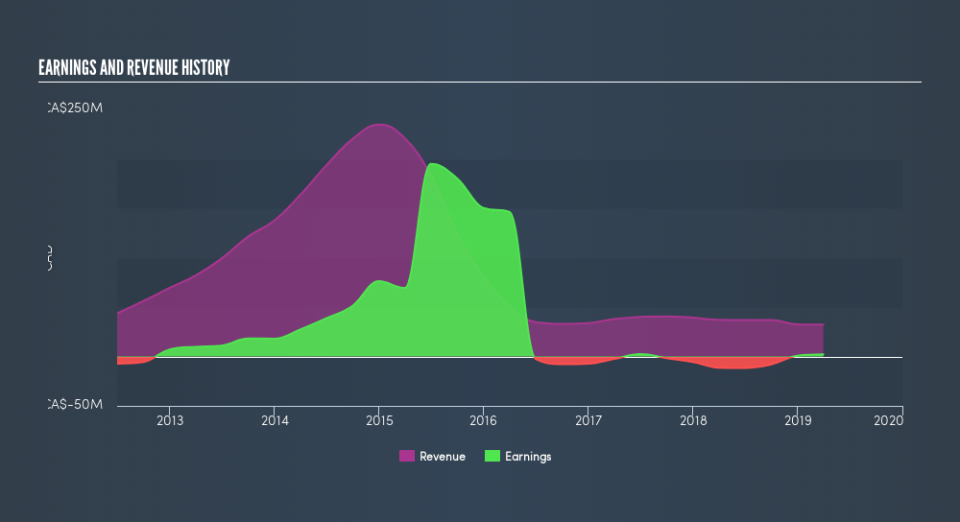

During five years of share price growth, Granite Oil moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Arguably, the revenue drop of 45% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Granite Oil will earn in the future (free profit forecasts).

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. In some ways, TSR is a better measure of how well an investment has performed. Over the last 5 years, Granite Oil generated a TSR of -85%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

While the broader market gained around 1.0% in the last year, Granite Oil shareholders lost 74%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 31% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Granite Oil is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance