Earnings Season: 3 Buy-Rated Stocks That Could Surprise

Earnings season is always an exciting time to be an investor, as companies finally pull the curtain back and unveil what’s transpired behind the scenes. The 2023 Q4 cycle looks to be another critical period, particularly as investors look to find further clues about what lies ahead in 2024 overall.

As usual, there will be surprises, a few of which could come from Netflix NFLX, Chipotle Mexican Grill CMG, and MercadoLibre MELI. All three sport a positive Zacks Earnings ESP Score heading into their respective releases.

Let’s take a closer look at what’s being expected.

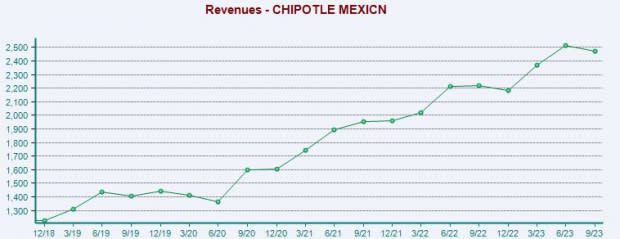

Chipotle Mexican Grill

Chipotle Mexican Grill, a Zacks Rank #2 (Buy), operates quick-casual and fresh Mexican restaurant chains. Shares have shown a nice level of relative strength in 2024 so far, adding 1.5% in value vs. the S&P 500’s 0.4% dip.

Analysts have been bullish for the release, with the $9.64 Zacks Consensus EPS Estimate 2% higher since October last year. The value suggests a sizable 16% uptick from the same period last year.

Image Source: Zacks Investment Research

The company’s top line is expected to expand nicely as well, with our $2.5 billion quarterly revenue estimate implying a 14% climb and up 1.4% since October. CMG has been aided by easing costs and continued business momentum, helping to explain its solid growth.

CMG’s top line has shown remarkable growth over the years, further illustrated below.

Image Source: Zacks Investment Research

Shares currently trade at a steep 44.1X forward earnings multiple, undoubtedly expensive but beneath the 53.3X five-year median. Investors have had little issue forking up the premium given the company’s growth.

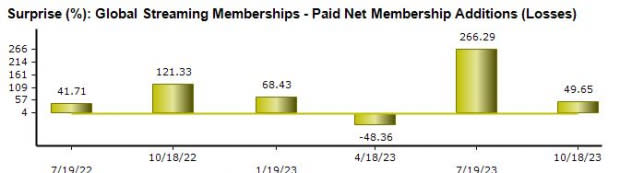

Netflix

Netflix is a leader in online streaming, with shares quickly becoming popular over the last decade following considerable outperformance. The stock is currently a Zacks Rank #2 (Buy), with earnings expectations increasing across the board.

Image Source: Zacks Investment Research

The Zacks Consensus EPS Estimate of $2.20 reflects quad-digit year-over-year growth of more than 1700%, with our $8.7 billion quarterly revenue estimate implying a climb of 11%.

Of course, subscribers are the key metric every investor watches. Paid Net Membership additions totaled 9 million throughout its latest release, crushing expectations and boosted by the adoption of the company’s new ad-supported plans. Impressively, ad-supported memberships grew 70% quarter-over-quarter.

For the upcoming release, the Zacks Consensus Estimate for Net Membership Additions stands at 8.9 million, well above the 7.6 million mark reported in the same period last year. The company has strung together back-to-back positive surprises on the metric, as we can see below.

Image Source: Zacks Investment Research

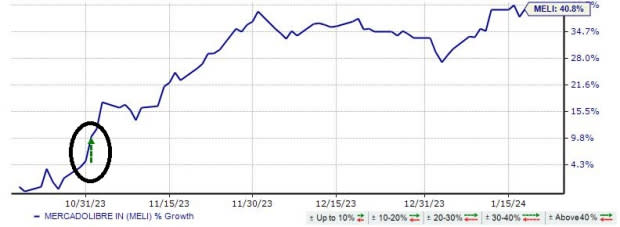

MercadoLibre

MercadoLibre is one of the largest e-commerce platforms in South America. The company is a market leader in e-commerce in Brazil, Argentina, Colombia, Chile, Ecuador, Costa Rica, Peru, Mexico, and Uruguay based on unique visitors and page views.

The company is expected to post sizable growth, with consensus earnings and revenue estimates suggesting upticks of 105% and 38%, respectively. MELI has been a strong earnings performer overall, exceeding our consensus EPS expectations by an average of 33% across its last four releases.

Shares popped post-earnings following its latest release, as shown below.

Image Source: Zacks Investment Research

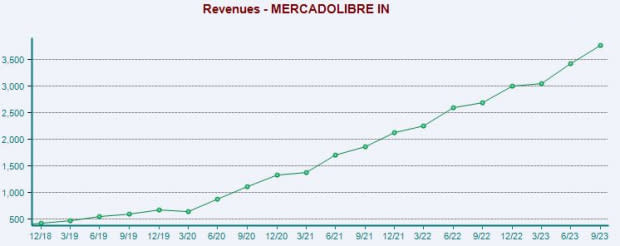

Like CMG, MercadoLibre’s revenue growth has been remarkably strong, posting double-digit year-over-year revenue growth rates in 13 consecutive quarterly releases.

Image Source: Zacks Investment Research

Bottom Line

While earnings season is undoubtedly hectic, it’s an exciting time for investors to get a deeper view of how companies are performing.

And all three stocks above – Netflix NFLX, Chipotle Mexican Grill CMG, and MercadoLibre MELI – could positively surprise investors, as suggested by their positive Zacks Earnings ESP Scores.

In addition, all three sport a favorable Zacks Rank, reflecting overall optimism among analysts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance