Eagle Bancorp Montana Inc. Misses Q1 Earnings Estimates, Declares Dividend

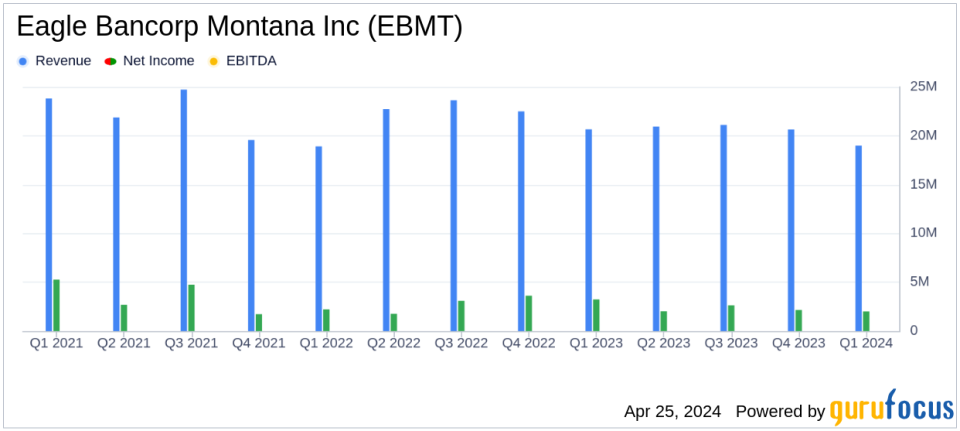

Net Income: $1.9 million, or $0.24 per diluted share, below the estimated $2.13 million and $0.27 per share.

Revenue: $19.2 million, surpassing the estimated $15.2 million.

Quarterly Dividend: Declared at $0.14 per share, with an annualized yield of 4.40% based on recent market prices.

Loan Growth: Total loans increased by 8.7% year-over-year to $1.50 billion.

Net Interest Margin (NIM): Improved slightly to 3.33% from 3.32% in the previous quarter, yet contracted from 3.86% a year ago.

Deposits: Total deposits grew modestly by 1.7% to $1.64 billion year-over-year.

Stock Repurchase: Renewed plan authorizing the repurchase of up to 400,000 shares, about 5.0% of outstanding shares.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Eagle Bancorp Montana Inc (NASDAQ:EBMT) disclosed its financial results for the first quarter of 2024 on April 23, 2024, revealing earnings that fell short of analyst expectations. The company announced net income of $1.9 million, or $0.24 per diluted share, missing the estimated earnings per share of $0.27. Despite this, EBMT declared a quarterly cash dividend of $0.14 per share and renewed its stock repurchase plan. The full details of the earnings can be accessed through their 8-K filing.

About Eagle Bancorp Montana Inc

Eagle Bancorp Montana Inc operates as a bank holding company through its subsidiary, Opportunity Bank of Montana. It offers a range of banking products and services including residential and commercial loans, as well as deposit accounts like checking, savings, and certificates of deposit. The company primarily focuses on residential mortgage loans, commercial real estate loans, and agricultural loans.

Financial Highlights and Challenges

The first quarter of 2024 saw EBMT generate revenues of $19.2 million, a decrease from $21.0 million in the previous quarter and $21.1 million year-over-year. Total loans grew by 8.7% to $1.50 billion, and deposits increased by 1.7% to $1.64 billion. However, the net interest margin (NIM) experienced a contraction, highlighting ongoing challenges in the banking sector such as the inverted yield curve and a persistent high-interest rate environment.

Strategic Financial Management

President and CEO Laura F. Clark commented on the company's strategic initiatives, stating,

Eagles first quarter operating results reflect disciplined loan growth and lower noninterest expenses as we continue to navigate the challenges impacting the banking industry."

This approach is crucial for maintaining profitability and asset quality in a fluctuating economic landscape.

Analysis of Performance

Despite the earnings miss, EBMT's management of its loan portfolio and cost control measures are notable. The slight increase in net interest margin from the preceding quarter suggests a careful balancing of asset yields against funding costs. Moreover, the company's capital management strategies, including the renewed stock repurchase plan, reflect a commitment to delivering shareholder value.

Conclusion

While Eagle Bancorp Montana Inc faced some earnings headwinds in the first quarter of 2024, its strategic focus on loan quality and cost efficiency, combined with proactive capital management, positions it to navigate the ongoing challenges in the banking sector. Investors and stakeholders will likely watch closely how EBMT adapts to interest rate changes and economic conditions in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Eagle Bancorp Montana Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance