E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Strengthens Over 27036, Weakens Under 27031

December E-mini Dow Jones Industrial Average futures are trading lower as we approach the mid-session of the trading day. The market gapped lower early Sunday, followed through to the downside shortly after the pre-market opening, but has been rangebound ever since. Sellers are reacting to renewed fears over a global economic slowdown due to a surge in oil prices.

At 15:17 GMT, December E-mini Dow Jones Industrial Average futures are trading 27113, down 101 or -0.37%.

Daily Technical Analysis

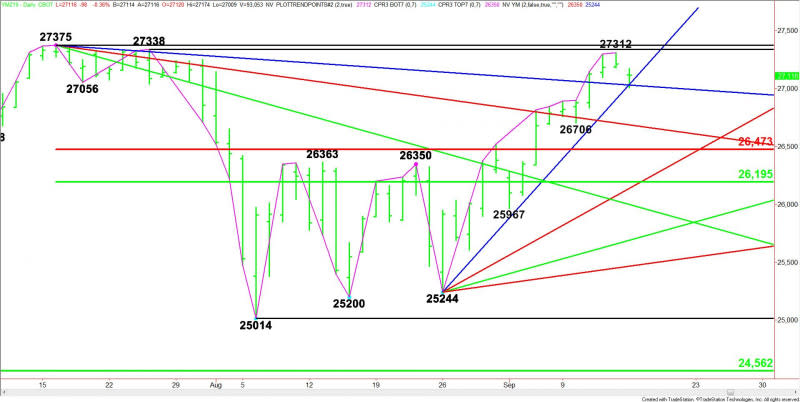

The main trend is up according to the daily swing chart. A trade through 27312 signals a resumption of the uptrend. The main trend is safe at this time, but there is room for a normal 50% to 61.8% correction.

The minor trend is also up. A move through 26708 will change the minor trend to down. This will also shift momentum to the downside.

The main range is 27375 to 25014. Its retracement zone at 26473 to 26195 is the first downside target.

Daily Technical Forecast

Based on the early price action, the direction of the December E-mini Dow Jones Industrial Average futures contract the rest of the session on Monday is likely to be determined by trader reaction to a pair of Gann angles at 27036 and 27031.

Bullish Scenario

A sustained move over 27036 will indicate the presence of buyers. The first upside target is the gap at 27174 to 27180. This is followed by the minor top at 27312.

Bearish Scenario

A sustained move under 27031 will signal the presence of sellers. This is a potential trigger point for an acceleration to the downside with the first target the minor bottom at 26706, followed closely by a downtrending Gann angle at 26687.

Taking out 26687 could extend the break into the Fibonacci level at 26473.

This article was originally posted on FX Empire

More From FXEMPIRE:

Gold Price Prediction – Gold Rallies as Geopolitical Risks Rise

S&P 500 Price Forecast – Stock markets gap lower after drone attack

Natural Gas Price Forecast – Natural gas markets continue to rally

USD/JPY Price Forecast – US dollar gaps lower to kick off week against Japanese yen

GBP/JPY Price Forecast – British pound gapped lower against Japanese yen amid chaos

Yahoo Finance

Yahoo Finance