E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Next Downside Target 28218

March E-mini Dow Jones Industrial Average futures are expected to open flat-to-lower on Tuesday as investors wrapped up a banner year that saw equities surge to record highs, overcoming concerns about the economy and a trade war with China.

On Tuesday, the Dow posted its worst performance of the month as investors booked profits and rebalanced portfolios after hitting a record high last week.

Dow components Apple and Microsoft finished this year up 84.4% and 55.2% respectively. They are the best-performing Dow stocks of the year and accounted for about 15% of the S&P 500’s overall gains for 2019.

At 13:48 GMT, March E-mini Dow Jones Industrial Average futures are trading 28406, down 34 or -0.13%.

Daily Technical Analysis

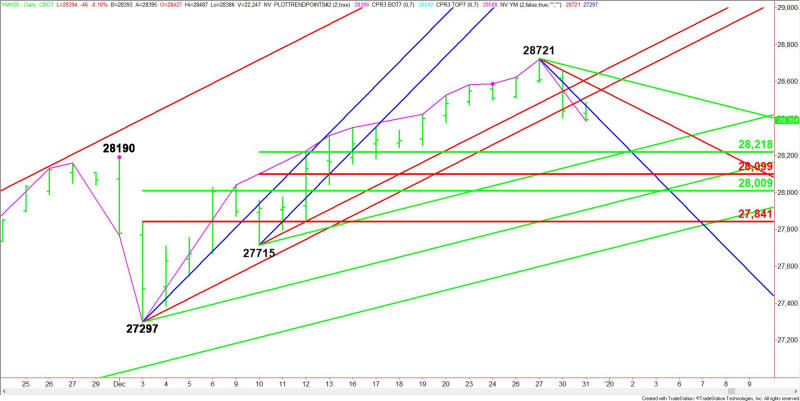

The main trend is up according to the daily swing chart. A trade through 28721 will signal a resumption of the uptrend. A trade through 27297 will change the main trend to down.

The minor trend is also up. A trade through 27715 will change the minor trend to down. This will also shift momentum to the downside.

The minor range is 27715 to 28721. Its retracement zone at 28218 to 28099 is the first downside target. Since the main trend is up, look for buyers to come in on a test of this area.

The main range is 27297 to 28721. Its retracement zone at 28009 to 27841 represents the best value zone. A test of this area should attract buyers.

Daily Technical Forecast

Based on the early price action, and the current price at 28406, the direction of the March E-mini Dow Jones Industrial Average futures contract the rest of the session on Tuesday is likely to be determined by trader reaction to a downtrending Gann angle at 28465.

Bearish Scenario

A sustained move under 28465 will indicate the presence of sellers. If this move is able to generate enough downside momentum that look for a possible break into the minor 50% level at 28218. Watch for a technical bounce on the first test of this level.

If 28218 fails as support then look for the selling to possibly extend into the uptrending Gann angle at 28163, followed by the minor Fibonacci level at 28099.

Bullish Scenario

Overtaking and sustaining a rally over 28465 could lead to a labored rally with potential upside targets layered at 28513, 28593, 28611 and 28657. The latter is the last potential resistance angle before the 28721 main top.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance