DuPont (DD) Tyvek Richmond Facility Gets ISCC+ Certification

DuPont de Nemours Inc. DD announced that its Tyvek production facility at the Spruance manufacturing plant in Richmond has achieved certification from the International Sustainability and Carbon Certification (ISCC PLUS).

The Spruance site is the second DuPont location to obtain ISCC certification, following the Luxembourg manufacturing plant in November 2023. This achievement illustrates DuPont's commitment to advancing its sustainability goals and developing capabilities to deliver Tyvek products derived from sustainable raw materials globally.

Completing the ISCC PLUS certification of global Tyvek product capabilities is a significant step toward improving the company's climate and circular economy sustainability objectives. ISCC PLUS certification verifies a product's sustainability across the whole supply chain, from raw material sourcing to manufacture and distribution, employing the mass balance approach in a robust, transparent and credible manner.

One of the primary aspects of ISCC PLUS certification is that it enables the decrease of product carbon footprint and the gradual substitution of fossil fuel-based raw materials with more sustainable alternatives, all while fostering the transition to a more circular economy.

Tyvek products safeguard and improve the lives of millions of people in the end markets that the company serves, which include healthcare packaging, personal protection, construction and a wide range of consumer and industrial uses. DuPont's global integration of ISCC PLUS certification into Tyvek production coincides with the company's commitment to empowering clients on their road to net zero emissions.

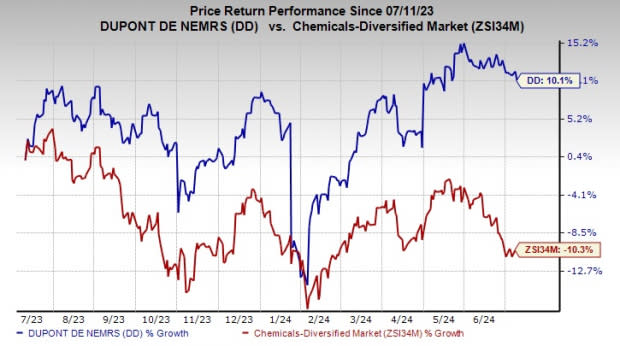

Shares of DuPont have gained 10.1% over the past year against a 10.3% decline of its industry.

Image Source: Zacks Investment Research

DuPont, on its first-quarter call, revised its financial outlook for 2024, increasing its projections for net sales, operating EBITDA and adjusted EPS. The company anticipates full-year 2024 net sales to be approximately $12.25 billion, operating EBITDA to be about $2.975 billion and adjusted EPS to be around $3.60 per share, based on the mid-point of the updated guidance.

For the second quarter of 2024, DuPont expects a sequential improvement in sales and earnings, attributed to favorable seasonal factors, continued recovery in the electronics sector and a decline in channel inventory destocking across industrial-based end-markets such as water and medical packaging.

For the second half of 2024, the company expects year-over-year sales and earnings growth, driven by ongoing recovery in the electronics market and a return to volume growth in the Water & Protection segment.

Zacks Rank & Key Picks

DD currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Ecolab Inc. ECL and Kronos Worldwide, Inc. KRO.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company's shares have soared 94.2% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company's shares have rallied roughly 31.9% in the past year.

Kronos Worldwide currently carries a Zacks Rank #2. KRO has a projected earnings growth rate of 297.7% for the current year. The company’s shares have rallied around 37.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance