Duolingo's 2024 Growth Is Already Priced In

If investors trusted the thesis for Duolingo Inc. (NASDAQ:DUOL) at the start of 2023 and held their positions for the year, they would have seen their value rise 3.3 times. With the stock up 240% at the time of writing, it has beaten some well-known companies that are favorites among institutional investors, such as Nvidia (NASDAQ:NVDA), Palantir (NYSE:PLTR) and Meta Platforms (NASDAQ:META).

But my analysis suggests investors lock in gains here, with downside expected in Duolingo as we head into 2024. By all valuation metrics, the stock is overpriced, overvalued and overbought.

About Duolingo

Duolingo is a language learning app that rewards its users by awarding virtual coins and tokens for completing milestones and courses in the app's language learning modules. The app's fun and immersive experience has made it the most popular language learning app platform in the world, beating other language learning app platforms such as Babbel, according to app intelligence provider Sensor Tower.

The language learning platform was co-founded in 2009 with a mission to teach English to non-English-speaking populations and vice versa. In the last 12 months, Duolingo has expanded the course modules that it offers via its app platform into subjects such as math and music.

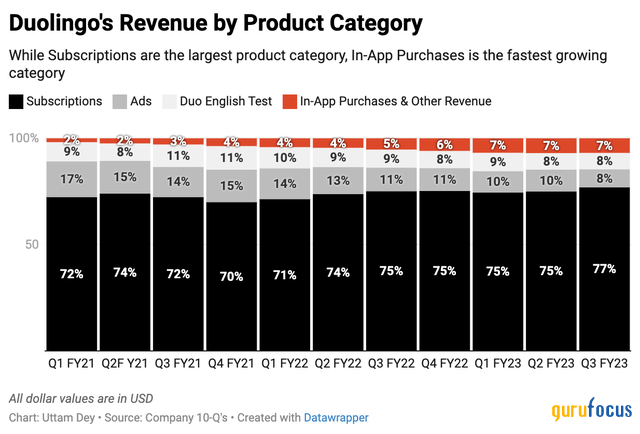

While the company operates in a freemium-type business model, approximately three-fourths of the app's revenue comes from its users, who pay monthly fees to get uninterrupted access to the app's language courses. Around 16% of the remaining revenue is from its ad revenue as well as the fees that it charges users for taking its English language tests. The remaining 7% to 9% of revenue comes from a fast-growing Other Revenue segment that mostly comprises in-app purchases made by users who want to buy additional tokens and other forms of virtual currency they use within the app.

Duolingo enjoys strong gross margins at 73%, but is yet to break even on an operating margin basis.

Duolingo's growth drivers are slowing

Bulls would argue that Duolingo has enjoyed substantial benefits from margin expansion. To understand this, let's look at the key products from which it derives revenue. The chart below illustrates the four product categories that contribute to the company's top line.

From the chart above, Subscriptions have always been historically the largest source of Duolingo's revenue, contributing around three-quarters of the total. While Duolingo is a free language learning app, the company makes money from people who pay a monthly subscription to unlock additional features. But it is really the in-app purchases that drive high-margin revenue for Duolingo. Users of the platform buy various tokens and virtual coins to unlock more features, like getting badges. In-app purchases now contribute 7% to Duolingo's revenue versus a mere 2% at the start of 2021, and this is one metric that bulls were excited by. However, if I look at it in a different way, I see that the growth rate for this metric is stalling.

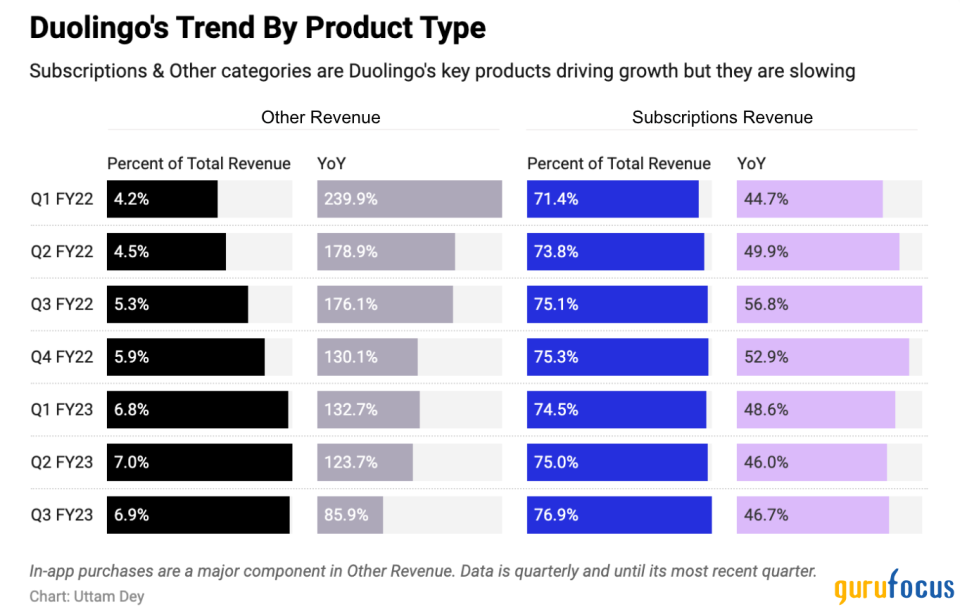

From the chart below, it is evident that in-app purchases have been slowing sequentially every quarter. With growth in both of these two product categories set to slow even further, in my opinion, the case for paying a higher premium from here on is unjustifiable to me.

While third-quarter subscriptions have grown 47% year over year, I strongly suspect this is a transitory bump since management noted in the shareholder letter that they had resorted to paid advertising. This is a strong signal to me, suggesting organic user growth is stagnating and the company has to spend more on ads to acquire users, leading to some margin compression in the future. This is one of the reasons why we can see a bump in third-quarter subscriptions this year. Duolingo usually runs paid ads in the summer with promotions to incentivize users to sign up on the platform.

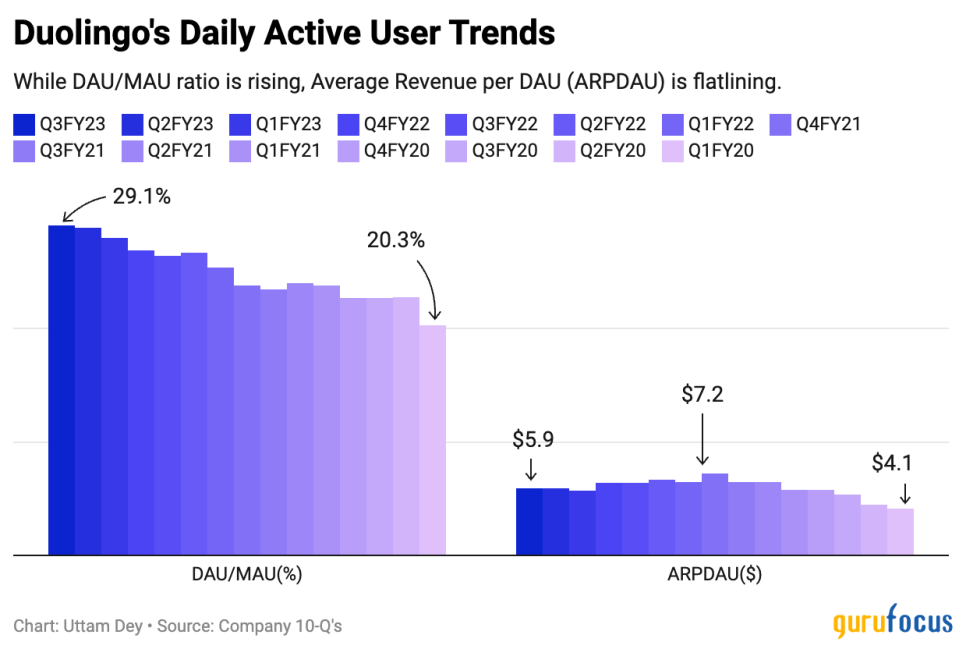

When I started covering Duolingo, I was bullish on the growth trajectories I noticed earlier on in its user base. User engagement continues to be strong, as can be seen by its daily average user to monthly average user ratio. The DAU/MAU ratio is a metric that illustrates the volume of users who are active on the app at least once daily versus the volume of users active at least once monthly. Over the past 15 quarters, only 20.3% of monthly actives used the app daily. But that metric significantly improved in its most recent quarter to 29%, as can be seen below. This was another reason that bulls were excited about the growth prospects of Duolingo.

However, monetization of these users is more important, in my opinion, than just user engagement. To understand the trend of Duolingo's monetization, I looked at the average revenue per daily active users and compared it to the DAU/MAU ratios.

On one hand, the DAU/MAU ratio is rising healthily, as can be seen above. This suggests Duolingo's user engagement metric is improving, meaning more users are using the app more frequently. But a telling sign of decelerating monetization is in its ARPDAU metric. With this metric down 18% from its high, fewer users are paying up for purchasing things on the app. To me, these monetization trends portend slowing growth for the language learning app and go further to justify how overpriced Duolingo's stock is.

What valuation models suggest for Duolingo

Duolingo has had impressive growth in revenue, with sales for the first nine months of this year rising 43% versus the same period last year. Its most recent quarterly results indicated that subscriptions, its key driver for sales, surged 46.7% on a year-over-year basis. Although I am impressed with the company's growth rate so far and the execution of Duolingo's management, I believe much of the growth is already priced into the stock.

On the recent earnings call, Duolingo's chief financial officer mentioned the company is on track to achieve $525 million to $528 million in revenue in 2023. Taking the midpoint of its revenue guidance, that would suggest Duolingo will grow its revenue by 42.5% this year. The consensus expectation is for Duolingo to grow its revenue by 31% in 2024. For the purposes of my valuation and looking at Duolingo's past history of beating expectations, I believe it can grow its revenue by 42% next year. My projections for next year's revenue growth rate are based on management's guidance for bookings to grow 40% year over year in 2023. Bookings are usually seen as an indication of future trends in financial results and revenue that may not be reflected in the current revenue growth rate.

Further, I will assume a five-year investment horizon when evaluating Duolingo's valuation. I had previously established the stock is on track to grow 42.5% this year and 42% next year based on my projections. If growth slows to an average pace of 25% per year after 2024 over the five-year investment horizon, the forward price-sales ratio will narrow to 8 by fiscal 2026. The stock currently trades at 20 times its revenue. This model suggests that paying 20 times revenue today, or 8 times 2026 revenue, is significantly expensive.

Although the company's growth rate is notable, I believe Duolingo's shares have risen faster than its growth drivers warrant based on my valuation model outlined above. Moreover, as we review the trajectory of the company's key growth drivers below, the perspective for being bearish on Duolingo becomes stronger.

Near-term prospects for Duolingo

The third-quarter earnings report for Duolingo also showed its GAAP Ebit margins improving from -21% to -3.4%. With negative margins narrowing, expectations for Duolingo to be GAAP Ebit positive have significantly risen next year and investors, in my opinion, have re-rated the stock in anticipation of the development. Currently, Duolingo trades at a forward price-earnings ratio of 1,150 on a GAAP basis. This is around 6000% higher compared to Duolingo's competition.

While the re-rating may have been justified at the time of the earnings report in October, I firmly believe this stock has been overcompensated with a high premium for forward earnings.

Takeaways

With bullish sentiment currently prevalent in markets, it can be easy to ignore the risks of locking in profits for positions in Duolingo. With a forward GAAP price-earnings ratio of 1,150, it is safe to say Duolingo's sky-high valuation levels could easily cause a nosebleed. Although the company's management has a good track record of executing well, my models suggest most of the forward growth is more than priced into the stock and it would be wise to take profits here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance