Dun & Bradstreet Holdings Inc's Dividend Analysis

An In-depth Look at the Upcoming Dividend and Its Sustainability

Dun & Bradstreet Holdings Inc (NYSE:DNB) has recently declared a dividend of $0.05 per share, scheduled for payment on June 20, 2024, with an ex-dividend date of June 6, 2024. This announcement has garnered attention from investors keen on understanding the company's dividend history, yield, and growth rates. Utilizing data from GuruFocus, this article delves into the dividend performance and sustainability of Dun & Bradstreet Holdings Inc.

Understanding Dun & Bradstreet Holdings Inc

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

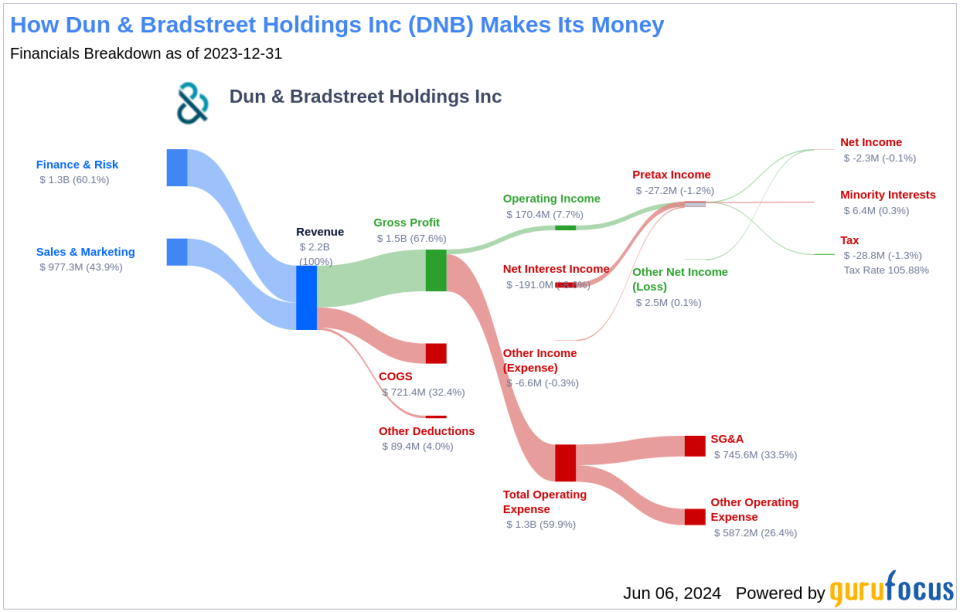

Dun & Bradstreet Holdings Inc operates primarily in providing critical business decisioning data and analytics. The company is segmented into North America and International operations, with the former contributing the majority of the revenue through services in Finance & Risk and Sales & Marketing data. The company's offerings also include digital marketing, sales acceleration, and risk management, positioning it as a pivotal entity in business insights across various regions.

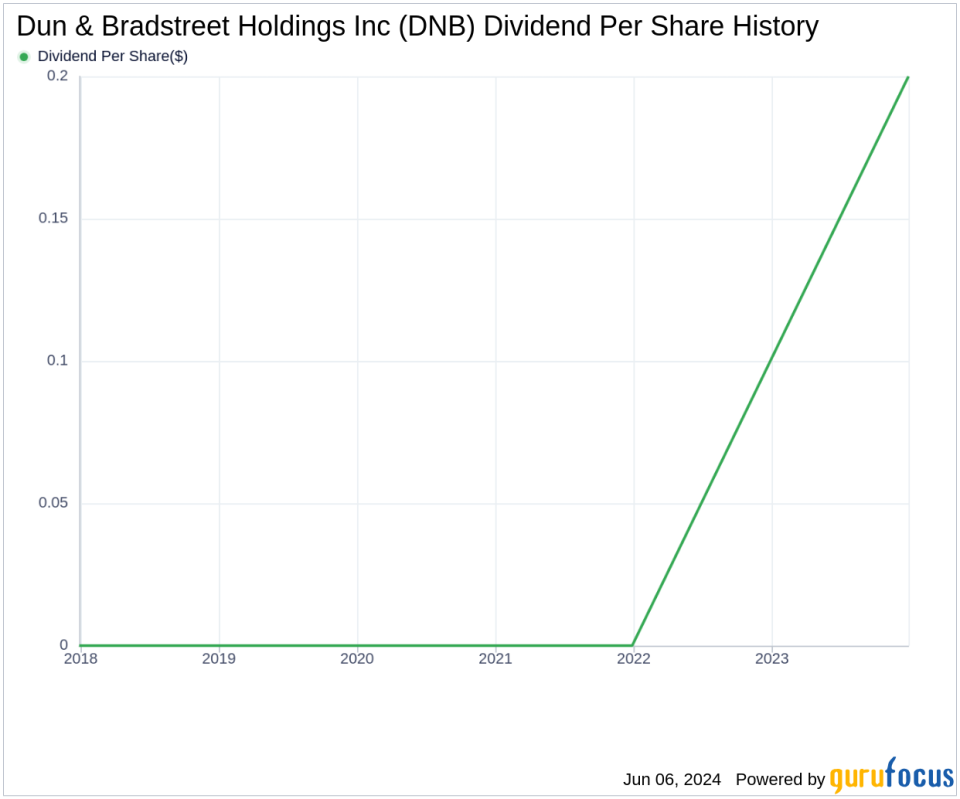

Review of Dun & Bradstreet Holdings Inc's Dividend History

Since 2022, Dun & Bradstreet Holdings Inc has maintained a steady record of quarterly dividend distributions. This consistency highlights the company's commitment to returning value to its shareholders.

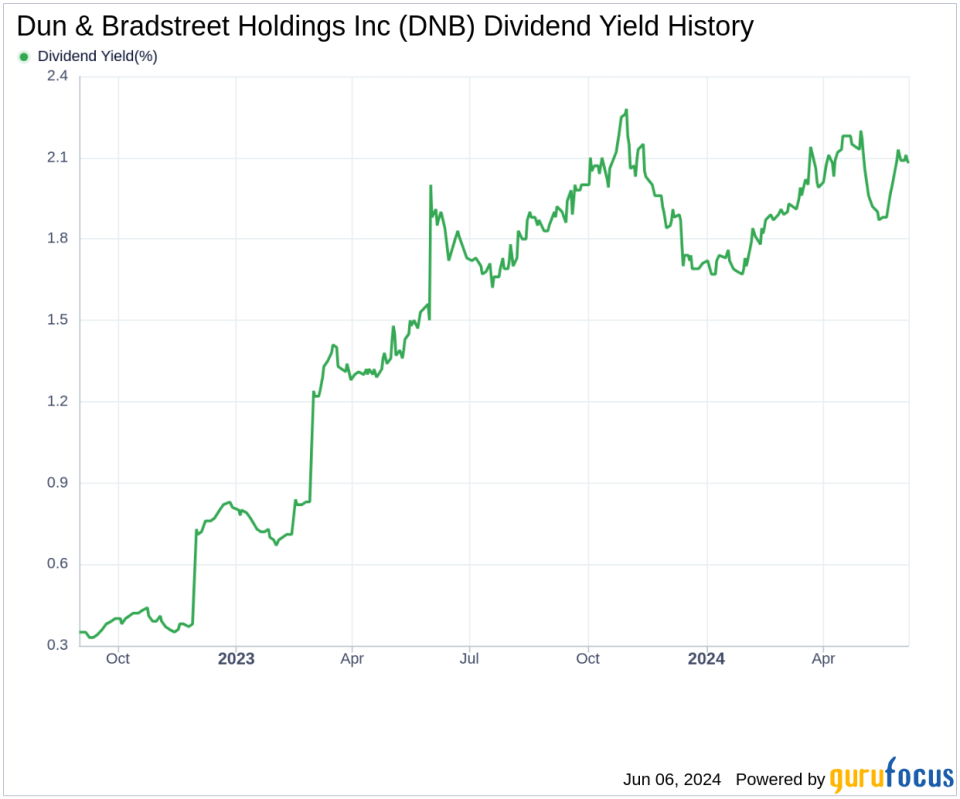

Analysis of Dividend Yield and Growth

Dun & Bradstreet Holdings Inc currently boasts a trailing and forward dividend yield of 2.10%, indicating stable expectations for dividend payouts over the next year. Additionally, the 5-year yield on cost stands at approximately 2.10%, suggesting a consistent return on initial investments made five years ago.

Evaluating Dividend Sustainability

The sustainability of dividends is crucial and can be assessed through the dividend payout ratio, which for Dun & Bradstreet Holdings Inc is currently 0.20. This low ratio indicates a substantial retention of earnings, which supports future growth and financial stability. Despite this, the company's profitability rank of 4 out of 10 raises concerns about its long-term dividend sustainability, especially given its profit generation in only 2 of the last 10 years.

Future Growth Prospects and Dividend Reliability

For dividends to be sustainable, underlying company growth is essential. Dun & Bradstreet Holdings Inc's growth rank of 4 out of 10 suggests limited future growth, which could impact dividend sustainability. However, the company has demonstrated a solid revenue model with a 4.30% average annual revenue growth over the past three years. Despite this, its earnings growth and EBITDA growth rates lag behind many global competitors, indicating potential challenges in maintaining its dividend payments without significant improvements in these areas.

Conclusion and Next Steps

While Dun & Bradstreet Holdings Inc has a commendable record of consistent dividend payments, its growth metrics and profitability raise questions about the long-term sustainability of these dividends. Investors should monitor the company's future earnings reports and growth indicators closely. For those interested in exploring more high-dividend yield opportunities, GuruFocus Premium offers a comprehensive High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance