Drilling Into Occidental Petroleum's CrownRock Acquisition

Houston-based Occidental Petroleum Corp. (OXY) released its third-quarter results on Nov. 7.

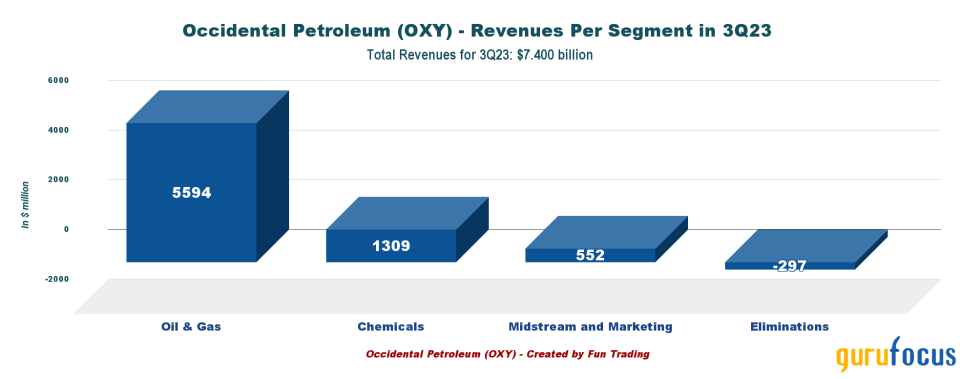

The company, which I have been following since 2017, is an integrated oil producer with three major segments, not just oil and gas. The diagram below shows the revenue per segment for the three-month period.

In terms of revenue, the oil and gas segment is the largest, accounting for 76.6% of total revenue in the third quarter.

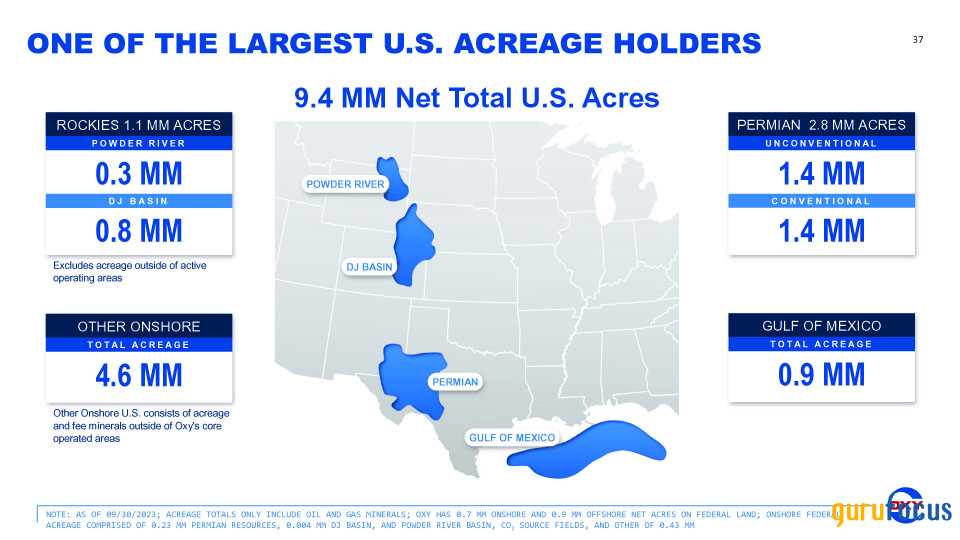

It produces oil, natural gas and natural gas liquids in the United States, including the Gulf of Mexico, and internationally in Algeria, the United Arab Emirates and Oman. Occidental is considered one of the largest U.S. acreage holders (DJ Basin, Permian Basin, Powder River and the Gulf of Mexico).

In the third quarter, the Oxy Chemical segment accounted for 17.7% of total revenue. Oxy Chemical owns 23 facilities worldwide and is a top-tier global producer of every product. It is the world's largest merchant caustic soda seller and vinyl chloride monomer exporter. It is also the world's second-largest producer of caustic potash and third-largest producer of chloralkali, with 17 distinct chlorine outlets. Occidental is the third-largest domestic supplier of polyvinyl chloride.

Finally, the midstream segment has physical midstream business, crude exports from the Gulf Coast and other marketing businesses (natural gas transportation, etc.).

Let's talk about the CrownRock acquisition

On Nov. 29, rumors circulated that Occidental Petroleum would pay around $12 billion for CrownRock LP and its 94,000 net acres of premium stacked pay assets in the Midland Basin, producing from nearly a thousand wells. The new was confirmed on Dec. 11.

I was surprised to learn the company was looking to expand in the Permian Basin once more. Following the contentious Anadarko acquisition, which nearly bankrupted the company, I expected it to be less inclined to grow the business through large acquisitions, increased debt and share issuance.

The transaction details were revealed in a press release. Occidental Petroleum is expected to pay a total of around $12 billion for the transaction in a cash-and-stock deal. The company will finance it with $9.1 billion in new debt and the issuance of approximately 29 million new shares. ($1.7 billion in common equity worth about $59 per share).

In addition, Occidental Petroleum will assume $1.2 billion in existing debt from CrownRock, bringing the total debt to approximately $29.1 billion, up from $19.1 billion in the third quarter of 2023 (including current debt). The total outstanding shares will reach about 833 million.

Furthermore, the company declared a 22% dividend increase from 18 cents to 22 cents per share to gain shareholder's support, beginning with the February 2024 declaration.

We do not learn much from CrownRock's website, so we must rely on what Occidental Petroleum says about the deal. The company said it will add approximately 170,0000 barrels of oil equivalent per day of good-quality production in 2024 and approximately 1,700 undeveloped locations. In addition, it will increase Occidental's Permian unconventional sub-$40 breakeven inventory by 33%.

Reuters reported:

"The deal is expected to close in the first quarter of 2024 and would boost Occidental's Permian production by 170,000 barrels of oil and gas per day in the Midland, to 750,000 boed."

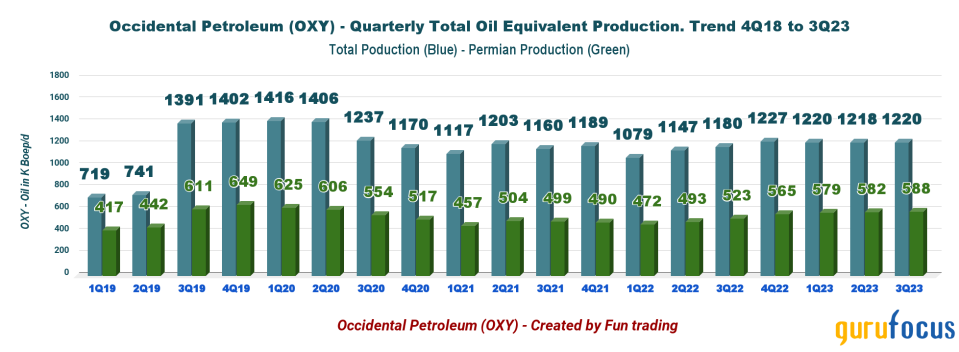

In the third quarter, Occidental Petroleum's U.S. output, including the offshore Gulf of Mexico, was 997,000 Boepd. Permian production was 588,000 Boepd, which equates to approximately 758,000 Boepd when CrownRock production is included.

The increased cash flow expected and a $4.5 billion to $6 billion divestment plan will enable Occidental to reduce debt by at least $4.5 billion in the next 12 months.

Unfortunately, corroborating the information presented here is difficult.

If the divestiture is successful, it will impact production, potentially greatly mitigating any increase in oil production from CrownRock, making this acquisition, despite what the company is trying to portray, a not-so-exciting deal.

Berkshire Hathaway is not a party to the CrownRock transaction. However, Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (BRK.B)(BRK.A) appears to approve of the transaction as it purchased 10,482,162 shares on Dec. 13 between $55.58 and $57.04.

The insurance conglomerate now owns 238,533,189 Occidental shares and 83,858,849 warrants, representing nearly 27% of the basic share outstanding and about 36.3% when warrants are included based on the share outstanding count (804 million) and before the impact of the CrownRock acquisition. This appears to be a strong show of confidence and support from the Oracle of Omaha.

Third-quarter results analysis

Occidental Petroleum reported third-quarter adjusted earnings of $1.18 per share, compared to $2.44 in the prior-year quarter. The GAAP earnings in the quarter were $1.20 per share, compared with $2.52 a year ago. The results largely beat analysts' expectations.

Total revenue came in at $7.4 billion, down 22.1% from $9.5 billion last year. Occidental's total expenses in the reported quarter were $5.69 billion, a 6.9% decrease from $6.12 billion in the previous year.

As previously stated, Occidental Petroleum is an integrated company with three distinct segments. Despite a significant drop in revenue due to lower commodity prices, the company exceeded expectations.

Oil and gas revenues were $5.59 billion in the reported quarter, a 21.2% decrease year over year.

OXY Chemical's revenue fell 22.6% to $1.31 million.

Midstream and marketing revenue was $552 million, a 45.1% decrease year over year.

During the conference call, CEO Vicki Hollub said:

"Our teams again performed exceptionally well with our assets this quarter and delivered the strongest earnings and cash flow from operations that we've had to date this year. This positions us to further advance our shareholder return framework and established a strong trajectory for the fourth quarter."

Occidental's debt profile has slightly improved this quarter. Total cash is now $611 million and long-term debt, including current, is $19.06 billion.

The debt-to-equity ratio is still high at 0.65, according to Ycharts. Unfortunately, with the recent acquisition, the debt profile will deteriorate in 2024 as Occidental is still paying for the overpriced Anadarko acquisition.

Finally, the company's cash flow from operations was $3.13 billion, while capital expenditures were $1.62 billion, resulting in $1.51 billion in free cash flow, down from $3.18 billion in the third quarter of 2022. Using another calculation, the company indicated $1.72 billion in free cash flow. However, I use the standard cash flow from operations minus capital expenditures.

Occidental repurchased $600 million worth of shares in the third quarter. The company has used 60% of its $3 billion share repurchase program through systematic buybacks.

The total third-quarter oil equivalent production was 1,220,000 Boepd, which has been quite stable in 2023. The Permian production increased again to 588,000 Boepd this quarter, as shown in the chart below:

The company's production this quarter exceeded the midpoint of its guidance by 34,000 Boepd, allowing Occidental to increase its full-year production guidance by 11,000 Boepd. Total sales volume was 1,222,000 Boepd, up 3.6% from the previous year.

For the fourth quarter, Occidental expects 1,206,000 to 1,246,000 Boepd in production. Output from the Permian Resources segment is projected at 571,000 to 591,000 Boepd.

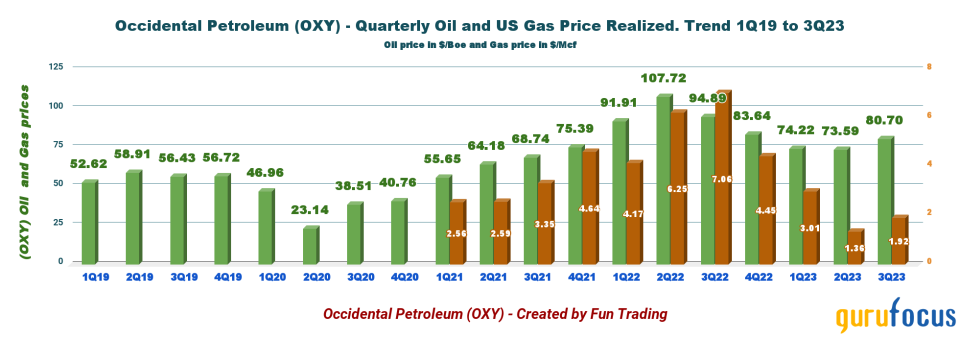

Oil and gas prices have dropped year over year. Crude oil realized prices fell 14.9% yearly to $80.7 per barrel. Natural gas liquids realized prices fell 40.3% to $21.04 per barrel. U.S. natural gas prices fell 65.9% from the previous quarter to $1.92 per thousand cubic feet.

Technical Analysis

Note: The chart has been adjusted to account for the dividend.

Occidental is forming a descending channel pattern, with resistance at $58.6 and support at $55.05. The relative strength index is now 48, indicating a possible breakout if oil rises over the next several weeks.

One possible strategy is to hold a medium to long-term position in Occidental and trade last in, first out with 40% of your holdings while you wait for a higher final price target above $70. It has worked very well for me.

A descending channel, also known as a bearish or declining channel, is a bearish continuation chart pattern that forms when the price moves lower in an orderly fashion between two parallel lines of a downward-sloping resistance level and a downward-sloping support level. However, the pattern generally ends with a breakout.

The trading strategy is to take profits (40% seems reasonable) between $58.60 and $60.95, with a possible higher resistance at $63.40, and wait for a retracement between $56.50 and $54.25, with a possible lower support at $53.25.

Warning: The TA chart must be updated frequently to be relevant because we are operating in a constantly moving environment. The chart above has a possible validity of about a week or two. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance