Dril-Quip (DRQ) Dips 9% Despite Reporting Narrower Q2 Loss

Dril-Quip Inc. DRQ shares have declined 9% despite reporting better-than-expected second-quarter 2022 results on Jul 28. Investors are concerned about the manufacturer of highly engineered drilling and production equipment generating negative free cash flows, which reflect its operational weakness.

Dril-Quip reported a second-quarter 2022 adjusted loss per share of 10 cents, narrower than the Zacks Consensus Estimate of a loss of 12 cents. The bottom line improved from the year-ago loss of 53 cents per share.

The company registered total quarterly revenues of $94 million, beating the Zacks Consensus Estimate of $87 million. The top line also increased from the year-ago quarter’s $81 million.

The second-quarter results were supported by an increase in product revenues as a result of higher subsea product volumes.

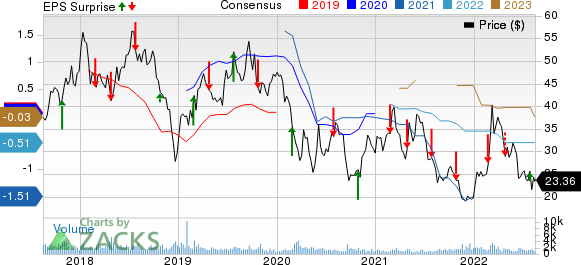

DrilQuip, Inc. Price, Consensus and EPS Surprise

DrilQuip, Inc. price-consensus-eps-surprise-chart | DrilQuip, Inc. Quote

Q2 Performance

Dril-Quip reported product bookings of $49.6 million for the quarter. At the second-quarter end, it had $208.6 million in the backlog.

The company reported a second-quarter operating loss of $3.9 million, narrower than a loss of $14.7 million in the prior-year period.

Total Costs and Expenses

On the cost front, the cost of sales increased to $69.7 million for the reported quarter from $61.5 million in the year-ago period. However, engineering and product development costs contracted to $2.7 million in the quarter from the year-ago figure of $3.7 million. Selling, general and administrative costs declined to $22.5 million from $29.6 million a year ago.

Total costs and expenses for the quarter were $97.8 million compared with $95.5 million a year ago.

Free Cash Flow

In the second quarter, Dril-Quip generated a negative free cash flow of $10.6 million against a cash flow of $8.2 million a year ago.

Financials

Dril-Quip recorded $1.4 million in capital expenditure for the quarter versus the year-ago level of $3.5 million.

As of Jun 30, 2022, the company’s cash balance was $320.8 million. Its balance sheet is free of debt load, which highlights a sound financial position.

Guidance

For 2022, Dril-Quip expects products bookings to increase 20% year over year. The company reiterated its capital expenditure guidance at $15-$17 million for the year.

The Zacks Rank #3 (Hold) company announced plans to reduce scope 1 and scope 2 greenhouse gas emissions by 50% by 2030.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Devon Energy Corp. DVN reported second-quarter 2022 adjusted earnings of $2.59 per share, beating the Zacks Consensus Estimate of $2.38 by 8.8%. The outperformance resulted from the company’s oil-weighted production mix, as well as a recovery in commodity prices.

Devon Energy’s share-repurchase authorization is $2 billion, which is equivalent to 5% of the company’s market capitalization. The board of directors approved a 13% increase of the fixed quarterly dividend of DVN to 18 cents.

DCP Midstream LP’s DCP reported second-quarter adjusted earnings of $1.77 per unit, beating the Zacks Consensus Estimate of $1.14. Strong quarterly earnings were primarily driven by increased NGL pipeline throughput.

DCP generated an excess free cash flow of $254 million in the reported quarter. At the end of the second quarter, the partnership reported long-term debt of $4,622 million. Cash and cash equivalents were $8 million. It had current debt of $505 million.

APA Corporation APA reported second-quarter 2022 adjusted earnings of $2.37 per share, meeting the Zacks Consensus Estimate. Strong quarterly results were supported by the higher realization of commodity prices.

As promised, APA is using the excess cash from a supportive environment to reward investors with dividends and buybacks. The company bought back 7 million shares at $41.59 a piece in the second quarter. Since APA started the program last October, 52.3 million shares have been repurchased in total up to Jul 31 at an average price of $31.19. It also shelled out $43 million in dividend payouts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

DrilQuip, Inc. (DRQ) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance