It's Down 44% But LY Corporation Limited (Catalist:1H8) Could Be Riskier Than It Looks

The LY Corporation Limited (Catalist:1H8) share price has fared very poorly over the last month, falling by a substantial 44%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

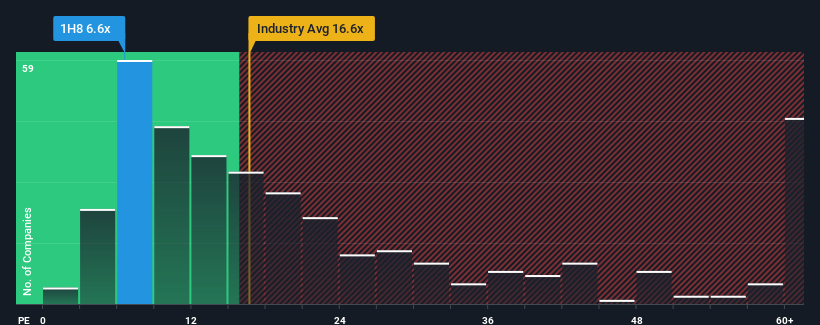

Following the heavy fall in price, LY may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.6x, since almost half of all companies in Singapore have P/E ratios greater than 12x and even P/E's higher than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

It looks like earnings growth has deserted LY recently, which is not something to boast about. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for LY

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LY will help you shine a light on its historical performance.

Is There Any Growth For LY?

The only time you'd be truly comfortable seeing a P/E as low as LY's is when the company's growth is on track to lag the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Although pleasingly EPS has lifted 301% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 1.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that LY is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

LY's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that LY currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for LY (of which 2 can't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance