Dover (DOV) Buys Acme & RegO, Expands Clean Energy Solutions

Dover Corporation DOV recently completed the acquisition of Acme Cryogenics, Inc. (Acme) for an upfront cash payment of $295 million. Also, the company entered into an agreement to buy Engineered Controls International, LLC ("RegO") for a cash payment of $631 million, which includes tax step-up benefits with a net present value of approximately $35 million. The companies will become part of the Dover Fueling Solutions segment’s OPW Global ("OPW") operating unit. These buyouts will help the company widen its presence in the cryogenic industrial gases end market with robust organic and inorganic growth prospects.

Acme and RegO provide highly-engineered, mission-critical components and services to valuable customers that enable the production, storage and distribution of cryogenic gases utilized in various sets of applications. These factors make Acme and RegO a great fit for Dover. The companies are expected to generate current-year sales of around $70 million and $210 million, respectively. Over the three years period, Acme generated double-digit average annual revenue (AAR) growth (excluding the impact of acquisitions), while RegO registered high-single digits growth in AAR.

These buyouts are likely to be accretive to Dover’s consolidated EBITDA margins, with possible significant synergy from leveraging its operating scale and capabilities. The RegO deal is expected to close in fourth-quarter 2021.

Acme and RegO’s products are crucial additions to Dover's existing clean energy solutions portfolio. The buyouts will boost its service offerings for the hydrogen ("H2"), liquefied natural gas ("LNG") and liquefied petroleum gas ("LPG") applications. The company’s enhanced clean energy applications are anticipated to generate annual sales of more than $300 million, comprising $100 million sales from cryogenic gas applications.

The buyouts align well with Dover’s focus on enhancing the Fueling Solutions portfolio with a growing presence in clean fuels and other attractive adjacencies. The company’s affiliation in electric vehicle charging and the recent LIQAL acquisition will solidify its position as a leading provider for clean and alternative fuel applications. LIQAL is a turnkey supplier of LNG, hydrogen refueling equipment and solutions as well as micro liquefaction solutions.

Dover has a long tradition of making successful acquisitions in diverse end markets. Recently, Dover completed three highly-complementary buyouts in radio signal intelligence solutions, industrial 3D visualization software and fueling solutions for alternative fuels like LNG and hydrogen. Last year, Dover acquired Innovation Control Systems (ICS) to expand its offerings in the growing vehicle wash market. The integration of this buyout is ahead of plan. These acquisitions are contributing to the company’s top line. In January 2020, Dover completed the acquisition of Systech International. The buyout supports Dover’s marking and coding portfolio and will expand software and service revenues in the Markem-Imaje segment.

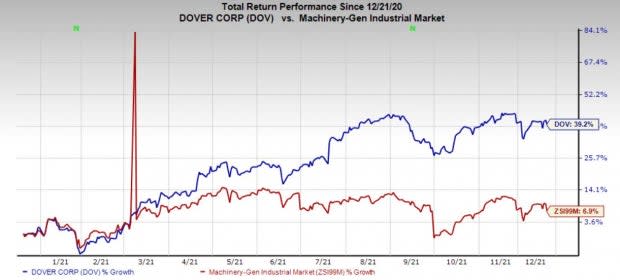

Price Performance

Dover’s shares have gained 39.2% in the past year compared with the industry’s growth of 6.9%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Dover currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are A. O. Smith Corporation AOS, SiteOne Landscape Supply SITE and ScanSource, Inc. SCSC. While AOS flaunts a Zacks Rank #1 (Strong Buy), SITE & SCSC carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

A. O. Smith has an expected earnings growth rate of around 35% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised upward by 1% in the past 30 days.

A. O. Smith’s shares have surged 44% in a year’s time. The company has a trailing four-quarter earnings surprise of 16.8%, on average.

SiteOne Landscape has an estimated earnings growth rate of around 77.2% for the current year. In the past 30 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 14%.

In a year, the company’s shares have increased 68%. SiteOne Landscape has a trailing four-quarter earnings surprise of 130.9%, on average.

ScanSource has a projected earnings growth rate of around 19% for 2021. The Zacks Consensus Estimate for current-year earnings has been revised upward by 1% in the past 30 days.

The company’s shares have appreciated 23% in the past year. ScanSource has a trailing four-quarter earnings surprise of 34.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

ScanSource, Inc. (SCSC) : Free Stock Analysis Report

SiteOne Landscape Supply, Inc. (SITE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance