Don't Overlook These Highly Ranked Manufacturing Stocks

The Industrial Products sector is currently the fifth-ranked sector out of 16 Zacks sectors and is comprised of five thriving business industries.

Furthermore, several manufacturing stocks are standing out in particular and now looks like a good time to buy.

Manufacturing-Thermal Products Industry

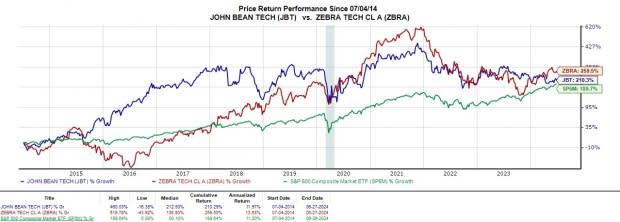

At the moment the Zacks Manufacturing-Thermal Products Industry sits in the top one percentile of approximately 250 Zacks industries with John Bean Technologies JBT and Zebra Technologies ZBRA being two stocks in the space that have proven to be historical winners.

To that point, both stocks have climbed over +200% in the last decade to outperform the S&P 500’s +190%.

Image Source: Zacks Investment Research

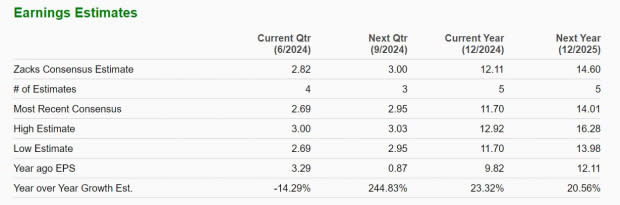

Sporting a Zacks Rank #1 (Strong Buy) Zebra Technologies is the leading provider of enterprise asset intelligence solutions in the automatic identification and data capture solutions market throughout the world. Notably, the rebound in Zebra Technologies robust bottom line is starting to stand out as EPS is expected to increase 23% in fiscal 2024 and is projected to stretch another 20% in FY25 to $14.60 per share.

Image Source: Zacks Investment Research

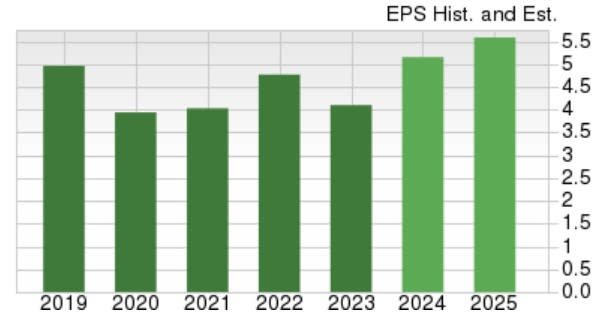

Pivoting to John Bean Technologies, it sports a Zacks Rank #2 (Buy) as a global technology solutions provider to high-value segments of the food and beverage industry. The company’s profitability has reached new heights in recent years and record annual earnings are expected to continue with EPS projected to soar 25% in FY24 to $5.15. Plus, FY25 EPS is projected to increase another 8%.

Image Source: Zacks Investment Research

Powell Industries POWL

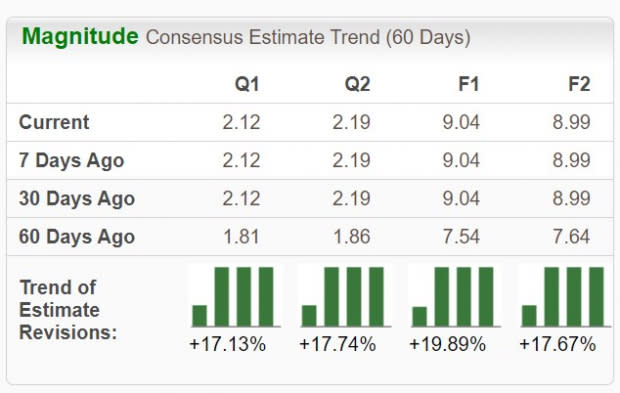

The Zacks Manufacturing-Electronics Industry is in the top 8% of all Zacks industries and Powell Industries is certainly worthy of investors' consideration with a Zacks Rank #1 (Strong Buy).

Supporting petrochemical facilities as a metal-working shop, Powell Industries has become the strategic supplier of choice for highly complex and integrated systems for the distribution and control of electrical energy and other critical processes. In addition to its strong buy rating Powell Industries has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum. To that point, POWL trades at an enticing 16X forward earnings multiple with FY24 EPS now expected to spike 119% to $9.04 compared to $4.12 a share last year.

Correlating with such, Powell Industries stock has been one of the market’s top performers soaring over +100% in the last year. Even better, earnings estimate revisions for FY24 and FY25 have soared over the last 60 days which suggests the rally could continue especially when considering Powell Industries' reasonable P/E valuation.

Image Source: Zacks Investment Research

Bottom Line

Like Powell Industries, earnings estimate revisions have remained higher for John Bean Technologies and Zebra Technologies for FY24 and FY25 as well. This largely suggests now is a good time to buy these top manufacturing stocks as their increased profitability looks set to continue.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

Zebra Technologies Corporation (ZBRA) : Free Stock Analysis Report

Powell Industries, Inc. (POWL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance