Donegal Group Inc. (DGICA) Reports Mixed Fourth Quarter and Full Year 2023 Results

Net Premiums Earned: Increased by 6.2% in Q4 and 7.2% for the full year.

Combined Ratio: Deteriorated to 106.8% in Q4 and 104.4% for the full year.

Net Loss: Reported a net loss of $2.0 million in Q4, compared to a net income of $3.5 million in the same period last year.

Net Investment Gains: After-tax gains of $1.8 million in Q4, an increase from $0.5 million year-over-year.

Book Value Per Share: Decreased to $14.39 at the end of 2023, from $14.79 at the end of 2022.

Investment Income: Net investment income increased by 14.1% in Q4 and 20.1% for the full year.

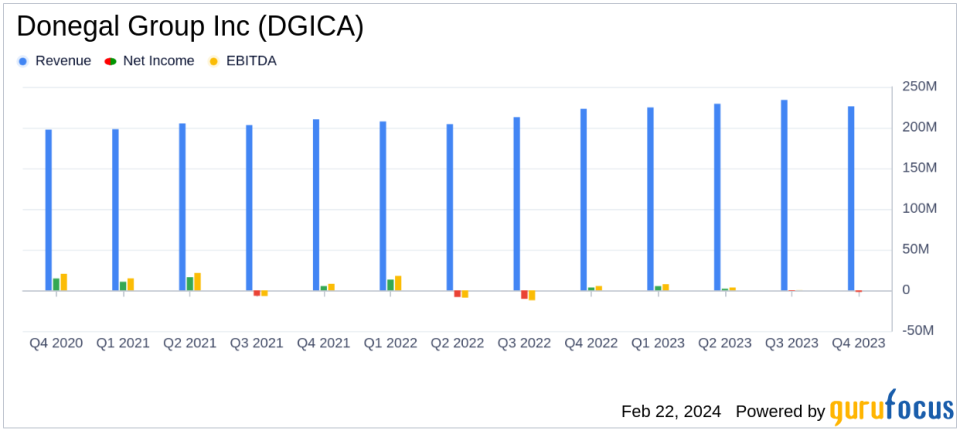

On February 22, 2024, Donegal Group Inc. (NASDAQ:DGICA) released its financial results for the fourth quarter and full year ended December 31, 2023, through an 8-K filing. The insurance holding company, which offers personal and commercial lines of property and casualty insurance, reported a net loss in the fourth quarter but an increase in net premiums earned both quarterly and annually.

Financial Performance Overview

Donegal Group Inc. saw its net premiums earned rise by 6.2% to $226.2 million in the fourth quarter and by 7.2% to $882.1 million for the full year. However, the company faced challenges, including a combined ratio that worsened to 106.8% in Q4, up from 102.8% in the same quarter of the previous year, indicating underwriting losses. For the full year, the combined ratio was 104.4%, compared to 103.3% in 2022. The net loss of $2.0 million in Q4 was a downturn from the net income of $3.5 million reported in the fourth quarter of the prior year.

Challenges and Strategic Initiatives

President and CEO Kevin G. Burke highlighted the company's strategic initiatives, including a focus on individual state strategies and profit improvement measures. Despite the net loss in Q4, Donegal Group Inc. reported net investment gains after tax of $1.8 million, a significant increase from the previous year's $0.5 million. The company's book value per share decreased slightly from $14.79 at the end of 2022 to $14.39 at the end of 2023.

"As we closed out 2023 and shifted our focus to 2024, we have continued to execute on our numerous strategic initiatives, particularly focusing on action items related to individual state strategies and profit improvement measures," stated Kevin G. Burke.

Segment Performance and Future Outlook

The company's commercial lines saw a modest decrease in net premiums earned, while personal lines experienced a significant increase. Donegal Group Inc. is taking measures to reduce operating expenses over the next several years and expects the expense ratio impact from its major systems modernization project to peak in 2024 before gradually subsiding.

Donegal Group Inc. remains committed to achieving sustained excellent financial performance and is taking significant rate increases through 2024 to maintain rate adequacy in its personal lines segment. With a focus on strategic modernization and profitable growth, the company is navigating the evolving insurance landscape with an eye towards long-term success.

For detailed financial information and the full commentary from Donegal Group Inc.'s management, please refer to the 8-K filing.

Investor Relations and Additional Information

Investors seeking further details can access a pre-recorded webcast and supplemental investor presentation on the company's website. For investor relations contacts, Karin Daly of The Equity Group Inc. and Jeffrey D. Miller, Executive Vice President & Chief Financial Officer of Donegal Group Inc., are available for inquiries.

Donegal Group Inc. is focused on achieving sustained excellent financial performance, modernizing operations, growing profitably, and delivering a superior experience to agents and policyholders. The company's forward-looking statements are subject to various risks and uncertainties, and actual results may differ materially.

For more information on Donegal Group Inc.'s financial performance and strategic initiatives, visit Donegal Group Inc. Investor Relations.

Explore the complete 8-K earnings release (here) from Donegal Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance