Don't Waste Your Money on Penny Stocks: These 3 Stocks Are Better Buys

Here's the flat-out truth: Penny stocks are often a scam or are, at best, struggling companies on the brink of bankruptcy that will end up wiping out common shareholders even if they return to the public markets. In short, don't fall for a penny-stock newsletter pitching you the "next big winner" or go big on a pending bankruptcy that's set to wipe out shareholders.

Here's where the real opportunity to create wealth in stocks is: High-quality -- and real -- companies with solid long-term prospects. Three Motley Fool contributors put together three legitimate stocks for you to consider: high-growth (and higher-risk) NV5 Global Inc. (NASDAQ: NVEE), long-term dividend growth (and lower-risk) Digital Realty Trust (NYSE: DLR), and a solid value investment in Kinder Morgan Inc. (NYSE: KMI).

Don't fall for a penny-stock trap. Image source: Getty Images.

Keep reading below to learn why these three stocks are not only far better investments than any penny stock, but also set to deliver above-average returns in the years ahead.

A far better risk-reward profile than any penny stock

Jason Hall (NV5 Global): If penny stocks are on your radar, that probably means you're willing to take on some risk. That can be good with stocks, if it can help you ride out volatility when your stocks are down or take advantage of a buying opportunity when they fall. But when it comes to penny stocks, your high-risk profile is more likely to compound inevitable losses by waiting for a recovery that never happens or "doubling down" on an already failed investment.

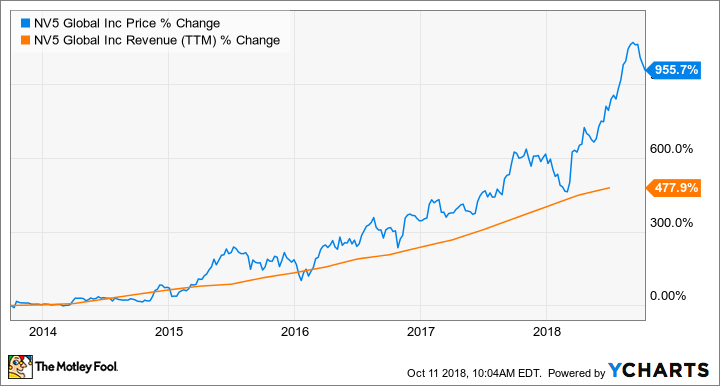

A great stock to consider if you're willing to take on higher risk but looking for really big upside is NV5 Global, a tiny infrastructure engineering and consulting company with substantial growth ahead of it. Since going public about five years ago, revenue has grown almost 480%, while its stock price has surged an incredible 956%.

Yet even with this huge growth, NV5 is still a tiny player in the $3 trillion global infrastructure market. Its total revenue this year is likely to fall below $450 million, compared to industry giants like Fluor and Jacobs Engineering, which generate over $19 billion and $13 billion, respectively, per year.

With founder and CEO Dickerson Wright's track record as a manager and capital allocator and substantial personal stake in the company, I expect to see many more years of market-beating returns from NV5. Its stock price will likely remain very volatile, and there's risk that its growth strategy fails, but unlike penny stocks, this is a very real business with audited financials, meaning substantially less risk of losing everything.

The right way to make money in the stock market

Matt Frankel, CFP (Digital Realty Trust): Newer investors are often drawn to penny stocks because they want to make a lot of money in a short amount of time. Unfortunately, that's rarely the way it plays out -- more often than not, penny-stock investors end up losing all or most of their investment.

The right way to make money in stocks is slowly. Don't measure your returns in a daily, monthly, or even yearly context. Rather, ask yourself what stocks will make you money for the next few decades. One stock that could be a big long-term winner is Digital Realty Trust, one of the world's largest owner-operators of data centers, and it's already been a big winner for investors.

DLR Dividend data by YCharts.

Simply put, the need for secure and reliable data storage has exploded in recent years and is showing no signs of slowing down. The number of connected devices is skyrocketing -- my doorbell, thermostat, and even my Crock Pot are connected to the internet -- and this trend should continue, especially with data-intensive devices such as automobiles. And the upcoming rollout of 5G technology should be another catalyst.

In short, while owning a data center may seem like a boring business, the potential of this industry over the next few decades is rather exciting.

Finally, Digital Realty recently announced its acquisition of a Brazil-based data center provider Ascenty, which will greatly expand its presence in the high-potential Latin American market. However, thanks to the equity offering that was announced along with the acquisition, the stock has pulled back by about 14% from its peak, making this a compelling time to buy (or add) shares.

A dirt-cheap stock with significant upside

Matt DiLallo (Kinder Morgan): Too many investors focus on the price of a stock instead of the underlying value of the company. Because of that, they can get burned buying into the overpriced hype. A better way to invest is to buy companies selling for less than they're worth, which can be the ticket to scoring big gains.

One stock that's currently selling for pennies on the dollar is pipeline giant Kinder Morgan. The company expects to produce $2.05 per share in free cash flow this year, which is money it could use to pay dividends, fund growth projects, or buy back its stock. However, with shares currently selling at around $18 a piece, it implies that Kinder Morgan trades at less than nine times cash flow. With most peers selling at more than 12.5 times cash flow, it suggests that Kinder Morgan could be as much as 40% to 50% undervalued.

As a result, the stock appears to have significant upside as it eventually reverts closer to the mean of its peer group. In addition, investors have two other ways to win: dividends and future growth. Kinder Morgan pays a well above-average 4.4%-yielding dividend that it expects to grow at a 25% rate in 2019 and 2020. That means investors who buy now would lock in a yield of nearly 7% for 2020. Meanwhile, the company has enough expansion projects underway to boost its earnings by more than 10% over the next couple of years, which should help drive the stock higher.

Put it all together and Kinder Morgan should generate significant total returns for investors from here, making it a much better buy than penny stocks.

More From The Motley Fool

Jason Hall owns shares of NV5 Global. Matthew DiLallo owns shares of Kinder Morgan. Matthew Frankel, CFP owns shares of Digital Realty Trust. The Motley Fool owns shares of and recommends Kinder Morgan. The Motley Fool owns shares of NV5 Global. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance