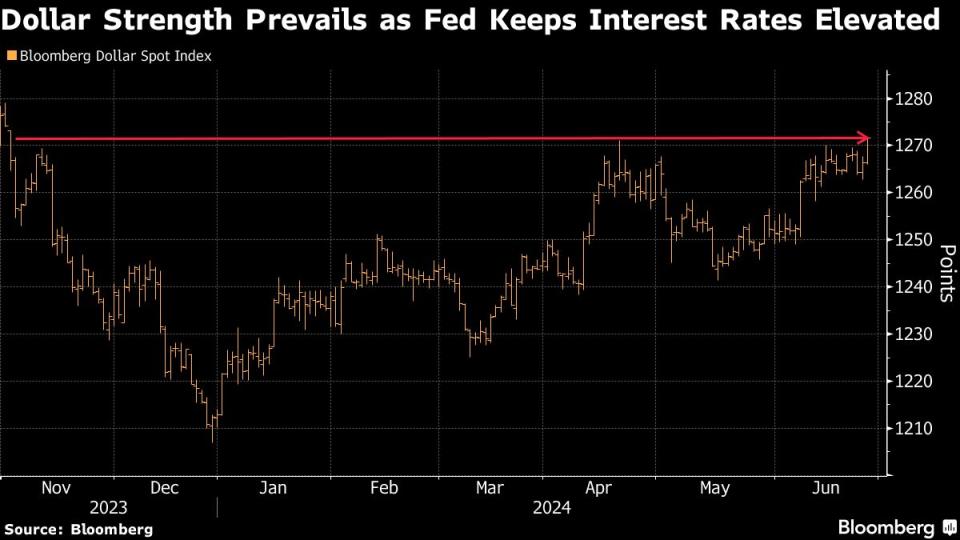

Dollar Soars to Fresh 2024 High as Fed Diverges From Major Peers

(Bloomberg) -- The dollar rose to its highest level since November amid speculation that the Federal Reserve will break with other central banks by keeping interest rates elevated, giving global investors an incentive to shift cash to the US to capture higher bond yields.

Most Read from Bloomberg

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

Volkswagen Invests $5 Billion in EV Startup Rivian to Form Joint Venture

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

The Bloomberg Dollar Spot Index climbed as much as 0.4% to a nearly eight-month high, extending the currency’s advance this year as the Fed’s policy leaves a wide interest-rate gap with other major economies. That difference has been particularly pronounced with Japan, driving the yen to the weakest since 1986 and sparking risks of another intervention by the Japanese authorities.

“The US economy remains resilient, and the case for an imminent rate cut isn’t clear unless the data soften, meanwhile, central banks elsewhere are cutting,” said Kit Juckes, chief FX strategist at Societe Generale SA. “With political uncertainty threatening to play a role in market from now until the end of the year, it’s hard to see why the dollar turns lower this year at all.”

While the European Central Bank and Bank of Canada kicked off their monetary easing cycles in early June, the US central bank has continued to hold interest rates at the highest level in more than two decades. Elections in France and the UK in coming weeks as well as the US presidential election later in the year are adding volatility to the market.

The yen has been the worst performer against the dollar this year, losing about 12% in value, followed by the Swiss franc and the Norwegian krone. The euro fell more than 3% this year.

“We don’t see the dollar strengthening meaningfully from here but it’s hard to argue it will reverse significantly in the short term,” said Nathan Thooft, a senior portfolio manager at Manulife Investment Management in Boston. “It is hurting global economic growth at these levels.”

Still, speculative traders have been loading up on contracts that would benefit from a stronger dollar, the most recent Commodity Futures Trading Commission data suggest. Over the last two weeks through June 18, they’ve added more than $12 billion worth of bets on greenback gains.

The end of the quarter rebalancing was also supportive of the dollar on Wednesday.

(Updates with details on other currencies, adds comments starting from third paragraph)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance