What Does Star Bulk Carrier's Purchase of Eagle Bulk Shipping Mean for Investors?

I recently read about Eagle Bulk Shipping Inc.'s (EGLE, Financial) announced acquisition by Star Bulk Carrier's Corp. (SBLK, Financial) in an all-stock merger with a market capitalization of $2.1 billion. Petros Pappas, Star's CEO, will retain his leadership role and Eagle management will assume supporting roles.

According to a recent Barron's article, the merger createsthe fourth-biggest commodities carrier, one that is large enough to be attractive to a wider pool of investors such as mutual funds that normally aren't interested in companies worth less than $1 billion.

Star Bulk Carriers, founded in 2006, has a market capitalization of nearly $2 billion and annual 2022 revenue of $1.4 billion. The company operates a range of vessel sizes in the dry bulk shipping industry. As of this writing, the company has a GF Score of 81 out of 100 with a range of values from 18 to 81 throughout its lifetime, peaking this year.

Eagle Bulk Shipping, founded in 2005, focuses on midsize dry bulk vessel operations. The company has a market capitalization of $535.5 million and annual 2022 revenue of $719.8 million. The business' revenues are roughly equally split between voyage charters and time charters. As of this writing, the company has a GF of 77 with a range of values from 22 to 82 throughout its lifetime, peaking in 2014.

In a prepared statement, Pappas announced:

"This transaction will create a global leader in dry bulk shipping with a large, diversified, and scrubber-fitted fleet of 169 vessels. We believe the transaction will increase our ability to serve our customers with proven technical and commercial management expertise and deliver significant cost and revenue synergies to our shareholders."

Gary Vogel, Eagle's CEO, is also enthused about the merger and said,The combined company will remain committed to returning significant capital to the shareholders and will have greater trading liquidity and enhanced prospects for growth.

The terms of the agreement include exchanging 2.6 shares of Star Bulk common stock for each share of Eagle common stock owned or $52 a share, a 17% premium based on the Dec. 8 closing price.

The press release and accompanying conference call paint a glowing picture of the merger with optimistic projections. Both leaders believe this event will create a premier dry bulk shipping company with a strong competitive advantage and a bright future. As of Dec. 22, 2022, the share price has jumped nearly 23% to over $55. So much for the premium, the share price exceeds it by $2; however, GuruFocus gives the stock a GF Value of $47.64.

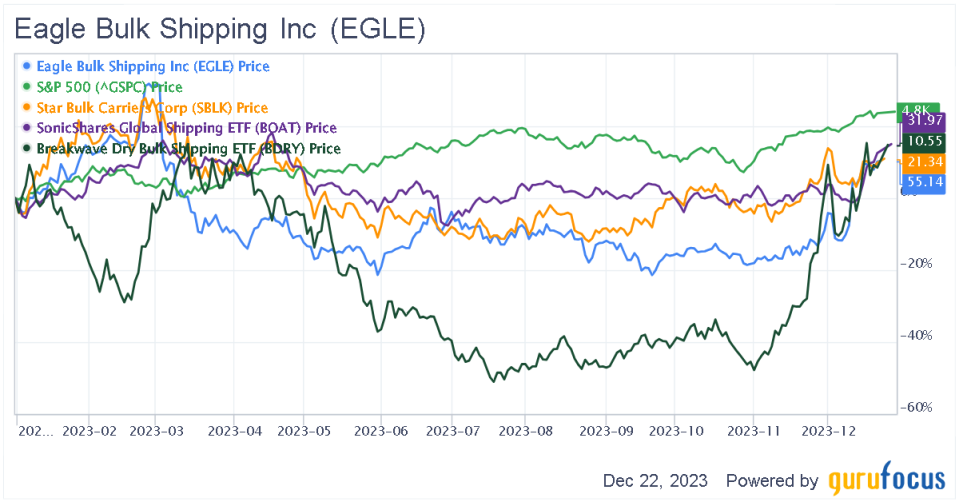

Within days, law firms expressed concern the selling price may be undervaluing the company. There's an investigation into whether Eagle shareholders are getting a fair deal. Although shares have been up since the announcement, the stock is underperforming the S&P 500 index by over 13% since the beginning of the year. Star Bulk is also underperforming the S&P 500 index by over 12%. Both stocks are outperforming the SonicShares Global Shipping ETF (BOAT, Financial), which tracks the global marine shipping industry, and the Breakwave Dry Bulk Shipping ETF (BDRY, Financial), which tracks futures in the Baltic Exchange Dry Index for the same period.

EGLE Data by GuruFocus

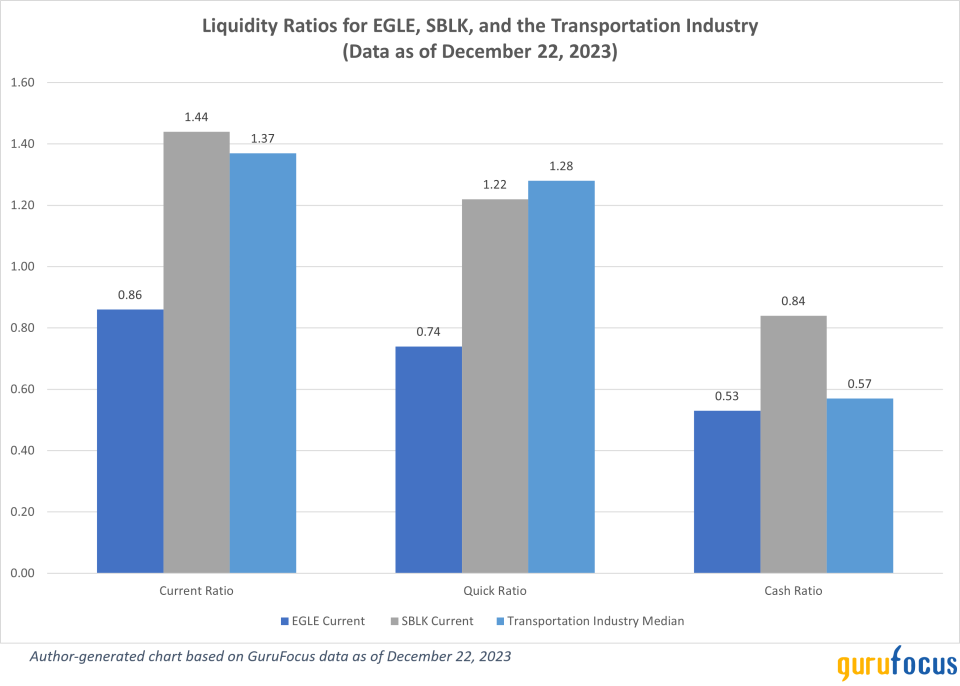

I started dollar-cost averaging into Eagle stock in February based on an analysis that stated that it was undervalued at the time. Interestingly, the share price peaked at $63.8 on March 1 shortly after the article was published. Perhaps I was also going for a cigar butt tactic as the price-book ratio was only 0.96; however, industry averages are also historically low. The analysis praised Eagle's price-to-free cash flow ratio of 2.31, but GuruFocus currently states the price-to-operating cash flow ratio is 9.31, worse than 66% of companies in the transportation industry. Eagle may have liquidity problems, as implicated in Vogel's statement above. The chart below illustrates that Star Bulk is in a much better position from a liquidity standpoint and may have been a significant factor in the merger decision for Eagle management:

The June 2023 repurchase of Oaktree Capital's entire stake of 3.8 million shares of common stock for a price of 219.3 million, representing 28% company ownership, may have foreshadowed this decision as well. Oaktree also backed the merger. After the repurchase Danaos Corp. (DAC, Financial), Eagle's largest shareholder after the Oaktree transaction, accused the company of adopting a poison pill by implementing a shareholder rights plan and by paying a 35% premium to Oaktree for the repurchase without seeking approval of shareholders beforehand. Since the merger announcement, law firms have conducted investigations into the sale.

In this review, I am attempting to examine the marine shipping market and the bulk shipping industry specifically. I will also document some events that led up to the merger and give a speculative assessment of what the Ealge- Star Bulk merger means for investors going forward. Please note this is merely an opinion based on my research as an uncredentialed, newbie investor in the industry and does not constitute investment advice.

Marine shipping

Global marine shipping is a critical component of the supply chain, so investors can benefit by studying the industry. Global marine shipping facilitates approximately 90% of global transport and affects consumer cyclical, consumer defensive, basic materials, consumer defensive, energy, industrial and technology sectors as well as the shipping industry. Investors in all sectors can benefit from understanding the industry.

Global marine shipping can be broken up into three categories reflecting the type of cargo shipped:

54% | Dry Bulk | Dry commodities and raw materials like coal and iron ore. |

29% | Tanker | Liquids like crude oil, gasoline, and natural gas. |

17% | Container | Containerized cargo like machinery and consumer products. |

Marine shipping is a highly volatile and cyclical industry that is sensitive to geopolitical concerns like regulatory environments, climate concerns, economic activity and trade patterns of major importing and exporting countries. The industry is heavily influenced by China's industrial output and growth rate. Shipping routes and trade flows are commonly disrupted or rerouted to accommodate events like trade agreement policies among countries, coups and weather patterns. Marine shipping and, to a greater extent, bulk dry shipping, experienced a boon during the pandemic as major global supply chain disruptions increased demand for liquified natural gas and China's use for iron ore and coal. Supply shortages have an upward drive on freight fees. The market dipped in 2022 during the China lockdowns in Beijing and Shanghai and has been rising since the lockdown was lifted in June of this year.

More recent events affecting the industry include the competitive relationship between the U.S. and China, the Hamas attack on Israel and Russia's invasion of Ukraine. Late this year, Iranian-backed Houthi militants in Yemen attacked commercial container ships in the Red Sea, forcing container ships to divert shipping routes from a path through the Babel-Mandeb Strait, the Red Sea and the Suez Canal to a path around the Cape of Good Hope in Africa. The diverted route may affect as much as 15% of global marine traffic and up to 30% of containerized shipping specifically and may have major impacts on shipments to Europe and Asia. So far, more than 100 shipping companies and four of the largest shipping companies accounting for 53% of global trade have diverted shipments to the Cape of Good Hope route. The event has also caused freight costs to rise and stock prices to jump in the containerized shipping industry.

Shipping cycles are comprised of four stages:

Trough - Supply is greater than demand. Business begins to slow. Freight charges typically decrease to match vessel operating costs. Shipping companies burn through cash and sell off inefficient fleets.

Recovery Demand increases to match supply, enabling shipping companies to charge higher prices, eventually surpassing operating costs. Businesses begin accumulating cash. Investors remain tentative, however, and the market experiences high volatility.

Peak Freight businesses can charge high rates, often up to three times the vessel operating costs. Businesses can deploy most of their shipping fleets. Supply and demand are roughly equivalent. Businesses typically have high cash flows during this stage.

Collapse Supply levels exceed demand and freight rates begin to decline. Shipping containers and fleets begin to accumulate in trading ports once again. Business cash flows are still high, but shipping companies start slowing operations and delivery times lengthen. Inefficient fleets may cease being used until they are either sold off in a subsequent trough phase or are redeployed in a recovery phase.

Charter party contracts

Charter parties are contracts between shipowners and their customers (commonly referred to as charterers) and fall into three main categories:

Voyage Charter - The charterer hires the vessel for a specific voyage between two or more ports. Cargo is typically loaded and discharged at the charterer's expense within a specified time in return for freight calculated at an agreed rate. The shipowner pays for fuel and operating expenses and port disbursements of the vessel. A derivative of a voyage charter is called a Contract of Affreightment (COA) in which the shipowner agrees to transport an amount of cargo of a specified size over a specified period. The charterer must pay the freight rate even if the shipment isn't ready, which allows the shipper to book the storage space needed for a specific shipment.

Time charter - The charterer hires the vessel for a specified time period. The shipowner provides for the crew and covers operational expenses and the charterer manages the voyage, including routes, ports and the care of cargo being transported.

Bareboat or Demise Charter This type of charter essentially mimics a lease agreement in which the shipowner gives up entire control of the ship to the charterer and is not involved in operations. In a bareboat charter, the shipowner leases the ship without a crew. In a demise charter, the shipowner includes the crew as part of the agreement.

Financial accounting

The shipping industry typically uses a form of non-GAAP revenue reporting called, Time charter equivalent (TCE) to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters. TCE is calculated by subtracting voyage expenses from revenues and then dividing the total by the voyage duration in days, giving shipping companies a tool to measure period-to-period changes.

Dry bulk shipping

The supply of dry bulk shipping is determined by the availability and cost of ships, which are influenced by factors such as shipbuilding, scrapping and financing. China is the largest importer of iron ore and coal, which are used for steel production and power generation. The changing balance between supply and demand can cause significant variations in freight rates and profitability.

The BDI is the benchmark for dry bulk shipping that tracks freight cost changes of various dry bulk commodities across more than 20 marine transportation routes globally. The BDI has risen nearly 55% since the beginning of 2023.

The BDI is calculated by averaging the daily freight rates of four different ship sizes:

Ship Size | |||

Capesize | Greater than 100,000 | 290 | Coal, iron ore |

Panamax/Kamsarmax | 65,000-100,000 | 229 | Coal, grain, iron ore, bauxite |

Supramax/Ultramax | 50,000-65,000 | 200 | Coal, grain, iron ore, bauxite, cement, fertilizer, forest products, petcoke, salt, scrap, steel, sugar |

Handysize/Handymax | 10,000-50,000 | 170 | Coal, grain, iron ore, bauxite, cement, fertilizer, forest products, petcoke, salt, scrap, steel, sugar |

Eagle focuses exclusively on the midsize Supramax /Ultramax vessel segment and claims to own one of the largest fleets of vessels in the world in that size.

Competitive or economic moats in the dry bulk shipping industry are debatable due to the commodity characteristics of the products being shipped. However, shipping companies often face high barriers to entry due to substantial capital requirements, complex logistics networks and regulatory compliance. Established players benefit from economies of scale, long-term contracts and strategic partnerships. Global regulatory bodies like the International Maritime Organization (IMO) and the European Union (EU) are shaping the industry's direction and rewarding efforts to reduce greenhouse gas emissions., a major contributor to acid rain. Companies are using carbon-efficient and low-sulfur fuels and installing scrubbers, devices that remove sulfur oxides from the exhaust gases of ships. Eagle and Star Bulk have claimed that the combined company will have a key competitive advantage since 97% of the vessels in their combined fleet will be equipped with scrubbers. Greenhouse gas emissions and industry efficiency are also impacted by organizational efforts. Speed reduction, route optimization, digitalization, predictive modeling, wind-assisted propulsion and air lubrication systems are also ways marine shipping organizations can reduce greenhouse gases, increase efficiency and add competitive advantages.

Events leading up to the merger

Since the beginning of 2023, there have been several events leading up to the merger announcement:

Jan. 5, 2023 Eagle announced the transfer of listing from Nasdaq to the New York Stock Exchange (NYSE.) I thought this was unusual, but the event is likely unrelated to the merger decision as Star Bulk is listed on the Nasdaq and I postulate that this event would have only been related to the decision if Star Bulk was listed on the NYSE.

Jan. 6, 2023 Eagle purchased an Ultramax Bulkcarrier to improve the age profileof the fleet, increasing the cargo capacity per vessel, and reducing emissions on a per deadweight ton basis.This move may have made the company more attractive to potential buyers. As noted above, the management of the combined organization believes its reduced emissions status is a key competitive advantage for the company.

Jan. 19, 2023 Eagle appointed Kate Blankenship to Eagle's board of directors. Blankenship's specialty is financial oversight.

Feb. 16, 2023- Sar Bulk reported 2022 net income of $566 million and fourth-quarter net income of $86 million. The company had cash of $269.8 million equating to 7.9% of total assets and a free cash flow yield of 22.9% at the end of the quarter according to GuruFocus. Throughout the quarter, the company refinanced debt to reduce interest costs and entered an additional loan facility of $24 million. The company also made efforts to improve its enviornmental, socaial and governance profile.

March 2023 Star Bulk repurchased 331,223 common shares on the open market for $7 million or a share price of $21.12 at an undisclosed date during March.

March 2, 2023 Eagle reported 2022 net income of $248 million and fourth-quarter net income was $23.3 million. The company had cash of $187.2 million, equating to 15.1% of total assets and a free cash flow yield of 17.1% at the end of the quarter according to GuruFocus. Eagle reiterated Blankenship's appointment and the modernization of fleets with the purchase of new vessels and the sale of an older one.

May 4, 2023 Eagle reported first-quarter 2023 net income of $3.2 million and Vogel acknowledged that the shipping market was seasonally weak. Cash levels had dropped to $113.9 million, equating to 9.83% of total assets and a negative 13.3% free cash flow yield at the end of the quarter according to GuruFocus. During the quarter, Eagle sold three 2011 non-scrubber fitted Supramax carriers for a total of $49.8 million.

May 16, 2023 Star Bulk reported first-quarter 2023 net income of over $45 million, and Pappas called this quarter the "seasonally weakest period of the year. The company had cash of $269.8 million, equating to 7.86% of total assets, and a free cash flow yield of 14.3% at the end of the quarter according to GuruFocus. Cash flow was negative 31.8 million for the quarter and ending cash levels were $254.4 million. During the quarter, Star Bulk sold two 2011 Capesize vessels and scrapped another. The company announced in the report that the board of directors canceled the previous share repurchase program, under which $8.5 million was still outstanding, and authorized a new program to repurchase up to $50 million in stock. The company had 102,881,065 shares outstanding as of the reporting date.

May 17, 2023 Eagle extended its credit facility by $175 million to enhance its liquidity profile position.

June 2023 Star Bulk repurchased 107,349 common shares in the open market on an undisclosed date in June for $17.65 per share for a total of $1.9 million.

June 22, 2023 Eagle repurchased approximately 3.8 million shares from Oaktree Capital for $219.3 million or $58 per share, representing 28% of the company and reducing outstanding common stock to approximately 9.3 million shares. The June 22 Eagle share adjusted closing price was $47.87.

June 26, 2023 - Danaos, a containerships company, accused Eagle of using a poison pill in the above buyback transaction by buying shares in a private transaction for a 35% premium to the stock price and enacting a rights agreement. After the Oaktree Capital transaction, Danaos, claiming Eagle shares lost 6% likely due to the market's reaction, became the company's largest shareholder, owning 16.7%.

Aug. 3, 2023 Eagle reported second-quarter 2023 net income of $18 million. The company had cash of $115.7 million, equating to 9.75% of total assets, and a free cash flow yield of negative 28% at the end of the quarter according to GuruFocus. Reported cash levels dropped to $118.3 million for the six months ending June 30, 2023.

Aug. 3, 2023 Star Bulk reported second-quarter 2023 net income of $44.3 million. The company had cash of $287.9 million, equating to 9.1% of total assets and a free cash flow yield of 20.51% at the end of the quarter according to GuruFocus. Cash levels were $299.4 million. The press release announced the company had cumulatively sold seven vessels and scrapped one vessel throughout the year, amounting to total net sales and insurance proceeds of $153.1 million, which the company could redeploy for fleet renewal, debt prepayment and share buybacks.

Aug. 30, 2023 Star Bulk appointed Ryan Lee, a senior vice president in Oaktree's Global Opportunities group, to its board to replace Brian Laibow, who had previously resigned.

Sept. 22, 2023 Star Bulk repurchased 10 million common shares from an affiliate of Oaktree Capital Management for $185 million, or $18.50 per share, representing approximately 8% of the company's shares. As a result of the transaction, one of the directors representing Oaktree shareholders was dropped from Star Bulk's board. The announcement claims the shares were purchased at a discount to the net asset value of the company. The share price fluctuated between $17.95 and $18.75 during the day on the open market.

October 2023 Star Bulk issued and sold 678,282 common shares of $19.81 per share during October, resulting in gross proceeds of $13.43 million.

Oct. 30, 2023 Star Bulk repurchased 10 million common shares from an affiliate of Oaktree Capital Management for $195 million at a share price of $19.50, representing approximately 10% of the company's shares. The company used debt to finance the share buyback transaction. Shares were trading between $18.57 and $18.70 during the day. Thus, the transaction represented a premium of approximately 4.3%.

Nov. 2, 2023 Eagle reported a third-quarter 2023 net loss of $5.2 million, yet still outperformed the BSI by 14% according to Vogel. The company had cash of $113.9 million, equating to 9.8% of total assets, and a free cash flow yield of 2.4% at the end of the quarter according to GuruFocus. Reported cash levels dropped to $116.5 million for the nine months ending Sept. 30.

Nov. 13, 2023 Star Bulk reported third-quarter 2023 net income of $43.7 million. The company had cash of $287.9 million, equating to 9.1% of total assets, and a free cash flow yield of 14.1% at the end of the quarter according to GuruFocus. Cash levels were $302.3 million at quarter end. The earnings report also noted the company took additional steps to renew its fleet by ordering two new Eco Kamsarmax vessels fitted with fuel-efficient engines and selling four additional ships from September to November totaling $72.5 million in gross proceeds. Star Bulk obtained loans totaling $315 million during the quarter.

Dec. 1, 2023 Star Bulk repurchased 10 million common shares from an affiliate of Oaktree Capital Management for an undisclosed amount, representing approximately 9.9% of the company's shares. The company used debt to finance the share buyback transaction. As a result of the transaction, one of the directors representing Oaktree shareholders was dropped from its board.

Dec. 11, 2023 Star Bulk and Eagle announced the merger.

Current and future outlook

Again, I am reiterating my statement that I am an uncredentialed individual investor and any future-looking statements below are merely my observations and opinion and should not constitute investment advice.

To summarize the above series of events, both companies appeared to increase buybacks throughout the year, which gave them additional control over their board leading up to the merger decision. Some of these buybacks appear questionable in terms of their value to shareholders, such as Eagle's June repurchase and Star Bulk's October and December repurchases, which were funded with debt.

Liquidity and cash levels have been fluctuating significantly for both companies, partly due to the extreme volatility of all areas of the shipping industry. Eagle's current cash-to-debt ratio is currently 0.22 and is ranked worse than 68.3% of 959 companies in the transportation industry. The working average cost of capital is 8.1% and the return on capital Investment is 3.2%, indicating the company is losing value. Star Bulk's current cash-to-debt ratio is currently 0.27 and is ranked worse than 63.9% of 959 companies in the transportation industry. The Working average cost of capital is 7.5% and the return on capital investment is 8.3% indicating the company is adding value. The merger appears to make sense from an evaluation of these current metrics.

Initially, I also had concerns about the fact Eagle was being bought by a Greek company where regulatory requirements and government policy may differ significantly from those of the U.S. However, upon learning more about the global nature of the shipping industry, I have developed more assurance that this transition may occur without great disruption. Greece's gross domestic product rose for the first two quarters of 2023 by 1.3%. Greece's economy is expected to grow by 2.0% in 2024 and 2.4% in 2025. For comparison, the U.S. economy is expected to grow by 1.5% in 2024 and 1.7% in 2025.

Recent global freight increases resulting from the Red Sea diversion may increase share prices for the merged company. As the Barron's article suggested above, the company's attractiveness to large institutional investors may also drive up the share prices, but that may be offset by additional consolidation in the industry.

The long-term outlook for the global shipping industry is not rosy as it is expected to grow at an average annual rate of 2.1% until 2027 versus a rate of 3.3% for the last 30 years. To put that in perspective, the S&P 500 index is expected to grow annually up to 7% for the next 20 years. In my view, investors may want to look elsewhere for long-term growth opportunities. I am planning to hold my shares for a bit longer to see how the buyout plays out, but I have stopped dollar-cost averaging into the stock since taking a closer look at both companies.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance