Does Jarvis Securities (LON:JIM) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Jarvis Securities (LON:JIM). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Jarvis Securities

Jarvis Securities's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Impressively, Jarvis Securities has grown EPS by 20% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

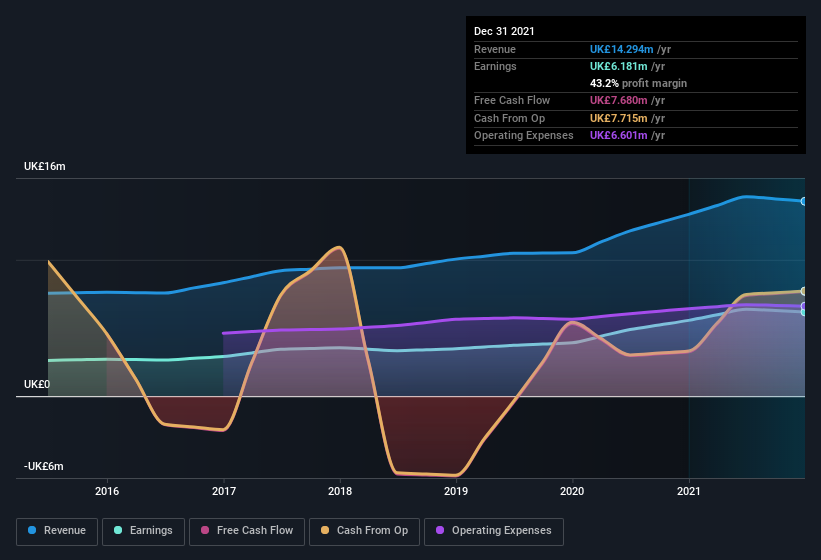

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Jarvis Securities's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Jarvis Securities's EBIT margins were flat over the last year, revenue grew by a solid 7.2% to UK£14m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Jarvis Securities is no giant, with a market capitalization of UK£101m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Jarvis Securities Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Jarvis Securities insiders own a meaningful share of the business. In fact, they own 58% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about UK£59m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Does Jarvis Securities Deserve A Spot On Your Watchlist?

For growth investors like me, Jarvis Securities's raw rate of earnings growth is a beacon in the night. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. Even so, be aware that Jarvis Securities is showing 2 warning signs in our investment analysis , you should know about...

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance