Does IMAX (NYSE:IMAX) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies IMAX Corporation (NYSE:IMAX) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for IMAX

What Is IMAX's Net Debt?

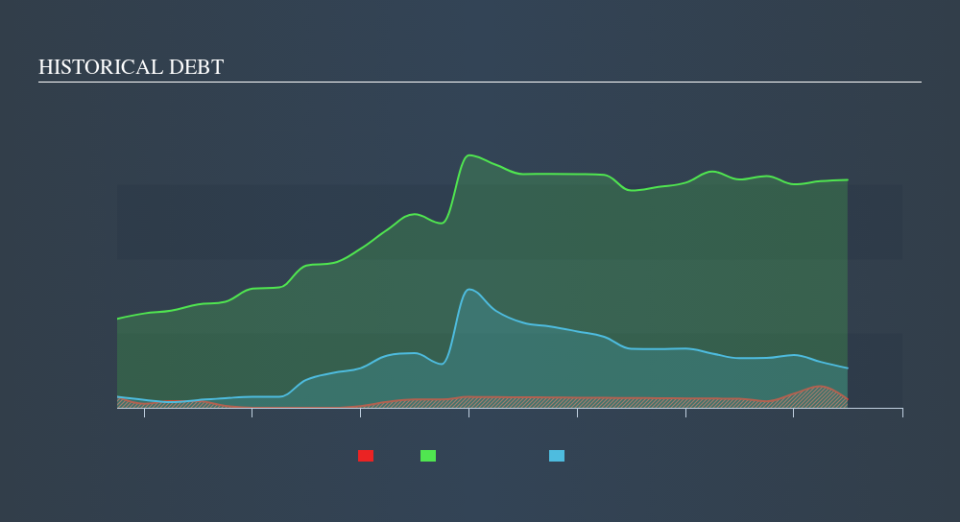

As you can see below, IMAX had US$23.0m of debt at June 2019, down from US$24.4m a year prior. However, its balance sheet shows it holds US$106.5m in cash, so it actually has US$83.5m net cash.

A Look At IMAX's Liabilities

Zooming in on the latest balance sheet data, we can see that IMAX had liabilities of US$115.7m due within 12 months and liabilities of US$149.0m due beyond that. On the other hand, it had cash of US$106.5m and US$164.0m worth of receivables due within a year. So it actually has US$5.76m more liquid assets than total liabilities.

Having regard to IMAX's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$1.30b company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that IMAX has more cash than debt is arguably a good indication that it can manage its debt safely.

On the other hand, IMAX saw its EBIT drop by 9.4% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if IMAX can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While IMAX has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, IMAX recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While it is always sensible to investigate a company's debt, in this case IMAX has US$83m in net cash and a decent-looking balance sheet. So we are not troubled with IMAX's debt use. We'd be motivated to research the stock further if we found out that IMAX insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance