Does good natured Products's (CVE:GDNP) Share Price Gain of 89% Match Its Business Performance?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. For example, the good natured Products Inc. (CVE:GDNP) share price is up 89% in the last year, clearly besting the market return of around 11% (not including dividends). So that should have shareholders smiling. It is also impressive that the stock is up 33% over three years, adding to the sense that it is a real winner.

View our latest analysis for good natured Products

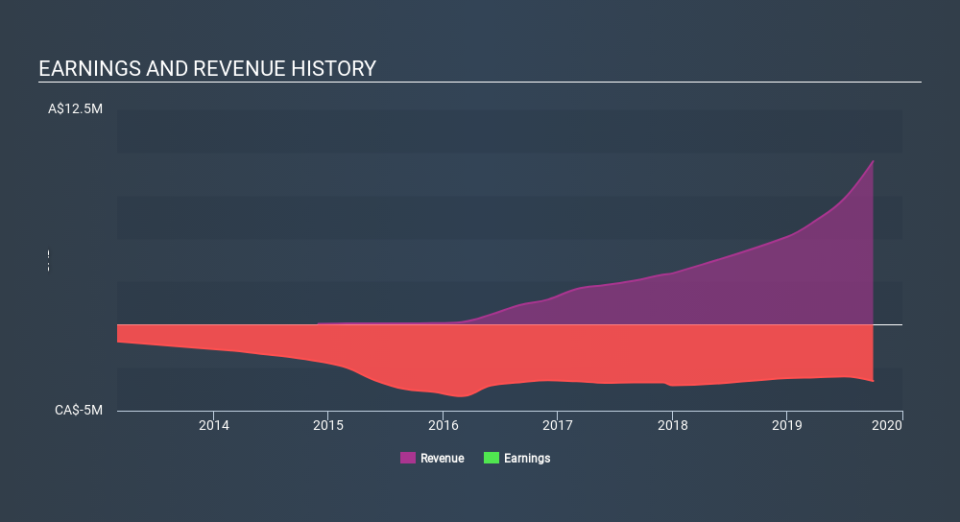

good natured Products wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year good natured Products saw its revenue grow by 108%. That's a head and shoulders above most loss-making companies. While the share price gain of 89% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. If that's the case, now might be the time to take a close look at good natured Products. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at good natured Products's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that good natured Products rewarded shareholders with a total shareholder return of 89% over the last year. That gain actually surpasses the 10% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting good natured Products on your watchlist. You could get a better understanding of good natured Products's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance