DocuSign (DOCU) Appreciates 40% in Six Months: Here's How

DocuSign, Inc. DOCU shares have gained 40% in the past six months, significantly outperforming the 18.4% rise of the Zacks S&P 500 composite.

Reasons Behind the Rally

DocuSign registered growth in both earnings and revenues in the fourth quarter of fiscal 2024. Non-GAAP earnings of 76 cents per share increased 17% year over year and total revenues of $712.4 million were up 8% year over year.

The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an average earnings surprise of 23.7%.

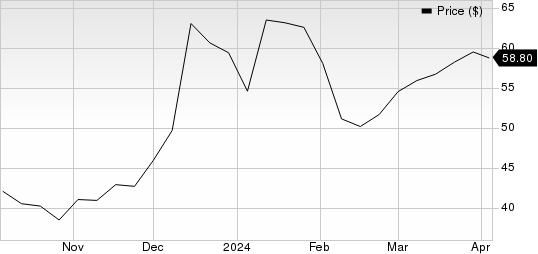

DocuSign Price

DocuSign price | DocuSign Quote

Nine estimates for fiscal 2025 have moved north over the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for fiscal 2025 earnings has climbed 13.3%.

DocuSign is benefiting from the continued demand for its main product, eSignatures. However, even with such soaring demand, it is yet to explore many markets that provide it with ample growth opportunity, especially in the eSignature business.

The company has been formulating various growth strategies for acquiring customers, increasing eSignature use cases to existing customers, improving its offerings, and popularizing other Agreement Cloud products to new and existing customers, and expanding internationally. The continuing investments in sales, marketing and technical expertise give an idea of how the company is eager to grow.

Zacks Rank and Stocks to Consider

DocuSign currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are Core & Main CNM and The Hackett Group HCKT.

Core & Main flaunts a Zacks Rank of 1 (Strong Buy) at present. CNM has a long-term earnings growth expectation of 12%. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNM delivered a trailing four-quarter earnings surprise of 1.5%, on average.

The Hackett Group currently carries a Zacks Rank of 2 (Buy). The company has a long-term earnings growth expectation of 13.5%.

HCKT delivered a trailing four-quarter earnings surprise of 2.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hackett Group, Inc. (HCKT) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance