Dividend Stocks Investors Love

Dividend-paying companies such as KWG Property Holding and Agile Group Holdings can diversify your portfolio cash flow by paying constant and large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

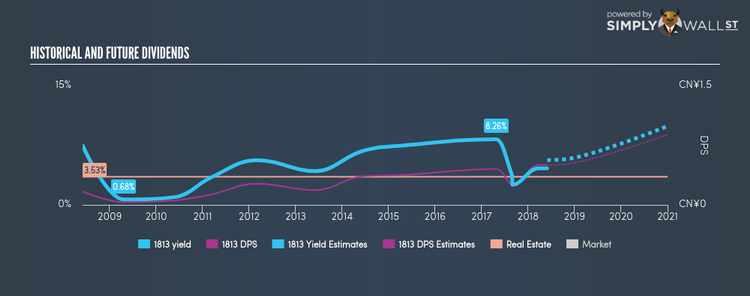

KWG Property Holding Limited (SEHK:1813)

KWG Property Holding Limited, an investment holding company, engages in the investment, development, management, and sale of real estate properties in the People’s Republic of China. Established in 1995, and now led by CEO Jian Kong, the company size now stands at 6,950 people and has a market cap of HKD HK$34.39B, putting it in the large-cap category.

1813 has a great dividend yield of 4.60% and their current payout ratio is 35.09% , with analysts expecting this ratio in three years to be 35.98%. While there’s been some level of instability in the yield, 1813 has overall increased DPS over a 10 year period from CN¥0.17 to CN¥0.50. Analysts are expecting an impressive triple digit earnings growth over the next three years. More detail on KWG Property Holding here.

Agile Group Holdings Limited (SEHK:3383)

Agile Group Holdings Limited, an investment holding company, engages in the property development, property management, hotel operation, property investment, environmental protection, and other businesses in the People’s Republic of China. Founded in 1985, and currently headed by CEO Zhuo Chen, the company employs 17,602 people and with the company’s market capitalisation at HKD HK$58.44B, we can put it in the large-cap stocks category.

3383 has a sumptuous dividend yield of 6.03% and has a payout ratio of 48.30% . While there’s been some level of instability in the yield, 3383 has overall increased DPS over a 10 year period from CN¥0.22 to CN¥0.90. Analysts are enthusiastic about the company’s future growth, estimating a 85.68% earnings per share increase in the next three years. More detail on Agile Group Holdings here.

Wharf (Holdings) Limited (SEHK:4)

Founded in 1886 as the 17th company incorporated in Hong Kong, The Wharf (Holdings) Limited (Stock code: 0004) is a premier company with a long history and Hong Kong as its base. Started in 1886, and now run by Tin Ng, the company provides employment to 8,800 people and with the company’s market cap sitting at HKD HK$76.61B, it falls under the large-cap category.

4 has a substantial dividend yield of 6.32% and pays 22.05% of its earnings as dividends , with the expected payout in three years being 38.89%. While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. Wharf (Holdings) is also reasonably priced, with a PE ratio of 3.5 that compares favorably with the HK Real Estate average of 7.1. Interested in Wharf (Holdings)? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance