Dividend Royalty: 3 Fabulous Stocks to Buy Now for Decades of Passive Income

Written by Brian Paradza, CFA at The Motley Fool Canada

The Canadian social security system is highly regarded globally, but rapid population growth and recent economic crises weighed heavily on it. The national purse could be thinly spread over the next decades while living expenses continue to rise. To feel safe, citizens may save more (whenever possible) and invest much more in private investment accounts to enjoy a care-free retirement.

Investing in dividend-paying stocks with resilient business models, growing recurring cash flows, strong financial positions, and proven track records of uninterrupted dividends could reduce one’s reliance on government-related programs, including the Old Age Security (OAS), the Canada Pension Plan (CPP), and Guaranteed Income Supplement (GIS).

Rogers Communications (TSX:RCI.B), BMO Equal Weight REITs Index ETF (TSX:ZRE), and Canadian Naturals Resources (TSX:CNQ) stock could make regular payouts to investors for decades to come and afford them a royalty lifestyle — whatever politicians do to social security schemes.

Rogers Communications stock

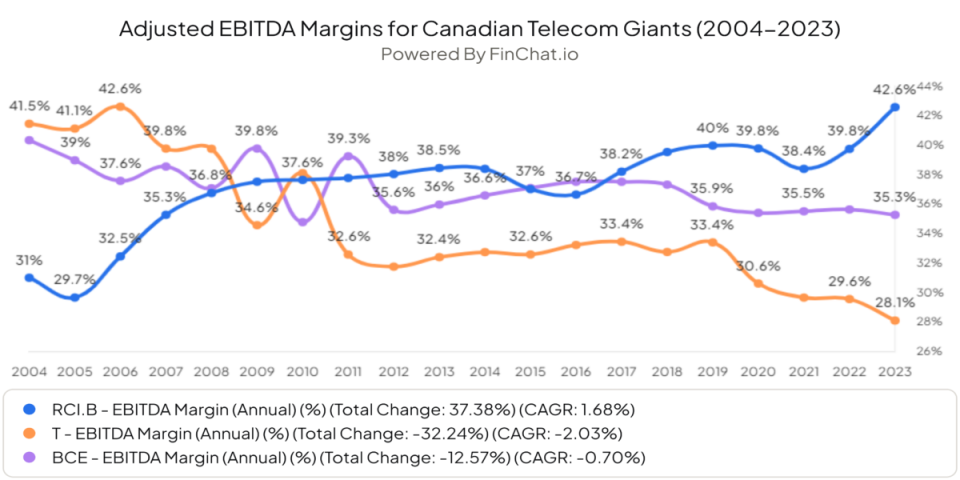

Rogers Communications’s recent acquisition of Shaw assets has been accretive to its operating earnings potential, as measured by its adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) during the past year. The $29.6 billion Canadian telecommunications industry leader boasts the industry’s highest EBITDA margins today. Close competitors include Telus and BCE.

Rogers is earning more operating profit per dollar of revenue from its highly defensive business lines. A successful cost-containment strategy over the next few years should unlock vast amounts of distributable cash flow and a new dividend-growth spree.

Current Rogers stock investors receive a quarterly dividend that yields 3.6% annually. Merger synergies could afford management a wide room for dividend raises.

Rogers stock has paid uninterrupted dividends for more than 40 years.

BMO Equal Weight REITs Index ETF

Investors looking for dependable monthly dividend income streams should check out BMO Equal Weight REITs Index ETF, an exchange-traded fund (ETF) managed by the learned professionals at Bank of Montreal. The ETF provides investors access to a diversified portfolio of 21 Canadian real estate investment trusts (REITs) that pay boatloads of cash every month from rental income generated from various commercial properties.

Why should you invest in the ZRE ETF for passive income? The medium-risk-rated ETF pays monthly distributions that currently yield a lucrative 5.3% annually. Its $545 million portfolio’s equal-weighting strategy reduces excessive exposure to any single REIT holding in its portfolio, diluting any risks of distribution cuts or losses due to acquisitions during your investment period.

BMO cheaply prices its management services for the ETF, and a management expense ratio (MER) of 0.61% implies you pay as little as $1.10 per annum for every $1,000 invested.

Since its inception in 2010, the ZRE ETF has averaged a respectable 7.5% average annual return to investors. It could do better once the Bank of Canada starts lowering rates again.

The ETF is an eligible investment to add to your registered accounts including the Tax-Free Savings Account (TFSA), and the Registered Retirement Savings Plan (RRSP), among others.

Canadian Natural Resources stock

Canadian oil sands stocks are increasingly becoming huge cash cows to buy and hold for passive income as reinvestment plans wane while the world attempts to move away from fossil fuels. Canadian Natural Resources stock is a favourite investment for growing dividend payouts due to the company’s sheer size, long-life, low-decline assets, low-cost producer status, and a recent commitment to pay out 100% of its distributable cash flow after reaching a $10 billion net debt during the fourth quarter of 2023.

CNQ raised its quarterly dividend by 5% in February to mark 24 consecutive years of consistent dividend growth. The $110 billion oil and natural gas production company has raised its dividend by 23% over the past 12 months; its management seems highly confident in the sustainability of CNQ’s business model for years to come. The latest quarterly payout yields 4.1% annually.

The TSX energy stock could be a reliable passive-income provider for Canadian investors for decades as it transitions into a low-investment, high-free cash flow operating environment that enables it to richly reward its loyal shareholders. CNQ has a total proven reserves life index of 32 years. The company can go for three decades at current production levels before depleting its resources.

The post Dividend Royalty: 3 Fabulous Stocks to Buy Now for Decades of Passive Income appeared first on The Motley Fool Canada.

Should you invest $1,000 in Canadian Natural Resources right now?

Before you buy stock in Canadian Natural Resources, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Canadian Natural Resources wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool recommends Canadian Natural Resources, Rogers Communications, and TELUS. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance