Dividend Investors: Top Canadian Utility Stocks for July

Written by Kay Ng at The Motley Fool Canada

These top Canadian utility stocks are good considerations for long-term dividend investors. The first name is a more conservative investment.

Fortis stock

Fortis (TSX:FTS) is a good stock for conservative investors on pullbacks. It is a traditional utility stock investors can depend on for growing dividends. It has increased its dividend for half a century. For your reference, its one-, three-, five-, 10-, and 15-year dividend-growth rates are in the 5-6% range.

Likely due to higher interest rates, its last dividend hike was lower at north of 4%. Investors can expect Fortis to increase its dividend soon, in late September, based on its usual dividend-hike schedule. Its payout ratio is estimated to be sustainable at about 74% of earnings this year. And management has guided predictable dividend raises of 4-6% per year through 2028.

Because the diversified, large North American regulated electric and gas utility makes quality, resilient earnings, historically, it commands a premium price-to-earnings ratio (P/E). At $53.54 per share at writing, the blue-chip stock trades at a relatively low valuation, specifically, a discount of about 11%, versus its long-term normal levels of approximately 19 times earnings. At the recent quotation, it offers a decent dividend yield of 4.4%.

Let’s be more conservative and assume no valuation expansion. Over the next few years, we can reasonably approximate total returns of over 8% per year in Fortis stock.

Investors can get the latest updates from the company on July 31 when it will be reporting its second-quarter (Q2) results.

For more income and higher growth potential, investors can investigate Brookfield Infrastructure Partners (TSX:BIP.UN).

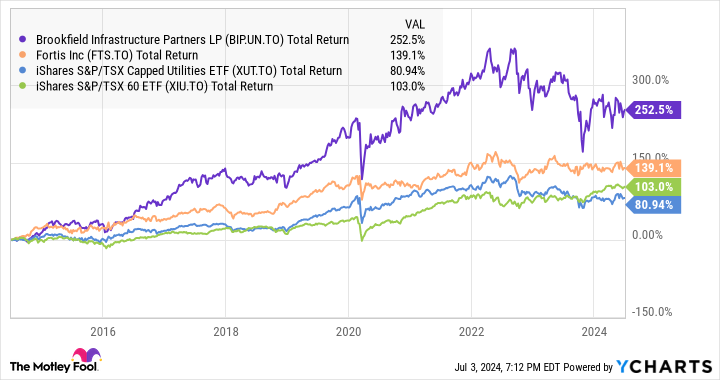

10-year total returns comparison between BIP.UN, FTS, XIU, and XUT. Data by YCharts

Brookfield Infrastructure Partners

Brookfield Infrastructure owns and operates a globally diversified portfolio of critical infrastructure assets across four business segments and about 45 businesses in over 15 countries.

Across gas and electric utilities, it has US$7 billion rate base, generating long-term returns on regulated or contractual asset base, which allows it to produce resilient cash flows.

Its transport segment consists of large rail operations, terminals, export facilities, and toll roads. Its midstream segment focuses on providing energy transmission, transportation, storage, fractionation, and value enhancement in Canada and the United States.

Its data segment includes operational telecom sites, fibre optic cables, data centres, semiconductor manufacturing foundries, fibre-to-the-premise connections, and distributed antenna systems.

Brookfield Infrastructure generates funds from operations (FFO) that are about 90% contracted or regulated with a weighted average duration of roughly 10 years. Altogether, it expects organic FFO growth of 6-9%. For example, it experienced organic growth of 7% in the first quarter (Q1).

For your reference, its one-, three-, and five-year cash-distribution growth rates were about 6%, while its 10- and 15-year rates were about 8% and 10%, respectively.

Over the last 10 years, BIP.UN delivered annualized returns of 13.4%, while Fortis stock’s rate of return was 9.1% Brookfield Infrastructure is more leveraged than Fortis, which may be why it underperformed the former under a higher interest rate environment. Since 2022, the stock returned -17% versus Fortis’s -4%. Notably, Brookfield’s debt are primarily at the asset level. So, in the worst-case scenario, it would hand over bad assets to its creditors.

At $53.81 per unit, BIP.UN trades at a good discount of about 26% according to the analyst consensus 12-month price target. It also offers a compelling cash distribution yield of about 5.6%. So, it’s probably a good buy here for long-term investment.

The post Dividend Investors: Top Canadian Utility Stocks for July appeared first on The Motley Fool Canada.

Should you invest $1,000 in Brookfield Infrastructure Partners right now?

Before you buy stock in Brookfield Infrastructure Partners, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Infrastructure Partners wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $16,110.59!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 29 percentage points since 2013*.

See the 10 stocks * Returns as of 6/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has positions in Brookfield Infrastructure Partners and Fortis. The Motley Fool recommends Brookfield Infrastructure Partners and Fortis. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance