Disney Board Showdown: What’s at Stake at Contentious 2024 Shareholder Meeting

Usually, shareholder votes for corporate board directors have all the suspense of a Soviet-style election.

Most of the time, director candidates are backed by the company, and they run unopposed — winning election or reelection in a landslide. In 2022, only 75 board-endorsed candidates at companies in the Russell 3000, less than 0.5% of almost 17,500 board members on the ballot that year, failed to get elected by shareholders, per an analysis by the Harvard Law School Forum on Corporate Governance (which also noted that, while small, the number had dramatically risen vs. 2017).

More from Variety

Disney Shareholders Officially Reject Nelson Peltz's Board Bid in Big Win for CEO Bob Iger

Disney Has Enough Votes to Defeat Activist Investor Nelson Peltz's Board Candidates: Report

For Disney, the 2024 shareholders meeting is different.

Investors are voting on three competing board candidate slates — Disney’s own recommended 12-member lineup, including CEO Bob Iger; two nominated by Trian Fund Management, which is headed by activist investor Nelson Peltz (Peltz himself and ex-Disney CFO Jay Rasulo); and three from another investment firm that has entered the fray, Blackwells Capital. The showdown has shaped up as the priciest proxy fight in U.S. history: Disney disclosed that it expects costs for the board battle to be in the neighborhood of $40 million; Trian estimates it could spend upwards of $25 million on the campaign and Blackwells expects to spend around $6 million.

Disney’s 2024 annual meeting of shareholders will be held Wednesday, April 3, starting at 10 a.m. PT. Eligible shareholders can participate in the virtual meeting at this link; Disney also is hosting a live webcast at this link. Investors have been able to cast their votes prior to the meeting online or by telephone, with a deadline of 11:59 p.m. ET on April 2; shareholders may vote at the meeting but Disney “strongly” encourages them to do so beforehand. The vote counts will be announced at the April 3 meeting.

Here’s the background on what could be a momentous change for the Mouse House.

Why Does Nelson Peltz Want to Shake Up Disney’s Board?

Peltz wants Disney’s stock price to go up — and he believes new thinking is needed on the Mouse House’s board to accomplish that. “Disney fell from its No. 1 position at the box office, was late to enter the streaming business and doubled down on linear TV at the wrong time,” Trian said in a letter directed to Disney shareholders. In the last several years, Trian alleges, Disney “has woefully underperformed its potential and its peers, costing shareholders more than $200 billion in value.” In 2023, Disney’s stock was up 35% year to date as of March 28 — but Trian has argued that “the pressure of our proxy contest pushing Disney to perform” was part of the reason for the rebound. Moreover, Trian has questioned whether the company can execute on recently announced strategic plans, including hitting double-digit streaming margins.

And more specifically, Trian argues the Disney board “botched its most important job — CEO succession — by installing Bob Chapek in that role seemingly without appropriate vetting or oversight. The board then renewed Mr. Chapek’s contract just months before firing him for poor performance. Ultimately, the board had to call Bob Iger out of retirement to fill the void.”

“We believe that reelecting the existing board will have the predictable effect of leading to more of the same: questionable strategic and capital allocation decisions, poor executive compensation alignment and suboptimal succession planning,” Trian said in a March 25 statement.

Peltz points to his track record as a board member in helping to turn around companies like H.J. Heinz and Procter & Gamble. He says he wants to “Restore the Magic” at Disney (as Trian has dubbed its proxy campaign) and his firm has called Disney “the most advantaged consumer entertainment company in the world.”

Does Peltz Want to Oust Bob Iger?

Not exactly, but it’s complicated. Peltz’s Trian issued a statement last week saying the firm “supports Mr. Iger as a candidate for the board and as CEO” — however, the investment firm has withheld its votes for Iger’s board candidacy. (Asked for clarification, a rep for Trian declined to comment.)

Iger commented on Peltz’s proxy fight at a Morgan Stanley conference last month, saying, “This campaign is designed to distract us. I am working really hard to not let this distract me, because when I get distracted everybody who works for me gets distracted, and that’s not a good thing.”

What Is Disney’s Response to Peltz?

Disney has called Trian’s proxy fight “disruptive and destructive” and said Peltz’s “quest also seems more about vanity than a belief in Disney.” The company has characterized Trian’s campaign as fueled by a “longstanding personal agenda” harbored by ex-Marvel Entertainment chairman Ike Perlmutter against Iger, who last year fired Perlmutter. Trian controls roughly $3.5 billion worth of Disney stock (about 32 million shares), 79% of which is owned by Perlmutter. Disney has about 1.83 billion shares outstanding.

Disney has told shareholders that Peltz “brings no media experience and has presented no strategic ideas for Disney” and the company highlighted an interview Peltz gave to CNBC in which he said, “They said I have no media experience — I don’t claim to have any.” Regarding Rasulo, Disney says his perspective “is stale given he left Disney in 2015 and has not held any executive positions in the industry since.” The company also has noted that Trian in the past six months has sold 500,000 Disney shares, an attempt to portray Peltz as looking for quick cash-outs rather than being invested in Disney’s long-term financial success.

“The Walt Disney Co. has turned a corner and is focused on creating lasting, long-term value,” the company said in a video posted to its shareholder campaign portal. Among the points it cited: Disney’s board has authorized $3 billion in stock repurchases in fiscal year 2024 and increased the cash dividend to shareholders to 45 cents/share payable in July (up 50% from the January dividend).

Disney says the board’s succession planning committee is “led by successful CEOs with recent, highly praised succession experience” who are conducting a “diligent and thorough succession planning process” to identify a successor to Iger, whose CEO contract expires at the end of 2026. James Gorman, the former CEO of Morgan Stanley who was named to Disney’s board last fall and is on the succession committee, recently told CBNC, “I just came through a huge succession process at Morgan Stanley. I’m impressed by the process [at Disney].”

What Are the Chances Peltz Will Win?

While Iger has dismissed Peltz’s proxy fight as a “distraction,” Trian could potentially pull off an upset and get the votes to secure at least one seat on the board.

In a big win for Trian, influential advisory firm Institutional Shareholder Services (ISS) recommended shareholders elect Peltz to the Disney board (but not Rasulo). In its report, ISS cited Disney’s “failed” CEO succession planning and said Peltz “could be additive to the succession process, providing assurance to other investors that the board is properly engaged this time around.” ISS recommended shareholders vote for current Disney director Michael Froman but abstain from reelecting Maria Elena Lagomasino, CEO and managing partner of WE Family Offices (and a former senior executive at JP Morgan Private Bank and Chase Manhattan Bank and a current director of the Coca-Cola Co.). Disney chairman Mark Parker, who is also executive chairman of Nike, responded that “we strongly believe that ISS reached the wrong conclusion.”

Last week, Peltz got another supporter: Egan-Jones Ratings Co., a credit ratings and proxy advisory firm, which recommended Disney shareholders vote for Peltz and Rasulo (over Lagomasino and Froman). In addition, CalPERS, the large California pension fund that owns 6.65 million Disney shares, voted its company shares for Peltz and Rasulo.

At the shareholder meeting, Disney’s directors will be elected on a plurality basis. That means that the 12 director nominees receiving the greatest number of “for” votes cast will be elected; “withhold” votes and any broker non-votes will not be counted as votes cast.

Who’s Supporting Disney?

Glass Lewis, another influential proxy-advisory firm, endorsed Disney’s slate of directors and Iger’s leadership. Disney “is undertaking what we consider to be a credible effort to shift key operational priorities under the leadership of one of the most well-respected CEOs in the industry,” the firm said. Disney and Iger also have received public support from George Lucas (Disney’s largest individual shareholder), former Disney CEO Michael Eisner, large shareholder Laurene Powell Jobs (founder and president, Emerson Collective), and the grandchildren of Walt Disney and his brother Roy O. Disney (including filmmaker Abigail Disney).

“Bringing in someone who doesn’t have experience in the company or the industry [i.e., Peltz] to disrupt Bob and his eventual successor is playing not only with fire but earthquakes and hurricanes as well,” Eisner wrote in a March 22 post on X. “The company is now in excellent hands and Disney shareholders should vote for the Disney slate.”

What Is Blackwells’ Beef With Disney About?

Blackwells generally supports Disney’s current direction (and opposes Peltz’s “contrived campaign that is disconnected from the needs of Disney stakeholders”) but asserts Disney’s board needs more directors with media-industry experience. Its three candidates are: Jessica Schell, a former Warner Bros. and NBCUniversal exec; Tribeca Film Festival co-founder Craig Hatkoff; and TaskRabbit founder Leah Solivan.

Blackwells also alleges Disney has a conflict of interest with investment firm ValueAct Capital, which announced an “information sharing” deal with Disney and its support for the company’s recommended slate of board nominees at the 2024 annual meeting. Under that agreement, Disney will consult with ValueAct on “strategic matters,” including through meetings with the Disney board and management. Blackwells sued Disney last week in Delaware chancery court, seeking “books and records in order to determine whether wrongdoing, mismanagement or breaches of fiduciary duty, including potential violations of disclosure obligations under the federal securities laws, have taken place in connection with Disney’s dealings with and disclosures related to ValueAct Capital Management.” According to the Blackwells suit, ValueAct was responsible in 2022 for managing more than $350 million in Disney pension fund assets and was paid “perhaps as much as $95 million in fees for its money-management services to Disney.”

In response to the lawsuit, a Disney spokesman said, “The claims made by Blackwells Capital are baseless, and this is merely their desperate attempt to gain attention for their slate of director candidates. No Disney pension plan funds are currently invested with ValueAct nor were they managing any Disney pension plan funds at the time of their entering into an information-sharing agreement with the company. Prior to Blackwells filing this litigation, Disney offered to meet with them and provide documentation confirming those facts, but Blackwells declined the meeting.”

What Else Is Up for a Vote at the Disney Shareholder Meeting?

Nothing as dramatic as the board election. There are some typical proposals (which Disney recommends voting for): ratification of the appointment of PwC as the company’s independent registered public accountants for fiscal 2024 and consideration of an “advisory vote” to approve executive compensation packages. (Trian supports the PwC renewal but not the executive comp.)

There are also various shareholder proposals (which Disney recommends voting against), including one seeking to cap “golden parachute” exec pay packages; one that would force Disney to disclose political expenditures and another that would require Disney to disclose charitable contributions; and one requesting a board report addressing the company’s benefits relating to “dysphoria and de-transitioning care across gender classifications.”

In addition, a Trian proposal seeks to repeal Disney’s amended bylaws adopted by the board in November 2023 that added new requirements for board candidates nominated by outside parties. Blackwells is seeking an advisory vote “to cause the board to increase its size” by the number of Disney-backed nominees if they fail to get more votes than Trian’s or Blackwells’ nominees and have those directors appointed to the board. (Disney opposes both of those.)

Who Are Disney’s Biggest Institutional Investors?

As of the end of 2023, they are: Vanguard (8.3% of outstanding shares), BlackRock (6.7%), State Street (4.1%), Morgan Stanley (2.6%), State Farm Mutual Auto Insurance (2.0%), Geode Capital Management (1.9%) and Trian Fund Management (1.8%). Overall, individual Disney shareholders own more than one-third of outstanding shares, making them a sizable force in deciding the board election.

Has Disney Been Challenged by Dissident Investors Before?

Yes. In 2003, Roy E. Disney (Walt’s nephew) and fellow dissident director Stanley Gold were kicked off the board and the duo led a “Save Disney” shareholder revolt against Eisner. At the 2004 Disney annual meeting, shareholders delivered an unprecedented rebuke to Eisner by withholding 45% of votes cast for his reelection to the board. Roy E. Disney and Gold also opposed Eisner’s selection of Iger as CEO (calling Iger’s appointment at the time a “sham”) before Iger was able to settle the hostilities in 2005. More than a decade earlier, in 1983, corporate raider Saul Steinberg staged an ultimately unsuccessful hostile takeover of Disney.

Meanwhile, Peltz in January 2023 launched a campaign threatening a proxy fight. However, by Feb. 9, Peltz suspended the bid for a board seat after Disney unveiled a broad restructuring of operations after Iger’s return as CEO.

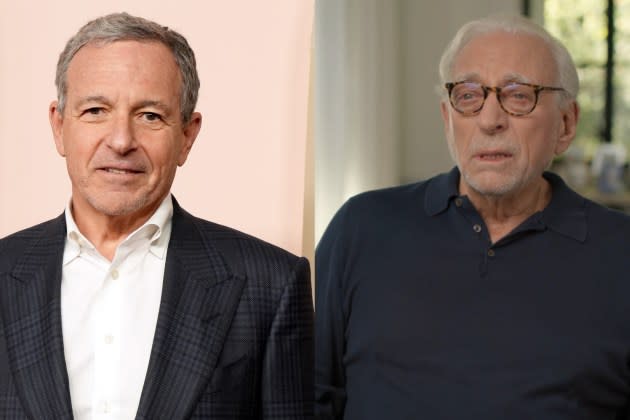

Pictured above: Disney CEO Bob Iger; Trian’s Nelson Peltz

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance