Discover Three Hong Kong Dividend Stocks With Yields Up To 7.2%

Amidst a backdrop of global economic fluctuations and regional growth, the Hong Kong market has shown resilience with the Hang Seng Index recently climbing by 4.67%. This positive momentum makes it an opportune time to explore dividend stocks, which can offer investors potential income stability and growth in this dynamic environment.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 8.27% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 9.30% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.30% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 9.60% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.02% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.18% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.90% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.34% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.68% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.64% | ★★★★★☆ |

Click here to see the full list of 85 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

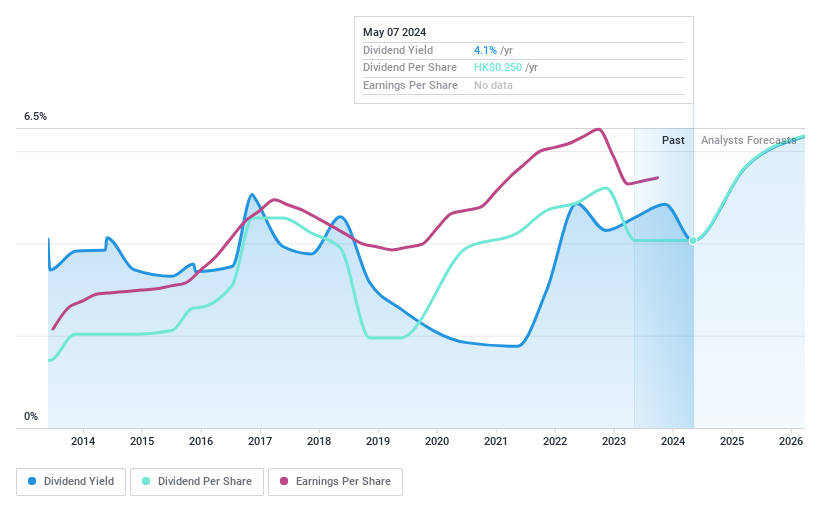

Man Wah Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Man Wah Holdings Limited is an investment holding company that specializes in manufacturing, wholesaling, trading, and distributing sofas and related products across the People's Republic of China, North America, Europe, and other international markets, with a market capitalization of approximately HK$23.92 billion.

Operations: Man Wah Holdings Limited generates revenue primarily through its Sofa and Ancillary Products segment, which brought in HK$11.77 billion, followed by the Bedding and Ancillary Products at HK$2.83 billion, and smaller contributions from the Home Group Business at HK$0.63 billion.

Dividend Yield: 4.1%

Man Wah Holdings has exhibited a mixed performance in the realm of dividend stocks. Over the past decade, its dividends have shown growth but with notable volatility, including annual drops over 20%. Currently, the dividend yield stands at 4.05%, which is modest compared to Hong Kong's top dividend payers. Despite this, both earnings and cash flows sufficiently cover the payouts, with a payout ratio of 50% and a cash payout ratio of 48.5%. Earnings are projected to grow by 16.73% annually.

Navigate through the intricacies of Man Wah Holdings with our comprehensive dividend report here.

Our valuation report here indicates Man Wah Holdings may be undervalued.

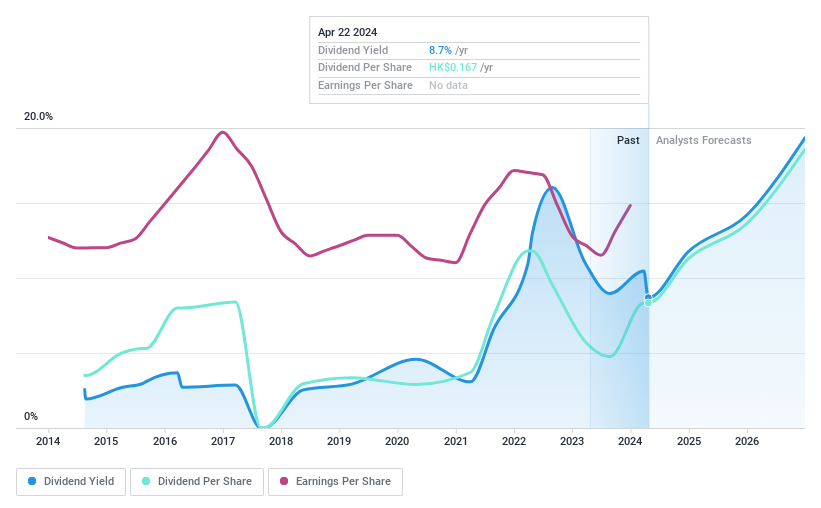

Best Pacific International Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Best Pacific International Holdings Limited operates in the manufacturing, trading, and selling of elastic fabric, elastic webbing, and lace, with a market capitalization of approximately HK$2.38 billion.

Operations: Best Pacific International Holdings Limited generates revenue primarily through two segments: HK$834.34 million from the manufacturing and trading of elastic webbing, and HK$3.37 billion from the manufacturing and trading of elastic fabric and lace.

Dividend Yield: 7.3%

Best Pacific International Holdings has a history of inconsistent dividends over the last decade, reflecting volatility despite a 50% payout ratio indicating earnings coverage. The company's cash flow also supports its dividends with a 23.9% cash payout ratio. Recently, it proposed an increased dividend of HK$0.1138 per share for 2023, aligning with improved earnings which rose to HK$346.92 million from HK$299.2 million the previous year, suggesting some financial recovery and potential for sustaining future dividends despite past irregularities.

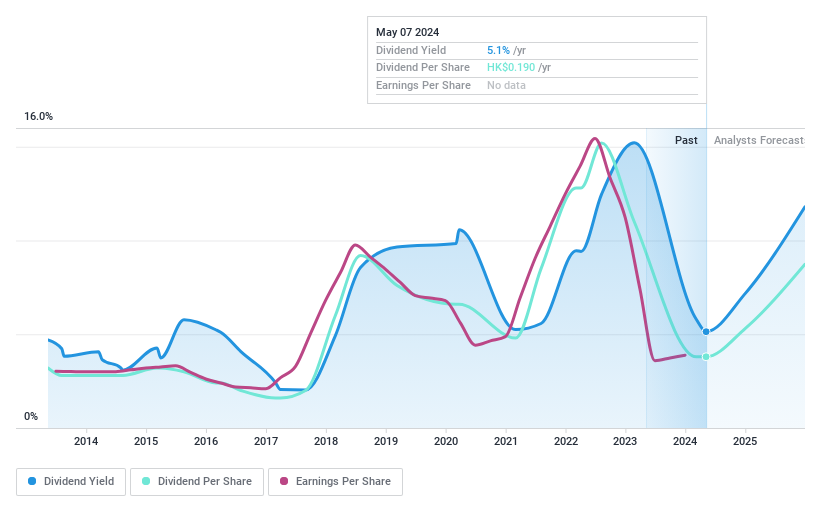

Lee & Man Chemical

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lee & Man Chemical Company Limited is an investment holding company that manufactures and sells chemical products in the People’s Republic of China, with a market capitalization of approximately HK$3.05 billion.

Operations: Lee & Man Chemical Company Limited generates revenue primarily through its chemical products segment, which amounted to HK$3.98 billion, and a smaller property segment contributing HK$69.66 million.

Dividend Yield: 5.1%

Lee & Man Chemical recently proposed a reduced dividend of HK$0.14 per share, reflecting a challenging fiscal year with revenue dropping to HK$4.05 billion and net income to HK$400.67 million from higher figures the previous year. The company's dividend yield stands at 5.14%, lower than the top quartile of Hong Kong dividend stocks at 7.83%. Despite this, dividends are reasonably covered by earnings and cash flows, with a payout ratio of 39.1% and cash payout ratio of 75.2%, suggesting some level of sustainability amidst financial pressures marked by volatile past payments and declining profit margins from 19.7% to 9.9%.

Next Steps

Unlock more gems! Our Top Dividend Stocks screener has unearthed 82 more companies for you to explore.Click here to unveil our expertly curated list of 85 Top Dividend Stocks.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1999SEHK:2111SEHK:746.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance