Discover FM Mattsson And Two Other Top Dividend Stocks On The Swedish Exchange

As global markets navigate through fluctuating economic signals, with some regions showing signs of cooling while others maintain resilience, investors are keenly watching for stable investment opportunities. In this environment, dividend stocks like FM Mattsson on the Swedish exchange offer a compelling focus for those seeking potential income combined with the prospect of capital appreciation in a mature market.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.34% | ★★★★★★ |

Betsson (OM:BETS B) | 5.59% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.69% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.52% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.43% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.52% | ★★★★★☆ |

Duni (OM:DUNI) | 4.94% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.37% | ★★★★★☆ |

Husqvarna (OM:HUSQ B) | 3.51% | ★★★★☆☆ |

AB Traction (OM:TRAC B) | 4.07% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

FM Mattsson

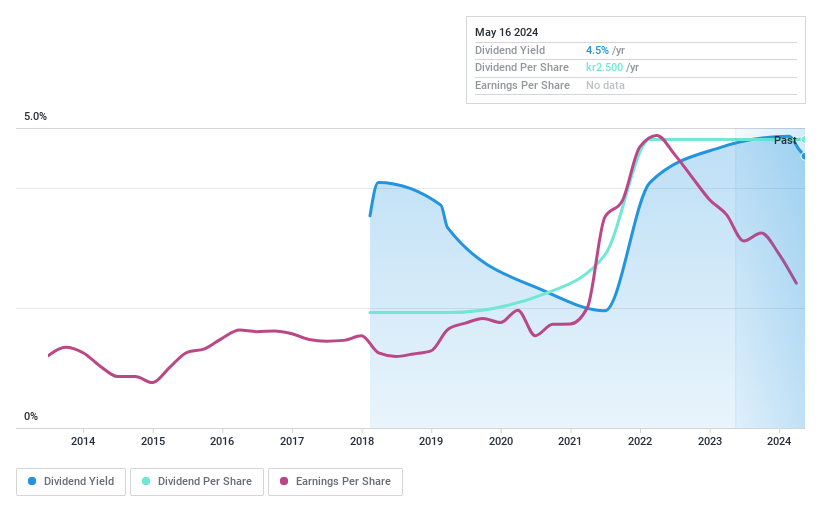

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) specializes in the development, manufacture, and sale of water taps and related products for bathrooms and kitchens across several European countries, with a market capitalization of SEK 2.19 billion.

Operations: FM Mattsson AB generates revenue primarily through its operations in the Nordic countries, where it earned SEK 1.12 billion, and from international markets, contributing SEK 783.23 million.

Dividend Yield: 4.8%

FM Mattsson, recently renamed, reported a Q1 2024 sales drop to SEK 493.4 million and a net income decrease to SEK 28.2 million from the previous year. Despite this, FM Mattsson maintains a stable dividend with a yield of 4.83%, ranking in the top quartile of Swedish dividend stocks. The dividends are well-supported by earnings and cash flows, with payout ratios of 86.3% and 49.5% respectively, indicating reasonable coverage despite less than ten years of consistent dividend history.

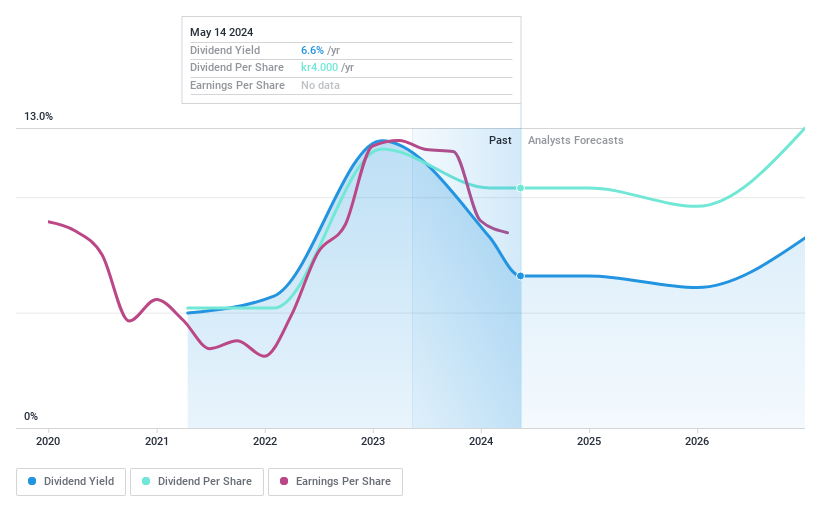

Nordic Paper Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordic Paper Holding AB operates in the production and sale of natural greaseproof and kraft paper across Sweden, Italy, Germany, other parts of Europe, the United States, and internationally, with a market capitalization of approximately SEK 3.39 billion.

Operations: Nordic Paper Holding AB generates revenue primarily through two segments: Kraft Paper, which brought in SEK 2.23 billion, and Natural Greaseproof paper with SEK 2.19 billion in sales.

Dividend Yield: 7.9%

Nordic Paper Holding reported a Q1 2024 sales decrease to SEK 1.21 billion and a net income drop to SEK 149 million, reflecting a challenging period. Despite this, the company maintains a dividend of SEK 4 per share. The dividends are backed by earnings and cash flows with payout ratios of 68.3% and 78% respectively, suggesting reasonable coverage. However, the company's dividend history is short and recent reductions may concern investors seeking stable returns.

Zinzino

Simply Wall St Dividend Rating: ★★★★★★

Overview: Zinzino AB (publ), a direct sales company, operates internationally offering dietary supplements and skincare products, with a market capitalization of approximately SEK 2.37 billion.

Operations: Zinzino AB generates its revenue primarily through two segments, with SEK 161.20 million from Faun and SEK 1,737.25 million from Zinzino (including VMA Life).

Dividend Yield: 4.3%

Zinzino AB has shown robust revenue growth, with a 20% increase in the first half of 2024 to SEK 959.9 million. This performance is underpinned by strategic expansions into Serbia and potential acquisitions in the US and Asia, aimed at enhancing distribution and market reach. The company maintains a dividend yield of 4.34%, supported by a payout ratio of 59.9% from earnings and 59.3% from cash flows, indicating sustainable dividend payments amidst expansion efforts.

Click here and access our complete dividend analysis report to understand the dynamics of Zinzino.

Our expertly prepared valuation report Zinzino implies its share price may be lower than expected.

Key Takeaways

Click through to start exploring the rest of the 20 Top Swedish Dividend Stocks now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:FMM B OM:NPAPER and OM:ZZ B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance