Discover Financial (DFS) Resolves Merchant Lawsuit Amid Merger

Discover Financial Services DFS recently announced a crucial agreement to settle a longstanding class-action lawsuit alleging overcharging of merchants due to card account misclassification. The company, which had increased the amount to cover liabilities related to the issue to $1.2 billion, expects this amount to fully address the settlement, pending court approval.

The misclassification, affecting certain credit card accounts since 2007, led to merchants being charged a higher amount of fees. This development resulted in Discover Financial suspending stock buybacks last year and undertaking internal reviews. Moreover, the company made settlement disbursements worth $9 million in the first quarter of 2024.

This settlement comes at an opportune time as Discover Financial navigates a significant $35.3 billion acquisition by Capital One Financial Corp. The merger aims to create a solid global payments platform, integrating 70 million merchant acceptance points worldwide. The resolution of the merchant overcharging lawsuit highlights Discover Financial’s strong stance in addressing compliance issues ahead of the merger with Capital One.

By settling legal liabilities, Discover Financial seeks to streamline operations and mitigate risks associated with ongoing litigation. This strategic move not only highlights regulatory compliance but also aligns with the company’s objective of enhancing operational efficiency and boosting investor confidence in the stock amid the transformative business initiatives. This settlement is expected to remove regulatory obstructions for the impending merger with Capital One. The deal is expected to close by late 2024 or early 2025, subject to regulatory and shareholder approvals and closing conditions.

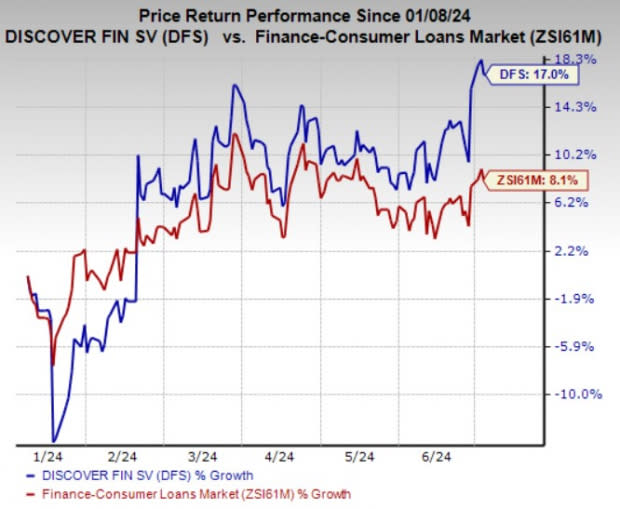

Price Performance

Discover Financial’s shares have gained 17% in the past six months compared with the 8.1% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Discover Financial currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Finance space are Coinbase Global, Inc. COIN, WisdomTree, Inc. WT and HIVE Digital Technologies Ltd. HIVE. While Coinbase Global sports a Zacks Rank #1 (Strong Buy) at present, WisdomTree and HIVE Digital carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Coinbase’s current-year earnings is pegged at $7.18 per share, up from 37 cents a year ago. COIN beat earnings estimates in each of the past four quarters, with an average surprise of 364.6%. The consensus mark for its current-year revenues is pegged at nearly $6 billion, a 92.2% jump from a year ago.

The Zacks Consensus Estimate for WisdomTree’s 2024 earnings indicates 51.4% year-over-year growth. In the past two months, WT has witnessed one upward estimate revision against none in the opposite direction. It met earnings estimates thrice in the past four quarters and beat once, with an average surprise of 2.3%.

The Zacks Consensus Estimate for HIVE Digital’s current-year earnings suggests a 29.1% year-over-year improvement. In the past 30 days, HIVE has witnessed one upward estimate revision against none in the opposite direction. The consensus mark for current-year revenues suggests a 36.2% jump from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

HIVE Digital Technologies Ltd. (HIVE) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance