Discover 3 Leading Japanese Dividend Stocks With Yields Up To 4.3%

The Japanese market has shown remarkable resilience, with a 3.8% increase in the last 7 days and a significant climb of 37% over the past year, alongside an anticipated earnings growth of 9.8% per annum. In this buoyant environment, identifying dividend stocks that offer both stability and attractive yields becomes particularly compelling for investors seeking to capitalize on Japan's current market dynamics.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

SOLXYZ (TSE:4284) | 3.49% | ★★★★★★ |

Yamato Kogyo (TSE:5444) | 3.46% | ★★★★★★ |

KEL (TSE:6919) | 5.32% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.15% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.30% | ★★★★★★ |

CMC (TSE:2185) | 3.60% | ★★★★★★ |

Star Micronics (TSE:7718) | 3.33% | ★★★★★★ |

Innotech (TSE:9880) | 3.49% | ★★★★★★ |

Toyo Kanetsu K.K (TSE:6369) | 3.22% | ★★★★★★ |

Japan Excellent (TSE:8987) | 4.37% | ★★★★★★ |

Click here to see the full list of 0 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

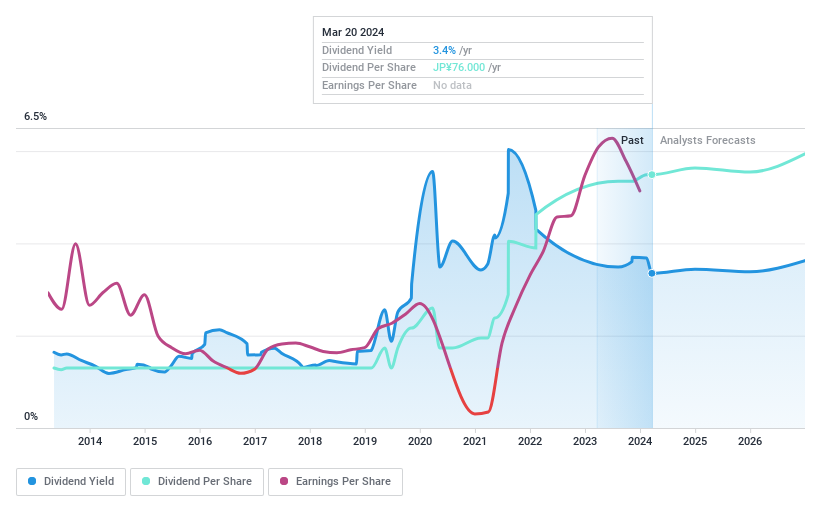

Inpex (TSE:1605)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Inpex Corporation is a global energy company involved in the research, exploration, development, production, and sale of oil, natural gas, and other mineral resources across various regions including Japan, Asia and Oceania, Europe and NIS countries, the Middle East and Africa, as well as the Americas; it has a market capitalization of approximately ¥2.85 trillion.

Operations: Inpex Corporation's revenue is primarily derived from its domestic oil and gas segment at ¥239.87 billion, its overseas oil and gas operations through other projects at ¥1.53 billion, and the Ichthys Project contributing ¥393.62 billion.

Dividend Yield: 3.4%

Inpex Corporation, with its dividend yield at 3.35%, stands above the Japanese market average of 3.19%. The company's dividends are well-supported, evidenced by a low payout ratio of 25.1% and a cash payout ratio of 16.7%, indicating sustainability from both earnings and cash flow perspectives. Over the past decade, Inpex has demonstrated reliability in its dividend payments, showing growth without significant volatility. Recent corporate guidance forecasts revenue up to JPY 1,931 billion for the year ending December 31, 2024, alongside an operational strategy that includes potential acquisitions to drive growth. Additionally, Inpex announced an increase in its year-end cash dividend to JPY 37 per share for fiscal year ended December 31, 2023, with expectations of further increases in the following periods.

Click here and access our complete dividend analysis report to understand the dynamics of Inpex.

Our expertly prepared valuation report Inpex implies its share price may be lower than expected.

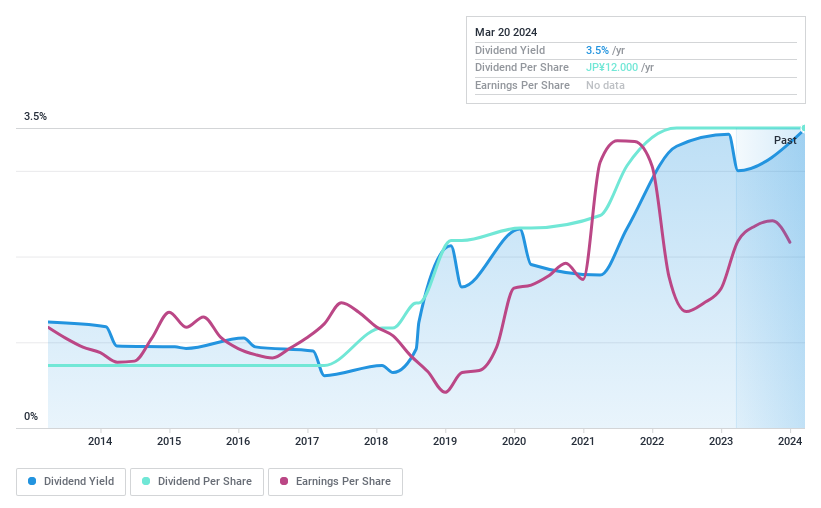

SOLXYZ (TSE:4284)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SOLXYZ Co., Ltd. is a company based in Japan that specializes in developing software solutions, with a market capitalization of approximately ¥8.37 billion.

Operations: Unfortunately, the provided text does not include specific details about SOLXYZ Co., Ltd.'s revenue segments, making it impossible to summarize this aspect of their business operations.

Dividend Yield: 3.5%

SOLXYZ Co., Ltd. is trading at 61.8% below its estimated fair value, presenting a potentially attractive entry point for investors focused on value and dividends. The company has shown consistent dividend reliability and growth over the past decade, with recent guidance affirming a stable dividend of JPY 12.00 for the year ending December 31, 2024. Its dividends are well-covered by both earnings and cash flows, with payout ratios of 34.7% and 31.8%, respectively, indicating sustainability. Additionally, SOLXYZ expects significant revenue growth to JPY 16,200 million by year-end December 2024, supported by an operating profit forecast of JPY 1,000 million, underscoring its financial health and potential for continued dividend payments amidst expansion efforts.

Dive into the specifics of SOLXYZ here with our thorough dividend report.

Our valuation report unveils the possibility SOLXYZ's shares may be trading at a discount.

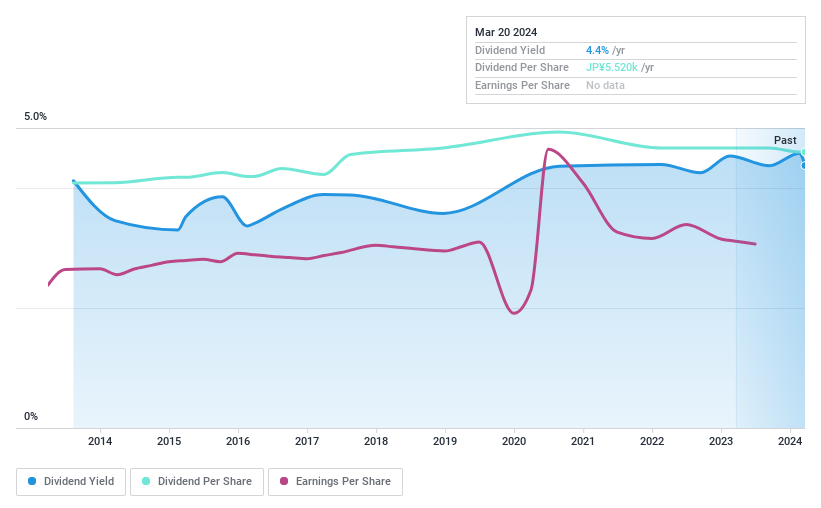

Japan Excellent (TSE:8987)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Japan Excellent, Inc. (JEI) is a real estate investment corporation focusing on office buildings, with a market capitalization of approximately ¥168.80 billion.

Operations: Japan Excellent, Inc. specializes in the real estate sector, primarily through investments in office buildings.

Dividend Yield: 4.4%

Japan Excellent, Inc. has demonstrated a commitment to enhancing shareholder value through a recent share repurchase program and an increase in dividend guidance, signaling confidence in its financial health. With a dividend yield higher than the market average and a low payout ratio, dividends appear sustainable, supported by stable earnings and cash flow coverage. However, the company's high level of debt warrants caution. Recent fixed-income offerings and credit line renewals suggest active management of its financial structure to support ongoing operations and shareholder returns.

Delve into the full analysis dividend report here for a deeper understanding of Japan Excellent.

Our valuation report unveils the possibility Japan Excellent's shares may be trading at a premium.

Summing It All Up

Get an in-depth perspective on all 0 Top Dividend Stocks by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance