DIMON: 11 ways America is holding itself back

In his annual letter, JPMorgan Chase (JPM) CEO Jamie Dimon told shareholders that while America today is stronger than ever before, there are key factors holding us back.

“Our problems are significant, and they are not the singular purview of either political party,” Dimon wrote. “We need coherent, consistent, comprehensive and coordinated policies that help fix these problems.”

Dimon’s picture isn’t all dark. In fact, Dimon celebrates the US military, self-reliance on natural resources (food, water, energy), top universities and hospitals, reliable rule of law and low corruption, strong work ethic, entrepreneurial strength, and wide and transparent financial markets.

But he also cites major flaws in our system. He points to 11 self-inflicted problems for the economy:

1) Excessive regulation

“Everyone agrees we should have proper regulation — and of course regulations have many positive effects. But anyone in business understands the damaging effects of over-complicated and inefficient regulations,” Dimon wrote. Dimon explained that some estimate that $2 trillion is spent on regulations annually (roughly $15,000 per US household). And even if exaggerated, he said that sum highlights a disturbing problem, particularly because it also hinders small business creation.

2) High spending on wars

“Over the last 16 years, we have spent trillions of dollars on wars when we could have been investing that money productively,” Dimon wrote. While some of the money needed to be spent, he explained that every dollar spent on battle could be spent elsewhere.

3) Student loan growth

“Since 2010, when the government took over student lending, direct government lending to students has gone from approximately $200 billion to more than $900 billion,” he wrote. “We have little to show for it except dramatically increased student defaults and students who are rightfully angry about how much money they owe.”

4) High health care costs

Our nation’s health care costs are essentially twice as much per person versus most other developed nations.

5) High-skilled immigrants leaving US

Approximately 40% of those who receive advanced degrees in science, technology, engineering and math at American universities—300,000 students each year—are foreign nationals with no legal way of staying here even when many would choose to do so. “We are forcing great talent overseas by not allowing these young people to build their dreams here,” Dimon wrote.

6) Felony convictions high

Felony convictions for even minor offenses have led, in part, to millions of American citizens with criminal records, and this group often has a hard time getting a job, Dimon explained.

7) Mortgage market tight

The inability to reform mortgage markets has reduced mortgage availability significantly, according to Dimon. “We estimate that mortgages alone would have been more than $1 trillion higher had we had healthier mortgage markets,” he wrote, adding that this would led to more homebuilding, creating more jobs and promoting more investment.

8) Labor force participation too low

Labor force participation in the US has gone from 66% to 63% between 2008 and today. While some of this decline is due to demographic changes, even men 25-54 have seen a significant participation drop (96% in 1968 to 88% today). Much of this decline is attributable to poor education and health issues (often obesity and diabetes), Dimon wrote.

9) Education leaving too many behind

Many high schools and vocational schools do not provide the education students need, Dimon said, adding that the goal should be to graduate and to get a decent job. “In many inner city schools, fewer than 60% of students graduate and many who do graduate are not prepared for employment,” Dimon wrote.

10) Infrastructure needs planning and investment

Dimon explained that while in the early 1960s, America was considered by most to have the best infrastructure—from highways to airports to tunnels—the World Economic Forum now ranks the US number 27 among 138 countries, behind developed countries including the UK, France and Korea. And, Dimon explained, the US has not built a major airport in more than 20 years while China has built 75 new civilian airports in the last 10 years alone.

11) Flawed corporate tax system

“Our policies continue to drive capital and brains overseas,” Dimon wrote. The US now has the highest corporate tax rates among developed nations while most other developed nations have reduced their tax rates significantly over the past decade. Dimon explained this is causing American corporations to invest overseas and incentivizing foreign companies to buy American companies. Meanwhile, American corporations hold more than $2 trillion in cash overseas that has not been brought back to the US because of the additional taxes that would be incurred.

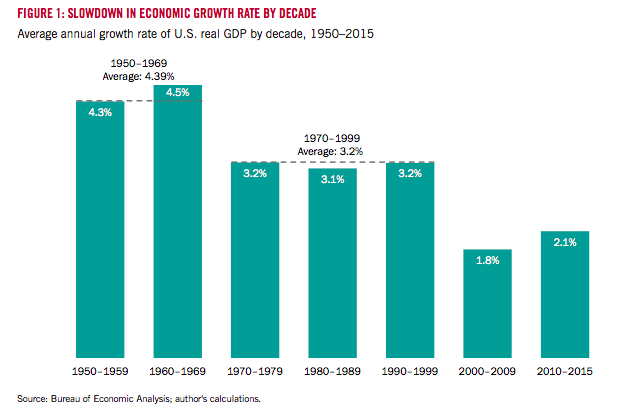

There’s something wrong with our growth

The US economy has been growing much more slowly in the last decade or two than in the 50 years before that. From 1948 to 2000, real per capita GDP grew 2.3%; from 2000 to 2016, it grew 1%. If the US achieved growth at its historical levels, GDP per capita would be more than $12,500 per person higher than it is, Dimon explained.

A longer historical snapshot of the slowdown in GDP growth can be seen below from the Harvard Competitiveness Project conducted last year.

Source: Harvard Business School US Competitiveness Study

Meanwhile, real median household incomes in 2015 were 2.5% lower than they were in 1999, and the percentage of middle-class households has shrunk over time (from 61% of households in 1971 to 50% in 2015), Dimon explained. The bottom 20% of earners—mainly lower skilled workers—have seen real incomes decline by more than 8% between 1999 and 2015.

Dimon disagrees with economists who believe we are now stuck in a state of slower growth and productivity.

Why? Because our problems (listed above) are fixable.

“Making this list was an upsetting exercise, especially since many of our problems have been self-inflicted,” Dimon said. “That said, it was also a good reminder of how much of this is in our control and how critical it is that we focus on all the levers that could be pulled to help the US economy. We must do this because it will help all Americans.”

Nicole Sinclair is markets correspondent at Yahoo Finance.

Please also see:

Why the next crisis could be worse for everyone else but the banks

DIMON: America’s high corporate tax rate is doing ‘considerable damage’

Jamie Dimon’s 9 reasons why the US is truly exceptional

Jamie Dimon’s new letter says America is great, but regulation is holding us back

DIMON: It’s clear that something is wrong with the U.S. economy

Jamie Dimon thinks America’s ‘secret sauce’ is at risk

Dimon explains what would happen if Lehman Brothers failed today

Jamie Dimon supports an earned income tax credit for low-skilled, low-paid workers

DIMON: 11 ways America is holding itself back

Yahoo Finance

Yahoo Finance