Will Diffusion Pharmaceuticals Inc. (NASDAQ:DFFN) Need To Raise More Money?

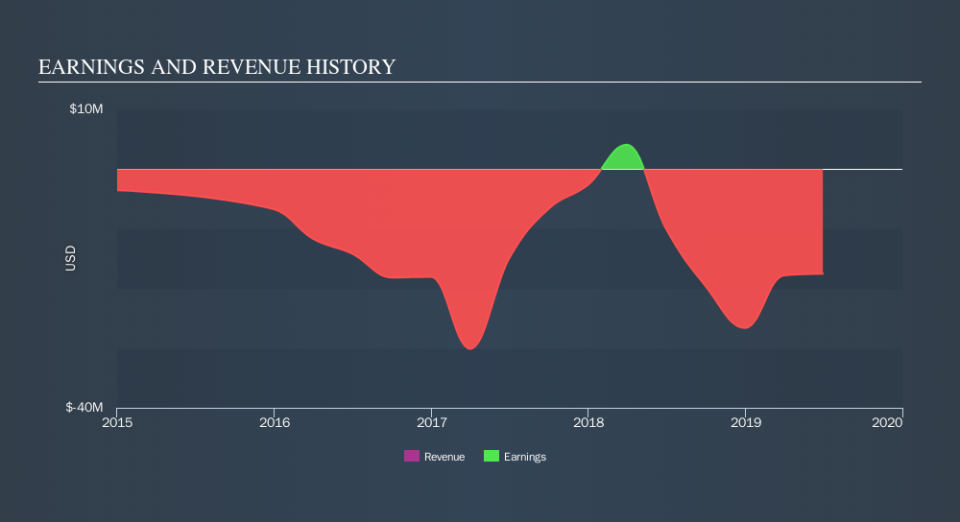

Trailing twelve-month data shows us that Diffusion Pharmaceuticals Inc.'s (NASDAQ:DFFN) earnings loss has accumulated to -US$17.5m. Although some investors expected this, their belief in the path to profitability for Diffusion Pharmaceuticals may be wavering. Savvy investors should always reassess the situation of loss-making companies frequently, and keep informed about whether or not these businesses are in a strong cash position. Selling new shares may dilute the value of existing shares on issue, and since Diffusion Pharmaceuticals is currently burning more cash than it is making, it’s likely the business will need funding for future growth. Diffusion Pharmaceuticals may need to come to market again, but the question is, when? Below, I’ve analysed the most recent financial data to help answer this question.

View our latest analysis for Diffusion Pharmaceuticals

What is cash burn?

Currently, Diffusion Pharmaceuticals has US$8.4m in cash holdings and producing negative free cash flow of -US$10.2m. Companies with high cash burn rates can eventually turn into ashes, which makes it the biggest risk an investor in loss-making companies face. Not surprisingly, it is more common to find unprofitable companies in the high-growth biotech industry. These companies face the trade-off between running the risk of depleting its cash reserves too fast, or falling behind competition on innovation and gaining market share by investing too slowly.

When will Diffusion Pharmaceuticals need to raise more cash?

When negative, free cash flow (which I define as cash from operations minus fixed capital investment) can be an effective measure of how much Diffusion Pharmaceuticals has to spend each year in order to keep its business running.

Free cash outflows grew by 0.6% over the past year, which is relatively reasonable for a small-cap company. Though, if cash burn continues to rise at this rate, given how much cash reserves Diffusion Pharmaceuticals currently has, it will actually need to raise capital again within the next couple of months! Moreover, even if Diffusion Pharmaceuticals kept its cash burn level at -US$10.2m, it could still need to raise capital within the next year. Although this is a relatively simplistic calculation, and Diffusion Pharmaceuticals could reduce its costs or open a new line of credit instead of issuing new shares, this analysis still helps us understand how sustainable the Diffusion Pharmaceuticals operation is, and when things may have to change.

Next Steps:

Loss-making companies are a risky play, especially those that are still ramping up its cash burn. Though, this shouldn’t discourage you from considering entering the stock in the future. The cash burn analysis result indicates a cash constraint for the company, due to its current cash burn growth rate and its level of cash reserves. An opportunity may exist for you to enter into the stock at a more attractive price, should Diffusion Pharmaceuticals raise equity to fund its operations. I admit this is a fairly basic analysis for DFFN's financial health. Other important fundamentals need to be considered as well. I suggest you continue to research Diffusion Pharmaceuticals to get a better picture of the company by looking at:

Future Outlook: What are well-informed industry analysts predicting for DFFN’s future growth? Take a look at our free research report of analyst consensus for DFFN’s outlook.

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Diffusion Pharmaceuticals’s board and the CEO’s back ground.

Other High-Performing Stocks: If you believe you should cushion your portfolio with something less risky, scroll through our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 30 June 2019. This may not be consistent with full year annual report figures. Operating expenses include only SG&A and one-year R&D.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance