Did You Manage To Avoid PPL's (NYSE:PPL) 17% Share Price Drop?

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

PPL Corporation (NYSE:PPL) shareholders should be happy to see the share price up 12% in the last quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 17% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for PPL

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, PPL actually managed to grow EPS by 2.7% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed. It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. However, taking a look at other business metrics might shed a bit more light on the share price action.

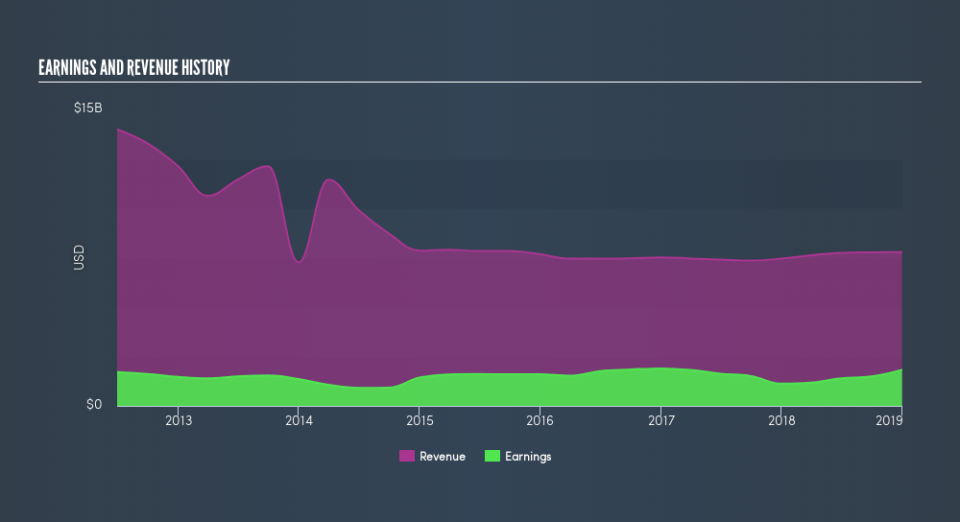

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. PPL has maintained its top line over three years, so we doubt that has shareholders worried. A closer look at revenue and profit trends might yield insights.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

PPL is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for PPL in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of PPL, it has a TSR of -3.8% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that PPL shareholders have received a total shareholder return of 19% over the last year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5.6% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Importantly, we haven't analysed PPL's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

But note: PPL may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance