Did You Manage To Avoid Cuda Oil and Gas's (CVE:CUDA) Devastating 73% Share Price Drop?

Cuda Oil and Gas Inc. (CVE:CUDA) shareholders should be happy to see the share price up 14% in the last month. But that isn't much consolation for the painful drop we've seen in the last year. Specifically, the stock price nose-dived 73% in that time. So it's not that amazing to see a bit of a bounce. The important thing is whether the company can turn it around, longer term.

View our latest analysis for Cuda Oil and Gas

Cuda Oil and Gas wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Cuda Oil and Gas saw its revenue grow by 103%. That's a strong result which is better than most other loss making companies. So on the face of it we're really surprised to see the share price down 73% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, markets do over-react so share price drop may be too harsh.

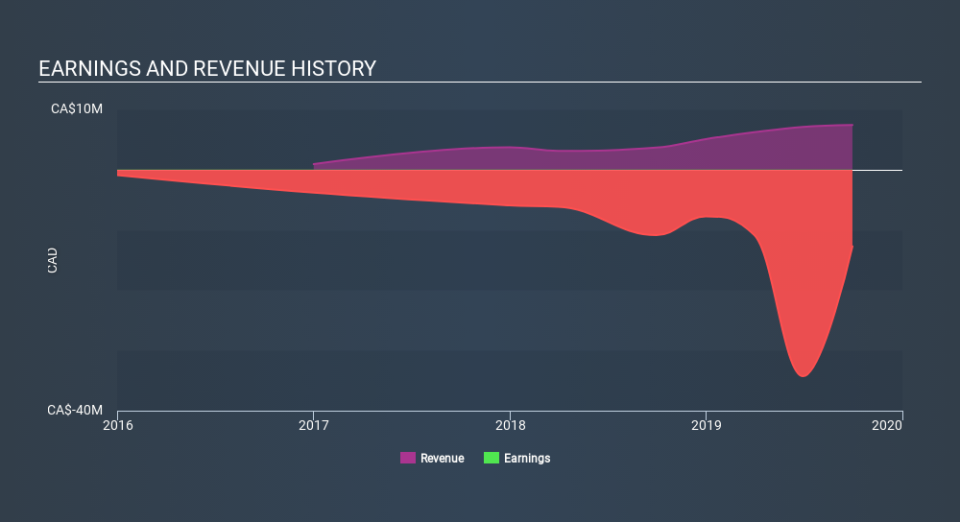

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Cuda Oil and Gas

A Different Perspective

While Cuda Oil and Gas shareholders are down 73% for the year, the market itself is up 12%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 9.3%, in the last ninety days. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Cuda Oil and Gas better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Cuda Oil and Gas (of which 3 are a bit unpleasant!) you should know about.

Cuda Oil and Gas is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance