Did Changing Sentiment Drive Unisys's (NYSE:UIS) Share Price Down A Worrying 54%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. Zooming in on an example, the Unisys Corporation (NYSE:UIS) share price dropped 54% in the last half decade. That's not a lot of fun for true believers. The falls have accelerated recently, with the share price down 15% in the last three months.

Check out our latest analysis for Unisys

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unisys became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

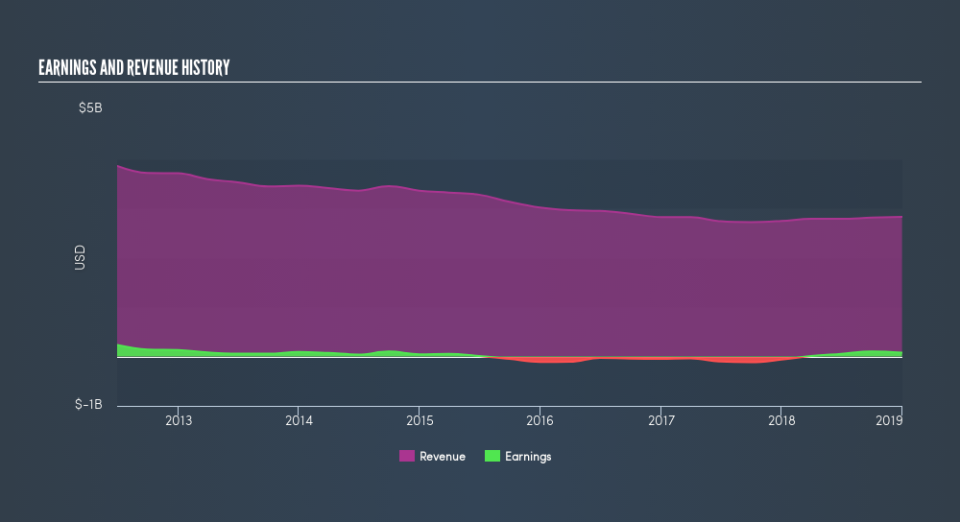

It could be that the revenue decline of 5.3% per year is viewed as evidence that Unisys is shrinking. That could explain the weak share price.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It is of course excellent to see how Unisys has grown profits over the years, but the future is more important for shareholders. This free interactive report on Unisys's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Unisys had a tough year, with a total loss of 3.9%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 15% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Before spending more time on Unisys it might be wise to click here to see if insiders have been buying or selling shares.

We will like Unisys better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance