Did Changing Sentiment Drive Terra Firma Capital's (CVE:TII) Share Price Down By 16%?

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Terra Firma Capital Corporation (CVE:TII) share price slid 16% over twelve months. That contrasts poorly with the market return of 1.7%. At least the damage isn't so bad if you look at the last three years, since the stock is down 5.5% in that time. The silver lining is that the stock is up 4.0% in about a week.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Terra Firma Capital

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Terra Firma Capital share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Terra Firma Capital's revenue is actually up 22% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

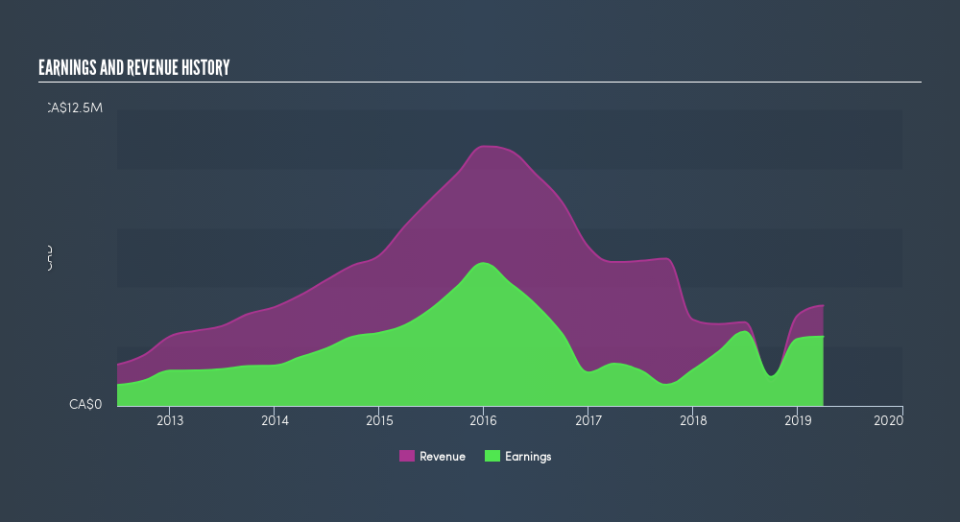

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We know that Terra Firma Capital has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Terra Firma Capital in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 1.7% in the last year, Terra Firma Capital shareholders lost 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 1.6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you would like to research Terra Firma Capital in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Terra Firma Capital may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance