Did Changing Sentiment Drive Teekay Tankers's (NYSE:TNK) Share Price Down A Worrying 63%?

Teekay Tankers Ltd. (NYSE:TNK) shareholders should be happy to see the share price up 17% in the last month. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In that time the share price has delivered a rude shock to holders, who find themselves down 63% after a long stretch. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

View our latest analysis for Teekay Tankers

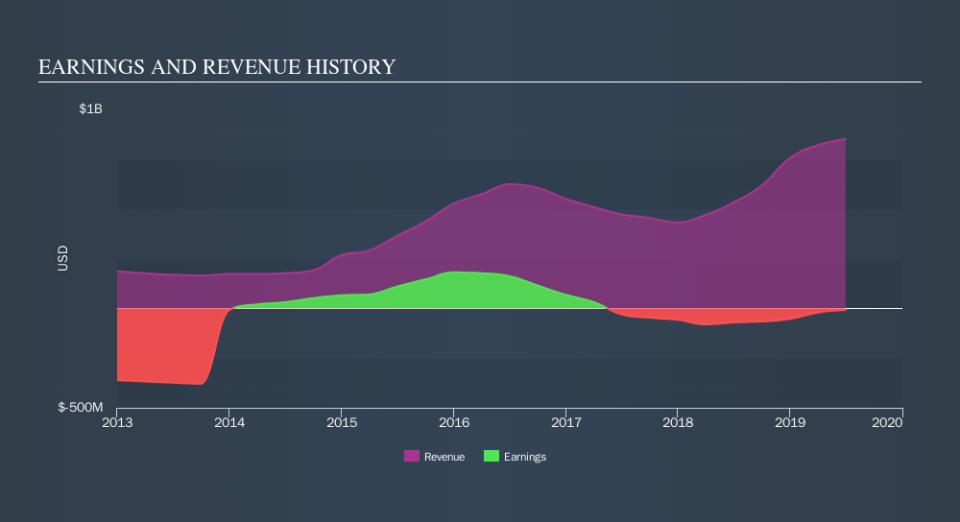

Teekay Tankers isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Teekay Tankers grew its revenue at 19% per year. That's better than most loss-making companies. Unfortunately for shareholders the share price has dropped 18% per year - disappointing considering the growth. It's safe to say investor expectations are more grounded now. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Teekay Tankers stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Teekay Tankers's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Teekay Tankers's TSR of was a loss of 55% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Teekay Tankers shareholders have received a total shareholder return of 25% over the last year. There's no doubt those recent returns are much better than the TSR loss of 15% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance