Did Business Growth Power Retractable Technologies's (NYSEMKT:RVP) Share Price Gain of 103%?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example Retractable Technologies, Inc. (NYSEMKT:RVP). Its share price is already up an impressive 103% in the last twelve months. On top of that, the share price is up 71% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Unfortunately the longer term returns are not so good, with the stock falling 44% in the last three years.

View our latest analysis for Retractable Technologies

While Retractable Technologies made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last twelve months, Retractable Technologies's revenue grew by 8.4%. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 103%. We're happy that investors have made money, though we wonder if the increase will be sustained. It's quite likely that the market is considering other factors, not just revenue growth.

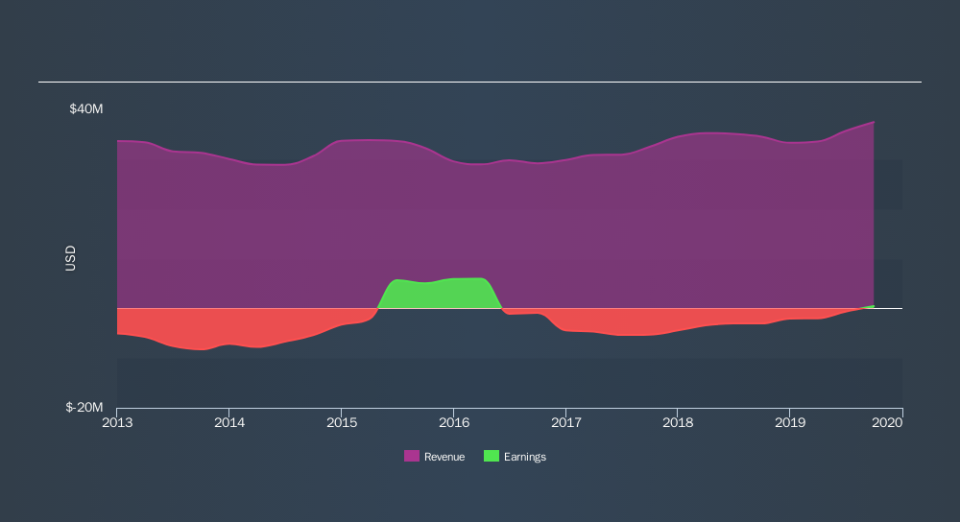

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Retractable Technologies's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Retractable Technologies has rewarded shareholders with a total shareholder return of 103% in the last twelve months. That certainly beats the loss of about 21% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Retractable Technologies better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance