Dick's (NYSE:DKS) Exceeds Q1 Expectations, Stock Soars

Sporting goods retailer Dick’s Sporting Goods (NYSE:DKS) announced better-than-expected results in Q1 CY2024, with revenue up 6.2% year on year to $3.02 billion. The company expects the full year's revenue to be around $13.15 billion, in line with analysts' estimates. It made a GAAP profit of $3.30 per share, down from its profit of $3.40 per share in the same quarter last year.

Is now the time to buy Dick's? Find out in our full research report.

Dick's (DKS) Q1 CY2024 Highlights:

Revenue: $3.02 billion vs analyst estimates of $2.94 billion (2.7% beat)

EPS (non-GAAP): $3.30 vs analyst estimates of $2.97 (11% beat)

The company reconfirmed its revenue guidance for the full year of $13.15 billion at the midpoint

Gross Margin (GAAP): 36.3%, in line with the same quarter last year

Free Cash Flow of $74.19 million is up from -$132.9 million in the same quarter last year

Locations: 857 at quarter end, in line with the same quarter last year

Same-Store Sales rose 5.3% year on year

Market Capitalization: $15.95 billion

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Sales Growth

Dick's is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

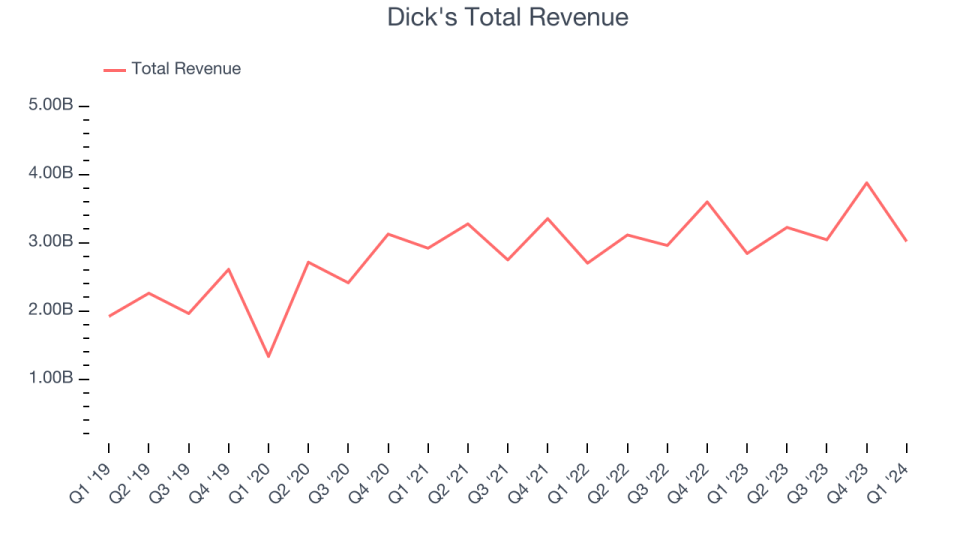

As you can see below, the company's annualized revenue growth rate of 9.3% over the last five years was mediocre despite closing stores, implying that growth was driven by higher sales at existing, established stores.

This quarter, Dick's reported solid year-on-year revenue growth of 6.2%, and its $3.02 billion in revenue outperformed Wall Street's estimates by 2.7%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Dick's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.7% year on year. Given its declining store count over the same period, this performance stems from higher e-commerce sales or increased foot traffic at existing stores, which is sometimes a side effect of reducing the total number of stores.

In the latest quarter, Dick's same-store sales rose 5.3% year on year. This growth was an acceleration from the 3.4% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Dick's Q1 Results

We enjoyed seeing Dick's exceed analysts' revenue and EPS expectations this quarter. We were also glad it raised its full-year revenue and earnings guidance, beating Wall Street's estimates, as it expects its same-store sales to rise by 2.5% year on year. As a reminder, same-store sales growth is more profitable than growth from new locations because it's less capital intensive. Overall, we think this was a really good quarter that should please shareholders. The stock is up 7.8% after reporting and currently trades at $210.17 per share.

Dick's may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance